China's e-Commerce consumer base looks set to explode, as does its online appetite for luxury. So why aren't brands making Chinese e-tail a priority?

Bally’s Chinese digital flagship, launched in collaboration with Yoox in May 2011

China’s e-Commerce consumer base looks set to explode, as does its online appetite for luxury. So why aren’t brands making Chinese e-tail a priority?

We all know China means business for the luxury industry, the market potential and unprecedented growth rates have been more than adequately documented. The economy is thought not only to be booming, but comparably stable and resilient to the economic problems looming over the United States and Europe. Testament to it’s strength, the sale of luxury goods in China grew by 16% in the depths of the 2009 global financial crisis, where developed markets were experiencing the worst revenue periods on record.

In a recent report by Strangeloop, Why Luxury Websites Are Disappointing Chinese Consumers, researchers have suggested that ‘luxury brands are failing to deliver an optimal online experience to their growing Chinese market’, whilst simultaneously identifying compelling opportunities for e-commerce in China.

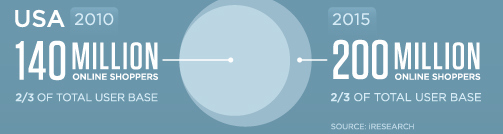

According to the report, only one third of China’s Internet users currently shop online, compared with two thirds in the US. Despite this fact, China’s online retail market expanded by 117 percent in 2009, from $19 billion to $39 billion, making it the second biggest in the world.

Strangeloop also noted that mainstream consumers of luxury goods are getting progressively younger, suggesting that three-quarters are under 43 years old, with more than half between the ages of 25-28. These new tech-savvy consumers are thought to be turning to the Internet just as enthusiastically as their western counterparts, in significantly larger numbers than any other major economy.

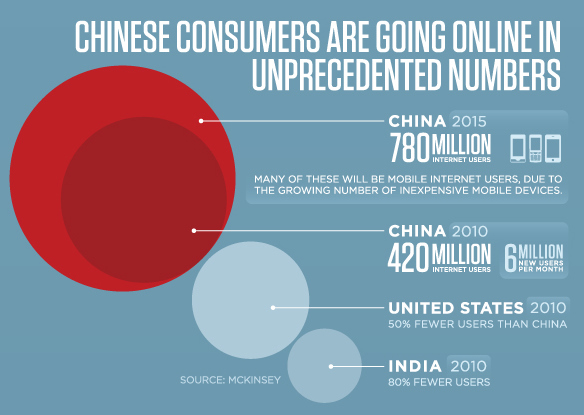

Statistically speaking, as of June 2010, China had 420 million Internet users, nearly twice as many as the US and more than five times that of India. This figure is thought to increase to approximately 750 million by 2015, driven in part by the affordability of web enabled mobile devices.

In terms of e-Commerce users, figures were level for the two nations at 140 million each in 2010. However, this figure represented only one-third of China’s consumer base, whereas it represents two-thirds of America’s. Further confirming China’s potential was the forecast that e-Commerce users would increase to 540 million by 2015, when America would only climb 200 million.

Despite the compelling case for luxury brand e-commerce in China, the report goes on to lament the performance of those already launched in China. The study examined 100 leading international luxury brands’ websites, to determine how they perform for a typical visitor in urban China, and the results were generally unimpressive.

The average luxury website allegedly takes sixteen seconds to load, when 75% of Chinese internet users expect websites to load in three seconds or less. The report did identify the use of ‘older’ browsers in China as a hindrance, where 60% of online shoppers in China are still using Internet Explorer 6, despite its delivery of a ‘suboptimal online experience’.

The report concluded that luxury brands ‘need to understand the rapidly evolving role of Chinese consumers in the marketplace, and they need to be prepared to deliver the premium online experience that these consumers demand’. Which Strangeloop identified as ‘fast, content-rich, feature-rich websites’, with average loading speeds around the two-second mark.

With brands increasingly working to produce China specific sites, it will be interesting to see which brands most effectively capitalise on this clear opportunity, in the coming years of e-Commerce boom.