Consumers

The Most Searched For American Fashion Brands in the World

by

Sophie Doran | October 26, 2012

Luxury Society, Fashion's Collective & Digital Luxury Group present the first global search analysis conducted on American fashion brands

Luxury Society, Fashion’s Collective & Digital Luxury Group present the first global search analysis conducted on American fashion brands

Digital Luxury Group and Luxury Society are proud to announce the launch of the World Luxury Index™ American Fashion, in a first-time partnership with Fashion’s Collective.

Unveiling for the first time, a ranking and analysis of the most searched-for American fashion brands in the world, based on the unbiased search inputs coming from Google, Baidu, Bing and Yandex. Our research examines 35 US-based fashion brands, through 31 million+ searches, from 10 global markets.

What is immediately clear is that US-based fashion brands are strongest on their home turf. BRIC markets currently count for less than 10% of global search interest for American brands, but this figure is growing – albeit selectively – as more and more companies tailor their communication and product offerings to individual regions.

“ US-based fashion brands are strongest on their home turf ”

Handbags & Ready-To-Wear Lead

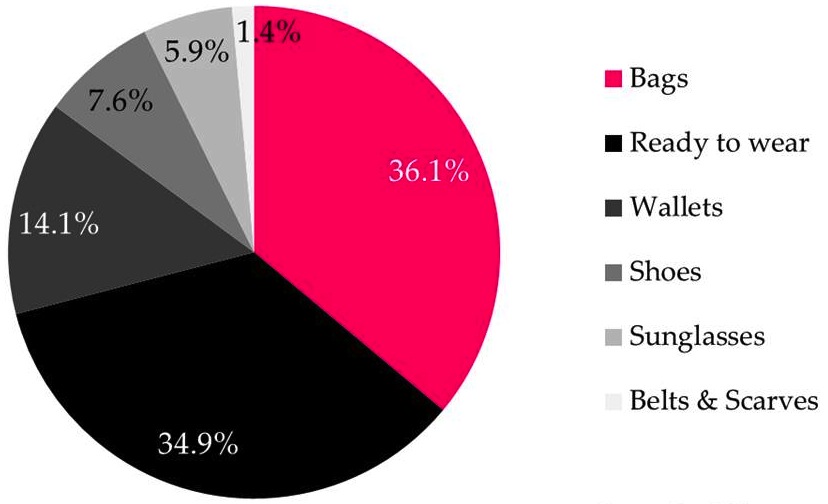

On average around the world, American brands are most often searched for within the Handbag and Ready-to-Wear categories. Handbag searches make up 36% of all American fashion brand searches globally, yet in China, as one example, this is even higher, representing more than 50% of American fashion brand searches.

Global searches for the top 2 brands, Michael Kors and Marc Jacobs, show handbags are representing close to 60% of total brand-related searches.

Top 10 most-searched American fashion brands worldwide.

January – June 2012, Source: Digital Luxury Group

Michael Kors

Michael Kors is the most searched for American fashion brand, capturing 19.6% of total brand searches. Its 2011 IPO garnered both the designer and the brand enormous publicity, when fashion’s biggest-ever public offering – oversubscribed by ten times – valued the company at $3.8 billion.

The brand now operates in 74 countries, with over 230 points of sale, with a deliberate strategic focus on Asia. In Q1 2012, total revenue reached $414.9 million, up 70.6% when compared with the same period of 2011, driven by directly owned store distribution.

“ Handbag searches make up 36% of all American fashion brand searches globally ”

American brands lagging in BRIC markets

While there are a few standouts, overall, European brands in the same sector do a far better job of marketing to and doing business with “emerging” BRIC markets, Brazil, Russia, India, and China.

For the American luxury fashion brands studied, 70% of search volume originated on home turn in the U.S. with only 7.4% from BRIC markets. For the European brands, BRIC search volume represents over 30%.

Global breakdown of searches by product category

January – June 2012, Source: Digital Luxury Group

Surprises from China

Brands such as Tory Burch and Hervé Léger do surprisingly well in China. In the case of Tory Burch, the brand’s first store in Mainland China was opened in Beijing in 2011 and the brand has made efforts to tailor its offering to this market by offering modified sizes and tastes to suit the Chinese consumer.

Hervé Léger has benefitted from local celebrities embracing the brand’s classic bandage dress as standard photo opportunity attire, thereby gaining attention with celeb-conscious consumers.

The World Luxury Index is an on-going international ranking and analysis of the most searched-for brands within the luxury industry, covering over 400 brands within six key segments, launched in partnership between Digital Luxury Group & Luxury Society. Please see previous editions below:

- The Most Searched For Luxury Hotel Brands in China

- The Most Searched For Handbag Brands in the World

- The Top 50 Most-Searched for Luxury Brands in Russia

The full report is available to download from: www.dlgr.com/usfashion. More detailed data and analysis on a particular segment or brand is available upon request.

For any further enquiries regarding the index or research, please contact Eric Roditi of Digital Luxury Group, eroditi@digital-luxury.com