The threat to the highly-specialised supply chains on which luxury brands depend is more real than ever, but luxury brands are vertically integrating to secure these precious skills and resources.

The threat to the highly-specialised supply chains on which luxury brands depend is more real than ever, but luxury brands are vertically integrating to secure these precious skills and resources.

PARIS — In the 1920s, there were approximately 10,000 couture-level embroiderers in France; today that number has dwindled to around 200. In Switzerland, watch-making technicians who survived the 80s onslaught of Asian competition and the emergence of quartz technology remain in peril as the market for high-end timepieces wilts, with watch exports in March 27 percent lower than in the same period last year. And in Louisiana, the alligator and exotic skin industry faces an unprecedented decline in orders, which in turn threatens the stability of sourcing of these rare skins for luxury firms worldwide.

There is a clear and present danger to the luxury world’s most treasured assets, its highly-skilled handcraft artisans as well as the precious resources they refine, constituting a possible hidden cost of the current economic downturn with potentially long-term consequences.

A slew of forward-looking brands, however, have taken decisive action over the years to ensure the survival of these production resources by acquiring essential elements of their supply chain.

One of the best known examples of this kind of vertical integration in luxury comes courtesy of Chanel which, between 1997 and 2006, purchased six struggling, highly specialised French ateliers that have catered historically to haute couture houses and bespoke clients. Among these are the fabled embroidery firm Lesage, costume jewellery and button-maker Desrues, floral fabric artisans Guillet, feather-maker Maison Lemarié, gold and silversmiths Robert Goossens and boot-makers Massaro.

Elena Glurdjidze dancing in a Karl Lagerfeld designed tutu. The costume required more than 100 hours of work, many of these at Lemarié, the Chanel-owned studio devoted entirely to feather specialists.

As couture houses closed their doors over the past decade, demand for these ateliers’ services decreased as well. However, the Wertheimer family, owners of Chanel, and designer Karl Lagerfeld implemented a strategy to keep them alive, going so far as to incorporate a subsidiary to manage these satellite ateliers called PARAFFECTION, which in total employs 130 with an annual turnover of around 35 million euro.

Chanel only accounts for 60 percent of their turnover, however; the workshops operate entirely independently, also supplying to competing houses, high-end ready-to-wear and private clients. They are actively encouraged to train new craftsmen and inaugurate younger collections, such as the fresh-faced, technologically-advanced approach that artistic director Eric Charles-Donatien, 33, has brought to Maison Lemarié, developing, for example, unusual combinations with silk flowers and feathers.

While an element of financial self-interest is definitely at play, haute-couture could not continue at the same rarefied level without these skills. Chanel is one of the few big maisons for which it’s both an image-builder and a source of income – the company insisting that its primary motive goes beyond turning a profit.

Nathalie Vibert, a senior press officer for the Maisons d’Arts, asserts that these acquisitions “amount to a genuine wager on creativity, which, beyond preserving unique archives and know-how, allows such craftsmanship to grow and bloom in full independence. The aim is clear: it is not for Chanel to grab exclusive suppliers, but to nourish a craft which is the quintessence of Paris couture. Nor is it to save the last remnants of a disappearing tradition. To the contrary, all highly profitable at the time of their purchase, these firms can now look at the future with hope and serenity.”

The trend towards consolidating operations extends across the luxury world. Bulgari began to acquire key suppliers for and competitors of its watch-making arm in 2000, namely Gerald Genta, Daniel Roth and Manufacture de Haute Horlogerie. In 2005, it purchased controlling shares of Cadrans Design and Prestige d’Or, and two years later, the intellectual properties and machineries related to watch components from Leschot. In 2008, Bulgari further expanded its purview to encompass the Swiss company Finger, specialising in the production of high-end watch cases for multiple brands.

Bulgari watch cases at the Finger SA facility in Lengnau, Switzerland.

By this point the company had fortified its manufacture of high-end dials, metal bracelets, cases and movements, furthermore gaining an advantage over its competitors. Today, as the domino effect of failing companies begins to expand through the luxury industry, the threat to the highly-specialised supply chains on which luxury brands depend is more real than ever. Targeted acquisitions such as these can curb the risk of production delays, diminished quality control or spiralling costs.

