Consumers

Luxury Society Market Guides: Brazil, Russia, India & China

by

Sophie Doran | March 20, 2012

The third and final launch, in our series of state-of-the-industry reports, focusing on the products, drivers and affluence that characterise the luxury industry in various regions

Following the launch of our local market guides for the United Arab Emirates, United Kingdom and the United States of America, we are pleased to present the third and final instalment of our series, including Brazil, Russia, India & China.

Last year, in partnership with Sofitel and Louis XIII, Luxury Society launched its first series of events, held in twelve countries over six weeks, where we drew on the collective local wisdom of members to gather valuable first hand market information and insights.

Our guides consist of wealth report data and statistics on the region, provided by LS Partner Ledbury Research, as well as comprehensive directories of all country-based service providers, to be contacted by brands wanting to develop their business locally. Below we have also included some key insights from LS members, sharing their analysis, visions and experiences.

São Paulo, an increasingly important hub of luxury consumption and appreciation

Brazil

Brazil’s luxury economy focuses on the consumption of luxury goods, driven by booming middle and wealthier classes. The number of millionaire households in South America’s biggest nation is forecast to more than triple by 2020, whilst its luxury market was expected to grow by 20% in 2011, reaching $3 billion.

Despite optimistic forecasts for growth, entry into Brazil by foreign luxury brands can be a difficult process, marred by bureaucracy. In 2011’s “ease of doing business” ranking by the World Bank, Brazil came in at No. 126, nestled between Ghana and Lebanon. Red tape, stiff tariffs on imports and significant sales taxes push already-high prices of luxury goods, up to 75% higher than purchasing the same item in the U.S. or Europe.

“ Red tape, stiff tariffs on imports and significant sales taxes push already-high prices of luxury goods up to 75% higher than Europe ”

“Brazil has become an essential region for many global luxury brands,” explains Claudia Ribeiro, director of São Paulo Luxury Magazine. “Brazilian consumers are very driven by emotion when purchasing, and the consumption of luxury brands is one way to distinguish from one another socially. But luxury is also seen as an important gift for yourself, as a result of merit.”

“More and more the Brazilian consumer is hungry for information,” continues Claudia. “They now know the price of goods in Brazil is on average three times more expensive due to high taxes. And that it is often cheaper to catch a plane and go to Miami, New York or Paris (the top three tourist destinations for Brazilians) to buy a product. The one advantage of shopping in Brazil is the system of pay-by-instalment credit card, something unheard of in the rest of the world.”

Red Square, Moscow, home to luxury department store GUM

Russia

Russia was one of the strongest markets for luxury goods before the global financial crisis hit in 2009, which forced the $8 billion luxury economy to contract by half. Luxury goods retailing has traditionally been Russia’s most developed sector, with the majority of international luxury brands present with mono-brand stores (CPP).

During the GFC, several big name brands were forced to permanently close boutiques in luxury capitals, Moscow and St Petersburg. Distributors Mercury and Bosco di Ciliegi have led the import of luxury goods since the early 1990’s, and also control TSUM and GUM department stores respectively. The biggest challenge said to be facing Russia’s luxury market is the exodus of Russians who prefer to shop abroad.

“ The biggest challenge said to be facing Russia’s luxury market is the exodus of Russians who prefer to shop abroad ”

“It is vital for luxury brands to understand that Russian consumers value the fact that locally available product has not been adapted to the market and is equal to that purchased abroad,” explains Ekaterina Petukhova, CEO of Esper Group. "This appeals to the Russian’s desire for truly global recognition, which requires no adaptation. What could be valued in terms of product specifics, however, are limited editions for the Russian market only.

“Another factor to bear in mind is that Russian regions are becoming more influential in terms of luxury, where the main points of regional development will be Sochi, Krasnodar, Permj, Kazan and Kaliningrad. Sochi will enjoy the growth of luxury segment up to 7-8%, Kaliningrad 4,5% and all the other cities mentioned around 5%. Though Russians will not necessarily appreciate ‘Russian’ themed products, brands may need to adapt range selection to regional tastes, as regional customers’ tastes tend to differ to that of the larger cities.

Mumbai, India’s commercial capital, home to luxury’s first stand-alone street-level store by Hermès

India

India’s luxury market is forecast to grow to $14.7 billion by 2015. Jewellery, electronics and cars are growing at the fastest rate, whilst accessories, wines and spirits and luxury travel continue to perform steadily. India’s retail landscape is highly regulated and product import duties in India hover at 30%. Most recent legislation forbids 100% FDI in mono-brand retail, unless 30% of all product is sourced from Indian SME’s.

