Our bi-weekly analysis of the must-read luxury news headlines

Pages featuring international jewellery brands in an issue of Harper’s Bazaar China

No earnest luxury brand executive would deny that cracking China is at the top of his or her agenda. Not these days. But it wasn’t long ago that many of the same CEOs and MDs were hesitant to admit that their fortunes were so dependent upon a single market. Their tone was decidedly cautious and they often put China into the context of tomorrow.

Today, of course, everyone knows that China is happening now – right now. It hasn’t been this urgent to lay down good foundations in a market since the mad rush to expand into Japan many decades ago. But to make matters even more urgent, the pace at which China and the luxury market within China is evolving has probably never been seen before – not in living memory at least.

“ It hasn’t been this urgent to lay down good foundations in a market since the mad rush to expand into Japan many decades ago. ”

This was the starting point for a spirited debate among luxury brand executives who gathered on Tuesday at the latest Walpole Luxury Summit, Luxury in Greater China. Presented by the organisation which represents the British luxury industry, Walpole, the summit provided a platform to discuss an extraordinarily broad range of topics including everything from understanding the subtleties in Chinese business culture like the concept of ‘guanxi’ and luxury’s soft power to hard statistical projections.

But it was the insights from a few key executives that will reverberate around the industry in the coming months.Walpole’s deputy chairman, Guy Salter, set the day’s agenda early on. “Despite all of its impressive stats and its sheer scale, China is probably the most complex and fast-moving market in the world [so] the question today is not so much about ‘how big’ but about how to do business in such a tricky market,” he said.

David Hughes of Barclays Wealth alluded to the increasing discernment of the affluent in China. “A recent poll asked Chinese luxury buyers to cite the reasons for their buying habits. The top two were a quest of supreme quality and a demonstration of ‘taste’ and ‘style’ [not ‘status’] — so a huge revolution is obviously taking place,” he remarked.

Bottega Veneta’s best selling item in China, the understated Cabat bag

Marco Bizzarri, President & CEO of Bottega Veneta agreed. “After decades of austerity, it looked like anything with a logo was being bought by the Chinese. This old fashioned wisdom is that the Chinese want to show off their status…But this would be a very misleading way of looking at their consumer habits. In fact, it’s wrong,” he cautioned.

“If the Chinese were just looking for logos, why has Bottega Veneta been so successful in China? I’m convinced that real, sustainable growth in China will be from a completely different way. My experience at BV, contrary to public opinion, is that the Chinese don’t buy just names. They are looking for quality, craftsmanship and service.”

Yuval Atsmon, a partner in McKinsey & Co’s Shanghai office offered the results of their research to support the same conclusion. In just two years, between 2008 and 2010, the number of Chinese luxury consumers who agreed with the statement, “I prefer luxury items that are low-key and under-stated” increased dramatically from 32% to 52%, he said.

Some other rather insightful tidbits could be gleaned from conversations on the various panels. Mark Henderson, the deputy chairman of Gieves & Hawkes revealed that, interestingly, the firm’s most profitable shop in the world is not even in one of China’s tier-1 cities but in a tier-2 city instead.

Shaway Yeh, editorial director of the upmarket Chinese lifestyle media group Modern Media said that, like other ‘grey areas’ in China which luxury brands must navigate, circulation figures for some high-end publications are inflated and “more of a concept than a real number” and should therefore be viewed sceptically unless there is proof that the figures have been audited.