Luxury brand Hermès has adopted a similar strategy with regard to the exotic skins segment of its leather goods operation, acquiring the largest alligator skin supplier in the United States, Roggwiller Tannery, located in Lafayette, Louisiana. While Roggwiller tans and dyes crocodile, shark, stingray, ostrich, lizard, python and frog skins for a number of clients in the fashion world, de Reynies, the firm’s director, estimates that its employment will double over the next 2 to 3 years as Hermès ramps up its production capability. The deal guarantees that the most exclusive variations will not be endangered by an unstable inventory of exotic skins — in the US alone, there is a glut of 840,000 hides waiting to be sold, while on average only 275,000 hides are sold nationally each year.

In the field of fine jewellery, two bold brands have incorporated different variations of a vertically-integrated approach into their companies’ growth plans – one focuses on raw materials, the other on skilled labour. Gem Palace, India’s premier jewellery house, and the maharajahs’ historic firm of choice, has implemented a completely vertically-integrated manufacturing unit (sourcing, cutting, designing, mounting, and retailing their own designs) with a strategic initiative to revive traditional skills that were nearly lost to history.

As Sanjay Kasliwal, one of the family firm’s principals, explains, “We are training craftsmen to do work that is dead, such as 18th-century settings of rubies and emeralds cut in a mosaic manner. Our belief is that if it was done in the 18th century, then if you put enough time and effort into it today, it can still be done. We don’t try to save time with our workers. We tell them even if it takes a month more that’s fine, because in the Mughal times the workers had all the time in the world.”

This is the level of quality to which Gem Palace aspires. Craft is paramount in both their brand identity and their business model. By controlling their highly-refined production, they are able to create more variable and unusual designs, fusing Western and Eastern aesthetics. What is more, they can farm out their services to other jewellery firms that do not have access to similar skill sets. Their clients range from major labels like Bulgari, to boutique firms like Marie-Hélène de Taillac and Adeline Roussel. And there’s a historical precedent as well – as early as the 1920s, houses such as Cartier and Van Cleef came to the Kasliwal family to source pearls and cut stones for their over-the-top Deco creations.

As a result of this top-to-bottom consolidation, the Kasliwals are able to offer other houses a wide range of assistance, from supplying loose, uncut stones at a mark-up, to providing intricate, precision-cut finished stones, to handling a designer’s entire production. With regard to their own, Kasliwal estimates that they’re able to deliver product at a 30 to 40 percent lower cost margin. Following the success of their in-house training efforts, the Kasliwals are thinking of opening a school to educate people in the traditional art of jewellery-making and its application to a Western aesthetic, fostering a source of future skilled labour.

London-based billionaire jeweller, Laurence Graff, on the other hand, has built his brand’s reputation by controlling access to the most important diamonds in the world. His steadfast belief that the highest quality will attract the best customers has resulted in a different approach to many of his competitors who have focused more on image and design.

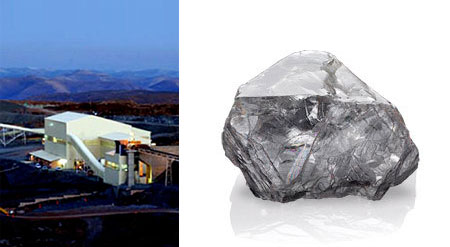

The Letšeng mine and the 603 carat Lesotho Promise.

As Josephine Dunn, Graff’s senior press officer explains, the company, “has never bothered much about mainstream branding or attention.” They’ve been concerned, instead, with catering to the desires of the extreme upper-tier. In order to satisfy this discerning clientele, they’ve gone to great lengths to ensure that their product is beyond reproach by involving themselves, like Gem Palace, in every stage of production — with the important addition of mining their own stones. In late 2008, Graff acquired a minority stake in the Letšeng-la-Terai mine in Lesotho, famous for yielding the Lesotho Promise, the 15th largest rough diamond ever to be discovered. Graff’s investment underscores the mine’s strategic value in ensuring the brand’s status as an industry leader, with access to the most exquisite stones in the world. In Graff’s case, access to coloured diamonds is as crucial to their success as the exquisite work of their cadres of stonecutters and master jewellers. Consolidating their supply ensures market dominance in their chosen niche for years to come.

As the luxury industry’s winter of discontent has stretched through the spring, there is an advantage to be had in strategic forms of insulation. Consolidating one’s supply chain provides a form of insurance at a time when no one can predict with any great certainty where things are headed. What’s clear is that without uninterrupted access to the refined skills and raw materials on which their businesses depend, luxury brands cannot effectively plan for the future.

Sameer Reedy is Editor at Large