Real estate is also heavily regulated, retail infrastructure is non-existent and street-level environments are often unkempt. Luxury brands generally launch boutiques in luxury malls or hotels, through joint ventures with local distributors. Future growth is expected to come from second-tier cities like Gurgaon, Pune, Chennai and Hyderabad.

“ The average Indian luxury customer values high quality & exclusivity, they are very price conscious and acquires goods based on social recognition ”

“The new Indian luxury consumer is young and aspirational,” suggests Bernd Schneider, general manager of Sofitel Mumbai. “While the average Indian luxury customer values high quality, exclusivity and social appeal as key drivers of luxury purchase, she/he is also very price conscious and acquires goods and services based on “badge value” and the social recognition that they will bring him.”

“Traditional luxury attributes such as high quality, heritage, longevity, the ‘stories’ associated with brands are beginning to emerge as drivers of purchase, however we are still far from the market behaving in a developed manner, where luxury is intrinsic and understated.. A small proportion of the market can certainly be considered as connoisseurs as they represent ‘old money’ but for the most part, the market is still at the nascent stage.”

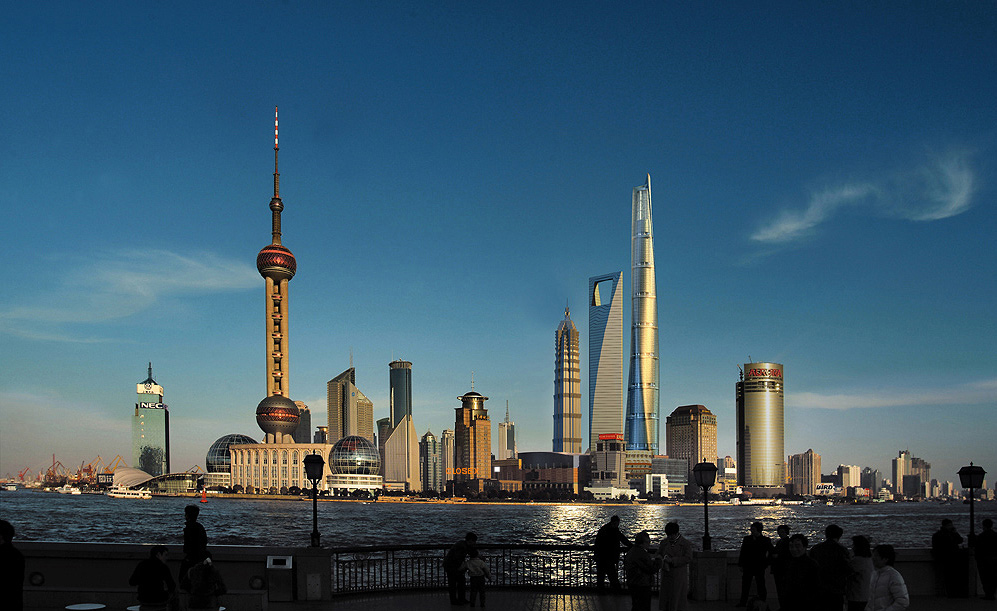

As luxury markets in Beijing and Shanghai begin to mature, luxury brands are looking to best serve second and third tier cities

China

Mainland China ranked in the top 5 global luxury markets in 2010, whilst Greater China (including Macau and Hong Kong) is expected to eclipse Japan in 2012, to become the world’s second largest market after the United States. Watches and leather goods have led recent growth, driven in part by an innate culture of gifting. Wines and spirits, supercars and menswear are categories growing at the fastest pace, whilst interest increases in superyachts and private aviation.

The Internet plays an increasingly important role in luxury brand retail and communications in China, reaching consumers across a wide geographical base, on domestic platforms such as SinaWeibo, Youku, Jiepang and Renren. More and more brands are launching dedicated Chinese e-Commerce platforms to better cater to emerging wealth hubs in second and third tier cities.

“ Chinese customers are very brand orientated, they buy luxury products as symbols of status and therefore aim for well-known brand names ”

“Chinese customers are very brand orientated,” suggests Emil Klingelfuss, chairman of Swiss Prestige in Hong Kong. "They buy luxury products as symbols of status and therefore aim for well known brand names. Hong Kong customers are slightly different as they have a deeper understanding of products and are more attracted by exclusivity and new technologies and designs. Chinese customers usually buy very classic designs, whereas Hong Kong customers are bolder.

“We do not design products especially for Asian market, as we don’t want to localise the product. Customers also don’t want to buy ‘localised’ products. The want what they see and know from other world cities when they travel. However we do keep in mind that Asian customers tend to buy small size watches and generally are not to much into Chronographs.”