Consumers

Japanese HNWI's Should be a Primary Target for Luxury Travel

by

Helge Fluch | January 21, 2011

Helge Fluch, CEO of Japan Access, outlines why Japan should be considered one of the most important source markets for the luxury travel industry

Helge Fluch, CEO of Japan Access, outlines why Japan should be considered one of the most important source markets for the luxury travel industry.

Japan is the leading nation when it comes to HNWI’s in the Asia-Pacific region, with a service level that is unmatched internationally, and one of the richest baby boomer markets in the world. If you combine this huge silver market and HNWI wealth with a new level of sophistication, far exceeding other Asian nations, then Japan should be considered one of the most important source markets for the luxury travel industry. Yet, the luxury travel market in Japan is amazingly underdeveloped, with some of the most exclusive gems in the travel industry remaining inaccessible to an international and affluent audience, and Japanese rich travellers longing for a better service level for booking exclusive travel arrangements.

In recent years, many companies have sprung up that offer companies in the luxury travel sector ways to tap a new affluent class, the ‘new rich’ in Japan. Their methods range from high class exclusive magazines, collaboration marketing with exclusive credit card companies, to more sophisticated approaches that include the creation of marketing environments and exclusive clubs and services for a limited audience. This missing part to access these people was developed in Japan over the last years but was never communicated to an international audience. Moreover, cultural differences made it hard to do so. Blossom Japan 2011, the first travel show dedicated exclusively to develop the high-end travel market represents a first step in changing this situation. Concierge service companies in Japan that sprung up during the last years, and marketing companies offering tailor-made research to understand rich Japanese are also representative of this first step.

HNWI wealth in Japan, highest in Asia

Japan is by far the single largest HNWI market in Asia-Pacific. The number of HNWI’s in Japan has been increasing by over 20% from 2008 to 2009, along with the wealth they wield. Japan alone accounted for 54.6 percent of the Asia-Pacific HNWI population and 40.3 percent of its wealth at the end of 2009. The change in HNWI population in absolute terms is outperforming Mainland China over 2,5 to 1. The baby boomer generation in Japan (born between 1947-49) started to retire in 2007 and are one of the wealthiest sectors in the world to market to (1).

Japan’s Influence on Other Asian Markets

Travel connects the different aspects of luxury and gives brands and service providers a truly global platform. Japanese consumers are travelling around the world, consuming (still) the highest amount of luxury goods. Brand images of Japanese consumers abroad are taken home and influence purchase and travel decisions. Understanding this influence, being able to tweak the offerings in other countries, and to increase reputation of a company’s services in Japan will have tremendous effects on the way Japanese people consume abroad (2).

Sophisticated and mature markets serve as idols, as role models for other markets. Companies should look at Japan not only for its market size (the biggest in Asia) or the amount of wealth (the second biggest in the world after the U.S.), but also at the role it plays in the consumption choices of the emerging and young Asian markets. Luxury companies should think globally about this issue. Mainland China is indeed growing at a rapid pace, but it would be a stupendous loss to neglect a gold mine like the Japanese market that has changed profoundly in the last years, with the opening up of channels, and insights that were not available before.

Sophistication of the Market

Luxury like everything else evolves. Mainland China is a young luxury market. They are in an aspirational phase where consumers aspire for new status and wealth. Japan, having gone through all that since the Bubble economy, has come through several paradigm shifts. The days of simple conspicuous consumption are a thing of the past. What is taking place now is once again the changing of a paradigm, of Japan going through a consolidation process.

Industries are transforming, brands are once again looking at their roots. The Japanese are starting to demand narratives, not just simply participating in a game of status (3). They want to consume in a more sophisticated manner, want to be educated, inspired and connect their Japanese cultural heritage with Western offerings in a way they can relate to. The Japanese market has moved on to a more subtle, abstract, and experiential paradigm. In this case Japan shows much more sophistication and complexity compared to Mainland China, and also much higher security in terms of investing capital.

New Players in the Market Open Up the Industry

In the new millennium new service providers began to appear in the Japanese market, in reaction to a shift in consumer behaviour among affluent people caused by the savvy ‘new rich’ consumers. They cater to companies dealing with HNWI’s and offer them sophisticated tools and access to social networks. Examples, to name only a few, are the Ypsilon Group, which offers concierge services on a high level to luxury companies and companies with exclusive clientele, KT Marketing, who started to offer specialized club marketing strategies to access affluent customers, and Root and Partners, who is offering refined management consulting for companies dealing with rich clients, giving them access to a network of over 6,600 HNWI’s.

Accessing HNWI’s in Japan was almost impossible 10 years ago. Now channels have developed that offer comprehensive tools to understand and reach them.

903,000 HNWI Households US$ 3,892 Bill. In Assets

Who are the rich people in Japan? How can they be accessed?

