Our weekly analysis of the must-read luxury news headlines

Marc Jacobs F/W 2011-12 show at New York fashion week

The Fashion Industry’s Newest Major Players

It’s only day eleven of the fall/winter 2011 season. Many late arrivals from New York fashion week are still unpacking their bags around a cluster of hotels in central London. Yet, with nearly three weeks ahead of us, it seems as if the there is already a lot that can be learnt from the headlines pouring out of the hourly media barrage.

As anyone remotely familiar with this industry knows, the seating plan of any runway show is a brutal reminder of the fact that the high-end of the fashion business operates on a strict hierarchy. The major players are always seated front row near the photographer’s pit and those on the periphery are, well, peripherally located. But the last few years have witnessed the arrival of a new league of bloggers and e-tailers who have not only upset the seating plan but also shook up the industry itself.

And while most observers acknowledge that these ‘new players’ are the personification of a digital revolution still sweeping the luxury industry, few have come to terms with the fact that they are also only the first of many more waves of new influential players to come in the years ahead.

“ These are also only the first of many more waves of new influential players to come. ”

Above and beyond the news that ‘first wave’ pioneer Net-a-Porter is now morphing into a multi-media outlet with both TV channels and a print magazine to bolster its e-commerce operations and the scoop that another ‘first wave’ giant, Gilt Groupe, may be considering an IPO to turn the flash sales site into an internet titan, there are early signs that a second wave of new players may be about to change the industry even further.

Enter Ideeli, a smaller rival that CNBC calls “the fastest growing flash-sale retail site" which "harnessed the buzz of Mercedes-Benz Fashion Week to host sales timed to go live on the same day as the designers were showing at Lincoln Center.”

What’s worth noting is that this wasn’t merely a case of strategic timing – Ideeli was an official sponsor of the event, attempting to cash in on the transformation of fashion weeks from trade shows to consumer and entertainment events. Forward-thinking fashion industry experts are predicting that an entire army of niche players will soon emerge to bridge the ever narrowing gap between the B2B and B2C fashion frontiers.

Lauren Santo Domingo and Aslaug Magnusdottir, founders of Moda Operandi

On the other side of the entrepreneurial divide are those firms developing highly specialised and efficient services for the remaining B2B aspect of the biannual fashion show season. Luxury Daily recently profiled a company which does not only this but also expands services to consumers at the same time. Founded by Lauren Santo Domingo, of Vogue, and Aslaug Magnusdottir, former head of merchandising at Gilt Groupe, Moda Operandi is described as a “digital trunk show destination.”

“For the first time ever, members will be able to order directly from designers, pieces from the runway collection as soon as 48 hours after the show,” Moda Operandi’s CEO, Magnusdottir, told Luxury Daily. “This will enable consumers to obtain the pieces as they were seen on the runway, as opposed to have to shop from the watered down version of the collection that’s been edited by retailers in an attempt to broaden the appeal as much as possible.”

As ‘first wave’ players such as livestreaming and location-based social networking firms become ubiquitous for the fashion industry, it will be ‘second wave’ players like Magnusdottir and Santo Domingo who will probably turn these add-on services into into profit-generating propositions in their own right.

Conglomerates Jockey For Position through M&A; Action

A screenshot of Gucci Group’s still functioning website

It’s good-bye Gucci Group; hello Mr. Pinault’s private PPR. The big story this week revolved around outwardly shocking headlines suggesting that (in addition to Robert Polet’s sudden departure as CEO of Gucci Group) that the third largest luxury goods conglomerate will simply “cease to exist.”

What the hyperbolic reporters actually meant, of course, was that Polet’s exit signals an abrupt restructuring of Gucci Group’s parent company PPR. A few canny observers came out to gloat, saying that the writing was on the wall for such a shake-up ever since PPR announced last year its plans to divest several of its non-luxury retail businesses including La Redoute, Conforama, Redcats and Fnac.

Women’s Wear Daily explained that, henceforth, Gucci Group’s larger assets (Gucci, Bottega Veneta, Yves Saint Laurent and Balenciaga) will be overseen directly by PPR chairman François-Henri Pinault while former Gucci Group COO Alexis Babeau, will effectively become deputy CEO of the PPR luxury division, shepherding the remaining brands (Stella McCartney, Alexander McQueen, Boucheron and Sergio Rossi).

“ Gucci Group’s death is merely a practical way for PPR to reorient itself around two distinct sectors. ”

While the luxury industry might pause for a brief moment of nostalgia for the loss of the Gucci Group banner and all that it meant in relation to the aggressive Tom Ford era in which it was born, it’s understood that Gucci Group’s death is merely a practical way for PPR to reorient itself around two distinct sectors: luxury goods and sports/lifestyle brands. Bloomberg noted that, “PPR is in a ‘healthy’ position to buy companies and is looking at ‘many’ opportunities…said Pinault.”

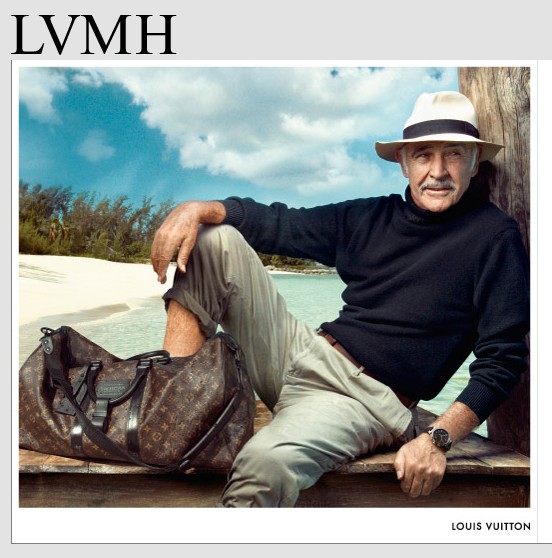

Meanwhile, over at PPR’s arch-rival LVMH, some other interesting developments have been taking place. Recent news that India’s Gitanjali Gems was on a buying spree for diamond specialists including the Stefan Hafner, IO Si, Porrati and Nouvelle Bague brands now makes much more sense in light of a new Reuters report claiming that Gitanjali itself is being courted by LVMH’s L Capital Asia Fund.

Only last week, it was revealed that LVMH had also steered two niche beauty brands into its stable: Ole Henriksen and Nude skin care. And although all this activity is of course negligible in the grand scheme of things, it doesn’t help LVMH’s public relations stance over the ongoing drama about its 20.2% stake in Hermès.

A partial screenshot from the LVMH corporate website

The latest in the war of words between LVMH’s CEO Bernard Arnault and Bertrand Puech, chairman of Hermès, came out a few days ago in the form of an unambiguous demand from Puech: “We want [Arnault] to reduce his stake to less than 10 percent.” Analysts seem to concur that it’s highly unlikely Arnault will budge, meaning that the impasse between the two will continue.

In other M&A; news, LVMH is also rumoured to be one of about a dozen companies interested in scooping up the Piper-Heidsieck and Charles Heidsieck Champagne brands from Remy Cointreau (according to Decanter.com). And, finally, American department store Nordstrom has been getting a lot of attention for its acquisition of flash sale e-commerce site HauteLook for $180 million (New York Magazine).