Magnus Danneck, German Marketing Team Leader at Jones Lang LaSalle, shares the key insights from their recently released study of Europe’s most important luxury shopping destinations

Louis Vuitton’s London Maison, located on New Bond Street

The global market for luxury goods has emerged from the financial crisis significantly faster than expected, according to a study of Europe’s most important luxury shopping destinations by Jones Lang LaSalle, focusing on the 100 most renowned luxury brands and their presence in Europe’s metropolitan centres.

James Dolphin, Head of EMEA Retail Agency at Jones Lang LaSalle, commented that “despite booming online offerings, retailing on Europe’s most prestigious high streets remains a very important success factor for the luxury segment. After two years of subdued spending, luxury retailers are responding to the return in consumer confidence with healthy expansion plans. Increased demand for prime space in the best locations is forcing rents up. Other retailers are also looking to benefit from the proximity to famous top-level brands, and this additional demand for scarce showroom space is placing even more pressure on premiums.”

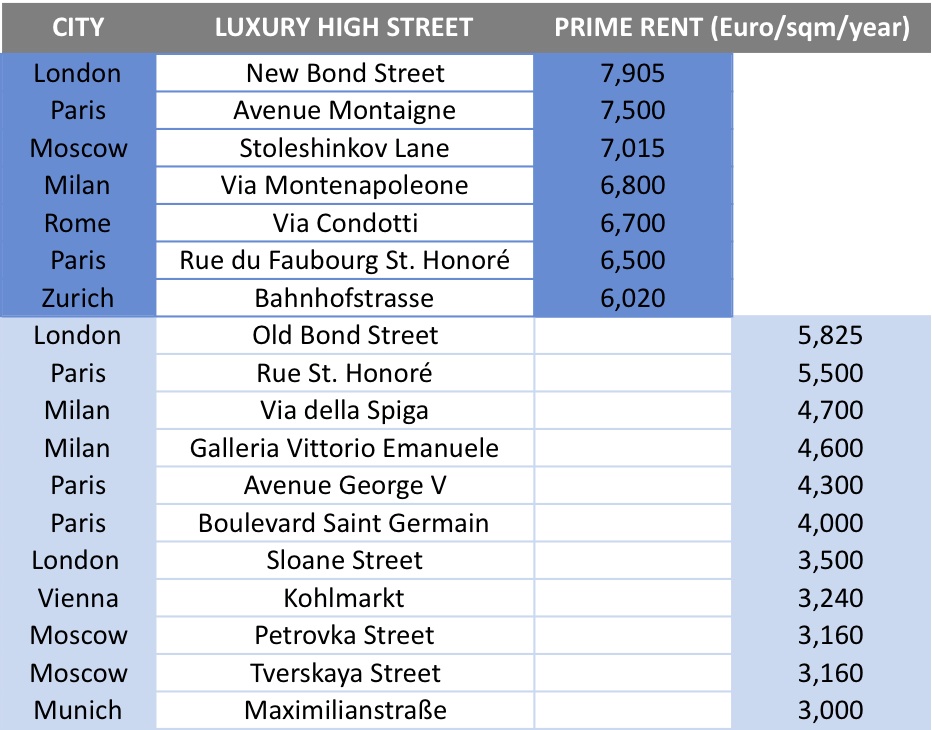

The top 18 prime luxury retail rents in Europe, for the full list please follow this link

Conducting the report…

we analysed the presence of the top 100 luxury brands as ranked by Jones Lang LaSalle in the 23 most important European metropolitan cities. The count of shops in the individual cities exclusively looks at manufacturers’ own luxury shop networks and only covers shops in prime locations and prime malls.

Only shops run under a firm’s main brand are counted; second-line brands, franchised stores and multilabel stores are not counted. Due to the lack of transparency, branded shop-in-shops in renowned department stores are not counted either. In geographic terms, the analysis covers the downtown area of each individual city, centring on its renowned luxury shopping streets, supplemented by the surrounding side streets where relevant.

Most surprisingly we found…

despite the booming online offerings, stationary retailing remains a very important success factor especially in the luxury segment. A look at the latest annual reports published by the leading firms impressively shows that the sales contributed by company-managed shop-in-shops and stores have risen considerably. Almost all renowned luxury brands have been making substantial investments in their own retail structures in recent years, thereby lessening their dependence on wholesale business.

“ Paris is the European luxury hot spot, whilst London’s New Bond Street is the most expensive street in western Europe ”

Not so surprisingly we confirmed…

the highest density in terms of international luxury labels can be found in Paris. Between them, the top 100 luxury labels operate more than 150 luxury stores in the French capital, meaning that a part of them have multiple stores here.

Also we discovered that London’s New Bond Street is the most expensive luxury shopping street in western Europe, commanding top rents as high as EUR 7,900 per square metre per year.

If we were to conduct this study in 12 months time…

We would expect that stationary retailing remains a very important success factor especially in the luxury segment. We would also predict that the highest density in terms of international luxury labels will still be found in Paris. China may well emerge as the world’s largest market for luxury goods but the Central and Eastern European region will become more interesting for expanding luxury labels.

If readers remember only one thing it should be…

Paris is the European luxury hot spot, London’s New Bond Street is the most expensive luxury shopping street in western Europe and Stationary retailing remains a very important success factor especially in the luxury segment.

Luxury Society is pleased to share Jones Lang LaSalle’s full report with our readers. Please click here for the free download.

For more information regarding the research, please contact Svetlana Shif via email: Svetlana.Shif@eu.jll.com.