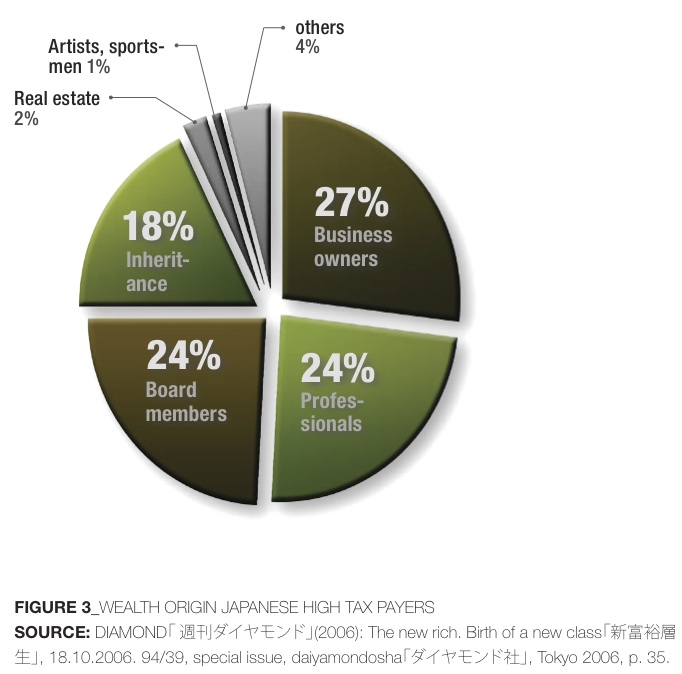

The term “Fuyuusou” ( 富裕層 ), meaning HNWI, becomes a buzzword of the year 2005 in Japan. Compared to their American and European counterparts, Japanese wealth is young money. From the 903,000 households that have more than 100 million Yen in assets (approx. US$ 1 million), 61,000 own more than 500 million Yen (US$5 million) (FIGURE 4) (4). FIGURE 3 shows the wealth origin of high taxpayers in Japan (classification by income, not assets) showing us that the majority of high earners in Japan are business owners and professionals.

I classify rich people in Japan into the following categories (5), each group showing distinct spending patterns and attitudes:

Old rich. The traditional rich families and old business owners in this group tend to keep their social networks closed. They travel in a sophisticated and often Japanese style, relying on quality, reputation and service, with conservative spending patterns. They are highly influential in social networks and their word of mouth is very valuable. Foreign companies gain full access to them only through intermediaries.

Winner rich. Their wealth stems from IPOs of their own businesses. Not all of them make it into the exclusive company and social networks of the traditional old rich. Their spending patterns tend to be more extroverted and less conservative than the old rich.

Silver market. A combination of the retired corporate warriors who were born during or immediately after the war and the Japanese baby boomers, born between 1947-49. It is now their time to enjoy the results of their life-long labour and they travel extensively.

Professional rich, doctors, lawyers, financial dealers, fund managers and also successful sportsmen and artists. They use consumption and travel as a way of rewarding themselves for their hard work over the years and often have high demands and very personal preferences.

New business owners. The Japanese who founded their young enterprises during or after the bubble exhibit different spending and investment patterns from the old rich business owners who made their wealth before the bubble.

The rising class. These young business owners, young professional lawyers, doctors and accountants, and young corporate climbers show are big in numbers. They cannot be considered high net worth yet, but are heavy spenders in lifestyle categories and will be the HNWI’s of tomorrow.

Networks are the key to reach HNWI’s

The networks of Japanese HNWI’s are closed, and very difficult to access for foreign and domestic companies alike. Yet the real insights are buried within those networks. Accessing them means having the power to create ser- vices and products that resonate perfectly with the affluent consumers in Japan. Communication problems, old structures and cultural differences keep a big part of the real business procedures from being seen by players from abroad.

It is now possible to access these hidden networks by using consulting agencies and service providers created exactly for that purpose, providing a variety of methods and tools that allow international companies access to a golden continent of business opportunity. This change in the market was never communicated to an international audience. There is nearly no com- petition in using these opportunities to their full potential.

Word of Mouth Within Networks

Why is it so important for foreign companies to access and understand the richest consumers who will access their services both in Japan and abroad? The reasons might not be immediately apparent. Besides their buying power, consider the following:

1 _ Rich customers are extremely well connected. Their word of mouth has a completely different value com- pared to less affluent customers, as it spans networks, also internationally. Rich consumers own and influence industries, are gatekeepers and network hubs.

2 _ Highly affluent consumers can access several networks at once. Thus their word of mouth jumps net- works and categories, offering new ways to look at collaborations.

3 _ Instead of looking at the customer lifetime value of a rich customer (CLV) consider the customer referral value (CRV). One satisfied highly influential affluent customer that does not consume much himself could influence so many others who value his opinion.

4 _ The consumer behaviour of rich people influences the choices and brand preferences of other consumers. People look up to and imitate the brand choices of affluent consumers. The press covers their behaviour and taste.

By accessing these closed networks, understanding their dynamics and preferences, companies can satisfy selected highly influential customers who will then take these experiences back into their circles, translating them and becoming the most sought after advocates. The companies who will harvest the change in industry first will enjoy an unprecedented competitive advantage.

How to access the most sophisticated Asian travel market

Japan is different. Not difficult to access, but complex.

