GroupM China and CIC, share the key insights from their 2011 luxury white paper, The Voice of Luxury: Social Media and Luxury Brands in China

Louis Vuitton’s branded page on Sina Weibo, akin to a hybrid of Facebook & Twitter

GroupM China and CIC, share the key insights from their 2011 luxury white paper, The Voice of Luxury: Social Media and Luxury Brands in China.

“An essential requirement for understanding the wealthy elite in China is to understand how they influence and are influenced by the massive, unique, fragmented and dynamic social media landscape in China," remarks Sam Flemming, Founder and Chairman, CIC.

“By listening to their consumers’ talk about luxury and understanding China’s online cultural context, luxury brands can develop a more impactful communications strategy, including leveraging a luxury voice on Sina Weibo, which resonates with their consumers in meaningful and appropriate way.”

Addressing just this issue, GroupM Knowledge China and CIC have undertaken collaborative research into Chinese consumers’ behaviour and interests in interacting online with luxury brands in China. Using the foremost social media analytical technologies to collect over 2.7 million consumer comments in the Chinese social media arena, the research findings help advertisers in the luxury industry to navigate the complex culture and fragmented landscape of China’s digital space, and to effectively participate in the conversation.

“ Sharing the shopping experience is very common in the luxury category. Chinese consumers want to show off their purchasing power ”

Conducting the report…

GroupM Knowledge provided general luxury market overview data, including data from the GroupM Knowledge/ Hurun Wealth Report 2011. The research looked at the number of key investment and spending indicators amongst Mainland Chinese, as well as measuring income distribution against the 2010 China GDP and 2009 China GNP.

CIC collected, mined and analysed millions of Chinese social media comments about luxury, utilising patent pending technology and a team of seasoned analysts, as well as drawing on archival social media conversations of over 10 million comments.

The luxury category – as defined by this study – includes leather goods (bags), shoes, fine jewellery, watches, RTW (Ready-to-wear or prêt-à-porter) and accessories (sunglasses, belts and so on). Cars, hotels, cosmetics and service level products were not covered in this report.

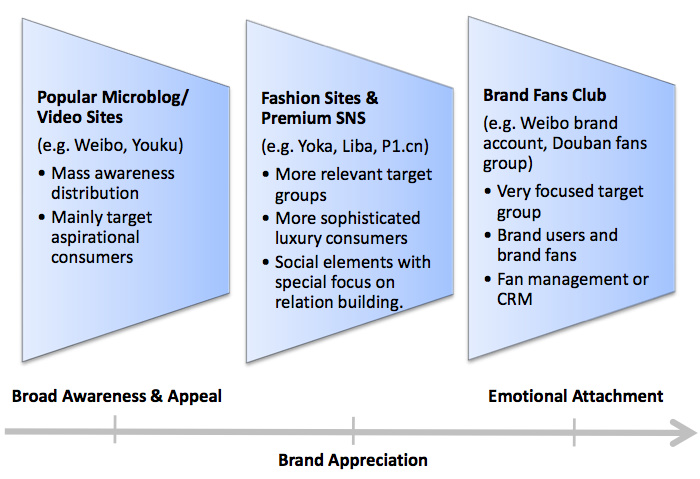

As Chinese social media platforms differ in various ways, luxury brands should take advantage of the particular strengths of each platform, to achieve various marketing objectives.

Not so surprisingly…

Sharing the shopping experience is very common in the luxury category, because Chinese consumers want to show off their purchasing power and shopping achievements. ‘Shai’ (or, showing off a product) is very hot in China’s luxury and fashion bulletin board system (BBS) communities. Trading second-hand luxury products and counterfeits is also common among Chinese luxury consumers.

Buzz surrounding luxury Shai posts showed obvious seasonality, peaking around festivals/holidays, when it was common to be shopping for oneself or others. The report suggested that Shai is an important touching point, to link netizens’ offline shopping behaviour with online expression.

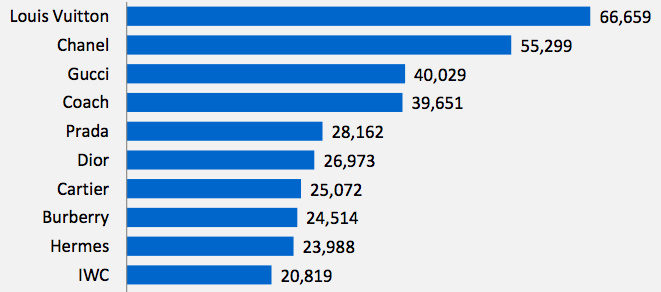

According to the brand buzz volume ranking, Louis Vuitton was most discussed online, followed by Chanel, Gucci and Coach.

Top 20 Luxury Brand Buzz Volume Ranking (by posts)

For fashion brands like Louis Vuitton, Chanel, Gucci, product Shai (87.1%) dominated online conversations. For watch brands, like IWC, knowledge sharing and brand news sharing were most common.

Additionally…

Sina Weibo (akin to a hybrid of Facebook and Twitter) has emerged as an important channel for real-time information updates, recently capturing the attention of the world’s leading luxury and fashion brands. In October 2010, Louis Vuitton became the first global fashion brand to launch a microblog presence in China. In Q1 2011, we have witnessed a rapid build up of luxury brands on Weibo, including Gucci and Burberry.

Among the top 20 most discussed luxury brands on the Chinese Internet, there are 8 luxury brands that have launched official accounts on Sina Weibo. BBS remains an important channel for listening but Weibo also facilitates participation.

“ Among the top 20 most discussed luxury brands on the Chinese Internet, 8 luxury brands that have launched official accounts on Sina Weibo ”

Also of interest…

The top 20% of Chinese netizens contributed 80% of the content within the luxury category. This top 20% were categorised as Luxury e-Fluencers, who command huge influence within communities and effectively engage luxury fans.

Based on the buzz content, there are four clear behavioural characteristics amongst Luxury Efluencers in the online community:

Shopaholic: The netizen showing off personal collections and regularly updating their shopping achievements to attract netizen awareness.

Style Guru: Expertise sharing to build effective interaction with luxury fans, especially in the watch category

Fashionista: Sharing the latest fashion trends and using street-style photography to show off their trendy lifestyles.

Brand Fan: Fiercely loyal to a particular brand, refer to themselves as ‘Fans’ to show their dedication to the brand.

If readers remember only one thing…

It should be the power of Shai. The common thread in all findings, was the Chinese desire to share and ‘show off’ their tastes and purchases. Luxury brands that can understand and harness the power of Shai, will be able to appeal to the emotional part of luxury consumers, and convert them from fans into purchasers or brand advocates.

Brands should also consider collaborating with local lifestyle communities and leveraging the emerging microblog and social networking service (SNS) platforms to maximise their influence.

Luxury Society invites members to download GroupM China and CIC’s full report regarding Social Media and Luxury Brands in China. Please click here to download.

For more information regarding the research, please contact Swee Lynn Chong at GroupM or Chander Guo at CIC.