Abhay Gupta, founder & CEO of Luxury Connect, details the findings of recent research conducted on the status of luxury talent and professionals in India

New Delhi’s DLF Emporio

Abhay Gupta, founder & CEO of Luxury Connect, details the findings of recent research conducted on the status of luxury talent and professionals in India

The research and analysis of this Luxury Retail Report is based on information received from various students and professionals in the Indian Luxury Product & Services Sector primarily through a research survey. Respondent category was also extended to brand owners or their key senior executives of up to CEO level.

Luxury Products & Services Sector in India

With the increasing number of international luxury brands entering India to numerous real estate builders claiming their developments to be luxury, “The Luxury Mantra” is here to stay. India is now perceived to be the new Mecca of Luxury. The Luxury market in India is growing at a steady pace.

As per a report by AT Kearney, the market size is estimated to touch $15 bn by 2015. Also projected is the fact that a quarter of the luxury market will be between India and China by then. Besides, India is the second fastest growing economy after China.

The ever-rising UHNI category has a net worth of over $ 600 billion. The luxury market size would quadruple by 2025 and India would be the fifth largest consumer market by then. India is all set to encounter this gigantic growth in Luxury, the question arises: does India have the required human resources to handle it?

“ The value of the Indian luxury market is estimated to reach $15 billion by 2015 ”

The current Luxury Market accounts for 10% of total Indian Retail. The National Skill Development Corporation projects the total retail human resource requirement by 2022 will be approximately 17.8 million. Bearing this equation in mind, we can roughly estimate that by 2022, the total manpower required to handle Luxury brands and services in India will be around 1.76 million head counts.

And the opening up of FDI in Mono Brand Retail in India may further surge this requirement much earlier than 2022. The Indian market is already in shortage of skilled personnel that has exposure or dedicated knowledge in Luxury.

This has resulted in a drill down effect, where opportunities are many but supply is less, further resulting in a high employee turnover rate. Through this research report, Luxury Connect has tried to understand the dynamics of training and educational needs in India as far as the Luxury Products and services sector is concerned.

“ The current Luxury Market accounts for 10% of total Indian retail ”

This report is the result of a research survey conducted amongst the following four respondent categories:

1) Top management (CEO) of Luxury Firms controlling franchise operations in India.

2) Working Luxury Professionals currently employed in the trade across various industry segments such as fashion apparel, automotive, yachts, spas, jewelry, fragrances, furniture, wines etc.

3) Brand owners whose brands have either already come in or are awaiting regulatory clearances.

4) Next generation prospective employees as in students from India’s top fashion and educational institutes like NIFT, Apeejay, Pearl Academy of Fashion, JD Institute of Design etc.

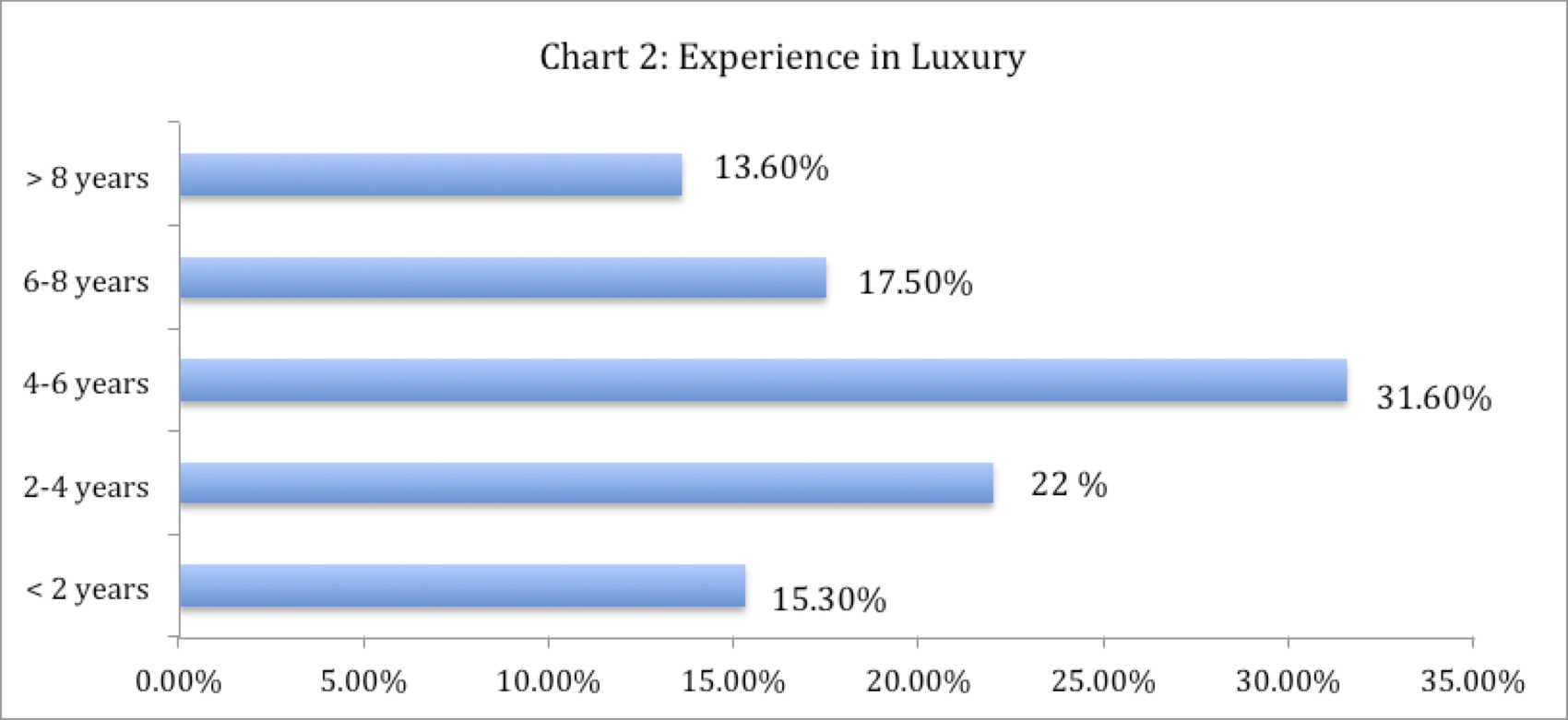

“ The majority of Indian luxury professionals have experience of 4-6 years ”