Companies who manage to get in touch with the right networks in the Japanese market will gain a tremendous competitive advantage, not only within Japan, but with the whole of Asia, opening a gateway to the biggest pool of HNWI wealth after the US market. There are three aspects as essential in unlocking this potential. The first is to understand that Japan offers high potential in inbound as well as in outbound travel, with the two influencing each other. The second is to enter the sophisticated networks of Japanese rich people to gather real insights. And the third is to understand the special allure that Japan can have in an international and mature luxury market, as one of the most exclusive destinations for HNWI’s worldwide.

Japan is a gem for luxury travel agents in three ways.

1_IN AND OUTBOUND

First, Japanese travellers are some of the best customers and spenders all over the world, yet even the companies dealing with them on a regular basis rarely understand them, nor do they know how to expand or improve services for them in order to induce the right word of mouth once they return home.

Second, Japan offers one of the most attractive destinations for HNWI’s to travel to. Hidden gems of utmost exclusivity are waiting to be discovered and made accessible to HNWI customers from abroad who demand the utmost in experiential travel paired with the most exclusive service level in the world.

Third, Japanese HNWI’s use Western hotels within Japan. Often hotels are not aware of the real needs of affluent Japanese travellers and how they would expect their special Japanese needs to be met within the Western exclusive environment. Creating bespoke experiences for them in Japan will influence their global travel behaviour.

2_ENTER NETWORKS

Understand that Japanese travellers are role models for other Asian HNWI’s. An intimate connection with their networks allows a company a close and accurate look into the mind-set of some of the most discerning customers.

What companies need is expertise in luxury marketing, a deep knowledge of the inner workings of the Japanese market, as well as the cultural difference in messaging and brand perceptions.

Agencies in Japan created networks of HNWI’s that can be accessed and can be used to create marketing strategies that truly resonate with the rich consumer in Japan. Companies should use those networks. They are the key to understanding Japan.

It is now possible to do this and gain information from them about the specific characteristics that make the Japanese market so well aligned with the direction in which luxury as a whole has developed globally. The goal is to create experiences of a vivid exoticness. To do so you have to enter the minds of your most exclusive customers.

3_INITIATION TO THE HIDDEN

The reasons why Japan was inaccessible are now exactly the reasons why it is the most sought after market in terms of tapping into undeveloped potential. The special role Japan has played among Western and Asian nations created a venue that is full of allure, a special hybrid character that fits perfectly into what international HNWI’s are demanding in a mature international market.

What is sought after is focused emphatically on psychological or experiential quality, intimacy, secrecy, and exclusive experiences, requiring a different sort of narrative. What is in demand at this stage is a vivid experience that adds value to the lives of HNWI’s in all sensory dimensions.

In today’s luxury travel market, giving global HNWI’s the feeling of accessing a world that is not open to everybody, the feeling of being in the know, an initiate, is essential. The message is that the true quality of luxury is hidden to the uninitiated. HNWI’s want to carry very distinguished experiences back into their networks, to talk about them, and share it with friends and colleagues.

Japan offers this like no nation in the West, and is much more sophisticated, secure and provides services and exoticism on a higher quality level than in other Asian nations. It is now the time for foreign and domestic travel agencies, visionaries and pioneers, for those who understand the psychology of mature luxury consumption (concrete to abstract. material to psychological. mundane to quality) to realise that the evolution of luxury is the transformation to a more sophisticated level.

Going to Japan is now becoming a logical step in the evolution of luxury towards an experiential pleasure. Tapping this potential first is like accessing a gold mine that has not yet been discovered, a unique and strange experience like peering into an alien world that is not yet tamed by globalization and modernization, yielding immense aesthetic pleasure.

1 The retirement of the baby boomer generation in Japan has created a flood of books that describe how to market to them and integrate the special role they have played in the development of the Japanese market. Accessing baby boomer millionaires demands a deeper understand- ing of their social background and their role within the Japanese economical miracle of the 1960s and 1970s.

2 Especially luxury hotel groups could easily enhance their services abroad for Japanese customers by understanding the preferences of affluent domestic travellers who stay in their hotels in Japan. Also, making one exclusive guest who commands and extensive business network in Japan satisfied, can lead to a change in reputation, heavily influencing the booking behaviour of others, also from different nationalities.

3 http://www.hnwimarketingjapan.com/2010/10/brand-narrative-marketing.html

4 The Nomura Research Institute uses 100 million Yen in assets (excluding primary residence) as the defining attribute of HNWIs in Japan. Merrill Lynch/Capgemini use US$ 1 million as the criterion.

5 The categories are constructed taking into account several sources of information, including categorizations from Usui (2005): The New Rich in Japan, Tsuchiya (2007): Marketing to the Rich, and Takahashi (2005): The Seven Rules of Luxury Marketing. I changed the categories together with Root and Partners, incorporating data and insights from conversations with CEOs and practitioners within the industry over the course of 4 years. For more detailed information on the rich in Japan, please refer to http://www.hnwijapanaccess.com/2_New%20Rich.htm