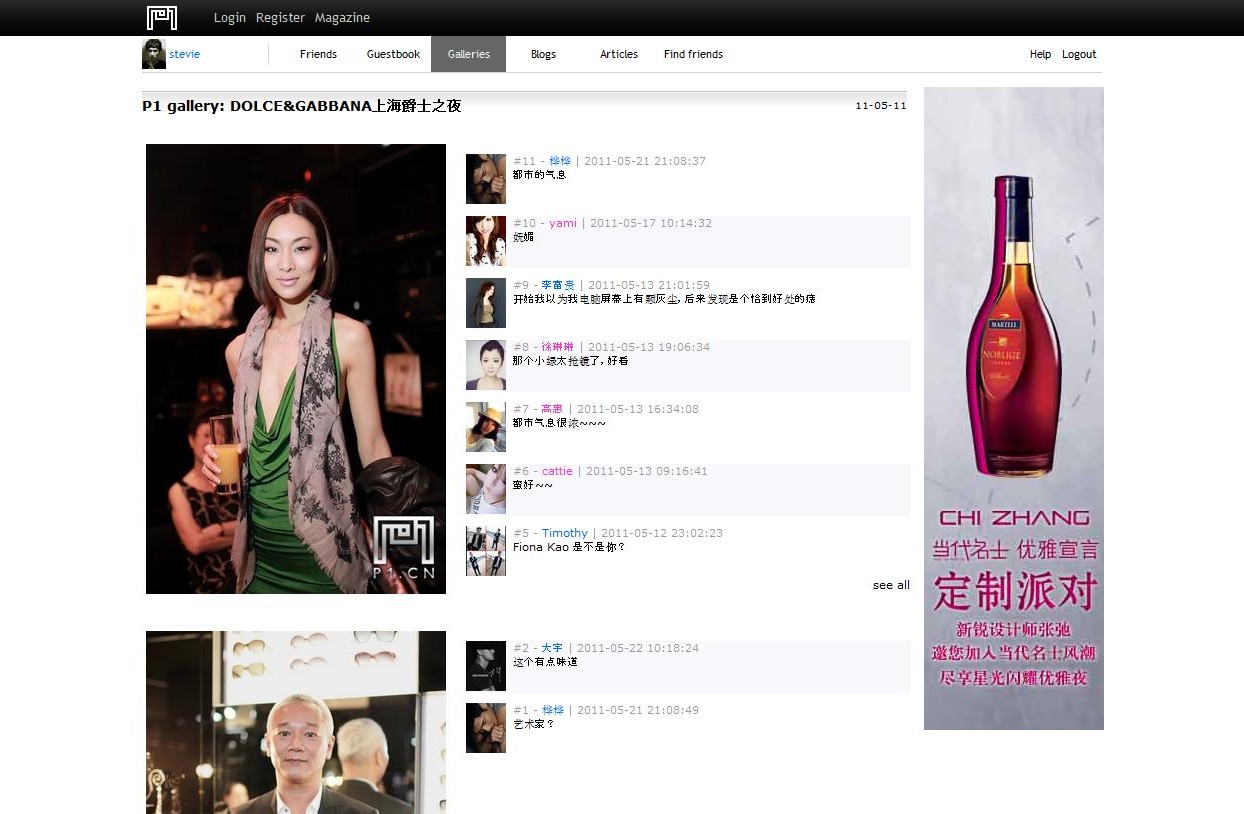

A page from the exclusive Chinese social networking site, P1.CN

Yu Wang, Founder & CEO of the exclusive social networking site P1.CN, which has stringent screening standards for its 1.1 million affluent members, explained how new online marketing models are being adopted and successfully exploited.

“The luxury brands that we work with work with us through brand pages. Through these, we can do CRM and monitor what people are talking about,” he said. “At the end of the first campaign that we did for Lamborghini, for example, we sent 30 of our members to an event and one of them bought a car there. [Keeping in mind that] Lamborghini only sold about 30 cars per year at the time, you can see how linking the right social networks with offline events can really work.”

There was consensus among panellists discussing the online market about many issues. Aline Conus, CEO of the Hong Kong-based firm E-Luxury Brands Distribution said that “the luxury e-commerce market in China is still small because of a lack of offer rather than a lack of demand.”

Martin Bartle, Founder, Arthur Ridley Esq., agreed: “All the research I’ve done indicates that the luxury market online is just waiting and that [when it does mature] the scale will be perhaps as big as it is in Europe.”

“Looking at the online environment in China, it looks a lot like it did with Net-A-Porter ten years ago. People are going to have to not make any assumptions and get in there and get their hands dirty,” he added.

A page from the luxury goods e-commerce site Wooha.com

From a recruitment and HR perspective, Charles de Brabant, CEO and founding partner of the Shanghai-based executive search firm Saint Pierre, Brabant, Li & Associates suggested that the talent war for luxury brands in China extends far beyond people working in the luxury industry itself.

“There just isn’t enough talent out there [to satisfy the ideal recruitment criteria of luxury brands]. So you have to be extremely open. If it’s a position in the supply chain, do you hire from Prada or from UPS? A lot of the time there are blinkers in the luxury industry. If you want to be successful in China, you have to be a lot more open and go broader,” he said.

Shifting demographics were another hot topic. James Kynge, the principal of FT China Confidential and founder of FT Rui made an interesting comparison.

“The premium on exclusivity in China is a mathematical function. If you are able to do something in China that most people can’t enjoy, then you are doing something that one billion other Chinese people can’t do," he said. "Whereas, in the UK for example, if you are able to do something that the masses can’t enjoy, then you are only talking about, say, 50-60 million people. So a great part of the perception of wealthy people in China is to be absolutely at the pinnacle. Therefore, in China, it isn’t a good idea to be too big.”

Patrick Chovanec, a professor at Tsinghua University’s School of Economics and Management in Beijing explained how China’s vast diversity often means that brands have to nurture relationships with local and regional strategic partners as well as national partners.

“I wrote a piece in The Atlantic called ‘The Nine Nations of China’ – nine incredibly different regions in the country… [which is why] you need a Sherpa guide to not only deal with the complexities of China itself being fragmented but also of Chinese retail being fragmented.”

Shoes and slippers from the eponymous luxury brand Mary Ching, who was one of the summit’s panellists