Respondent Characteristics

Luxury has just started to strengthen in India and obviously a lot depends on which age group will be taking it on to the next level of growth till the time Luxury in India starts looking for niche markets. This reports finds the average employee age in the Luxury sector to be around 35 yrs.

It is interesting indeed that majority of professionals have experience of 4-6yrs. Younger blood accounts for 37% of total share where as 17.5% have 6-8 years experience and only 18.5% have more than 8 years of experience in Luxury Products & Services.

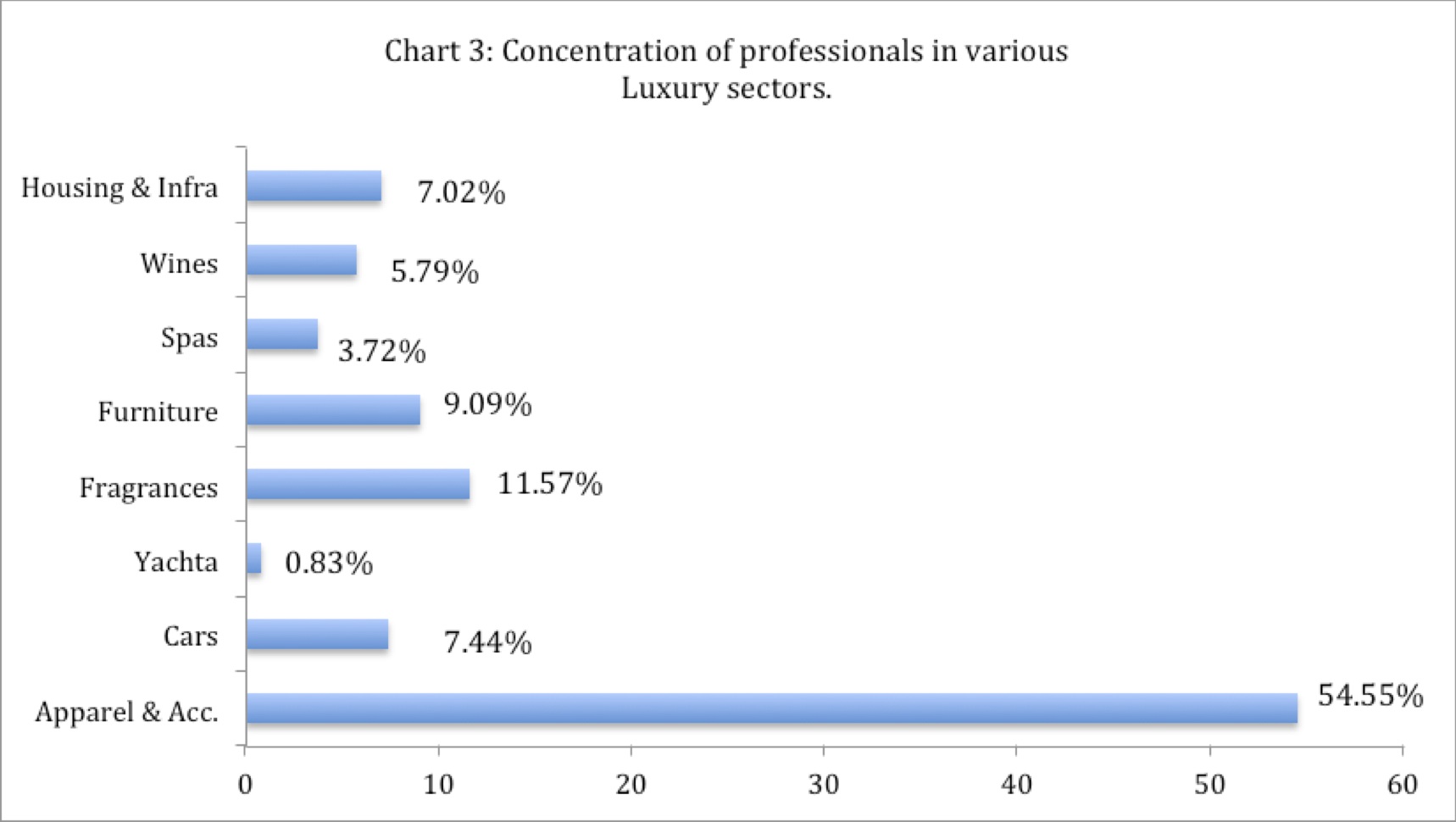

The Luxury industry in India is not just limited to fashion and lifestyle – there are luxury automobiles, yachts, helicopters, luxury spas etc., and the market is ever growing. In the FY 2010 – 11, Mercedes has sold 5,819 cars and BMW topped the chart with sale of 6,246 units.

Audi is threatening to overtake them both! Spas account for the total revenues of 400 million dollar annually to Indian economy. Chart 3 shows the concentration of professionals in various Luxury sectors.

Manpower Demand & Supply for Luxury

86% student respondents would want to work for the Luxury Products & Services Sector. This is a positive sign, as future supply of the luxury manpower will mostly come from younger segment only. It will be interesting to find out as to how the younger generation will be further educated in luxury since there are hardly any Luxury specific education institutes in India.

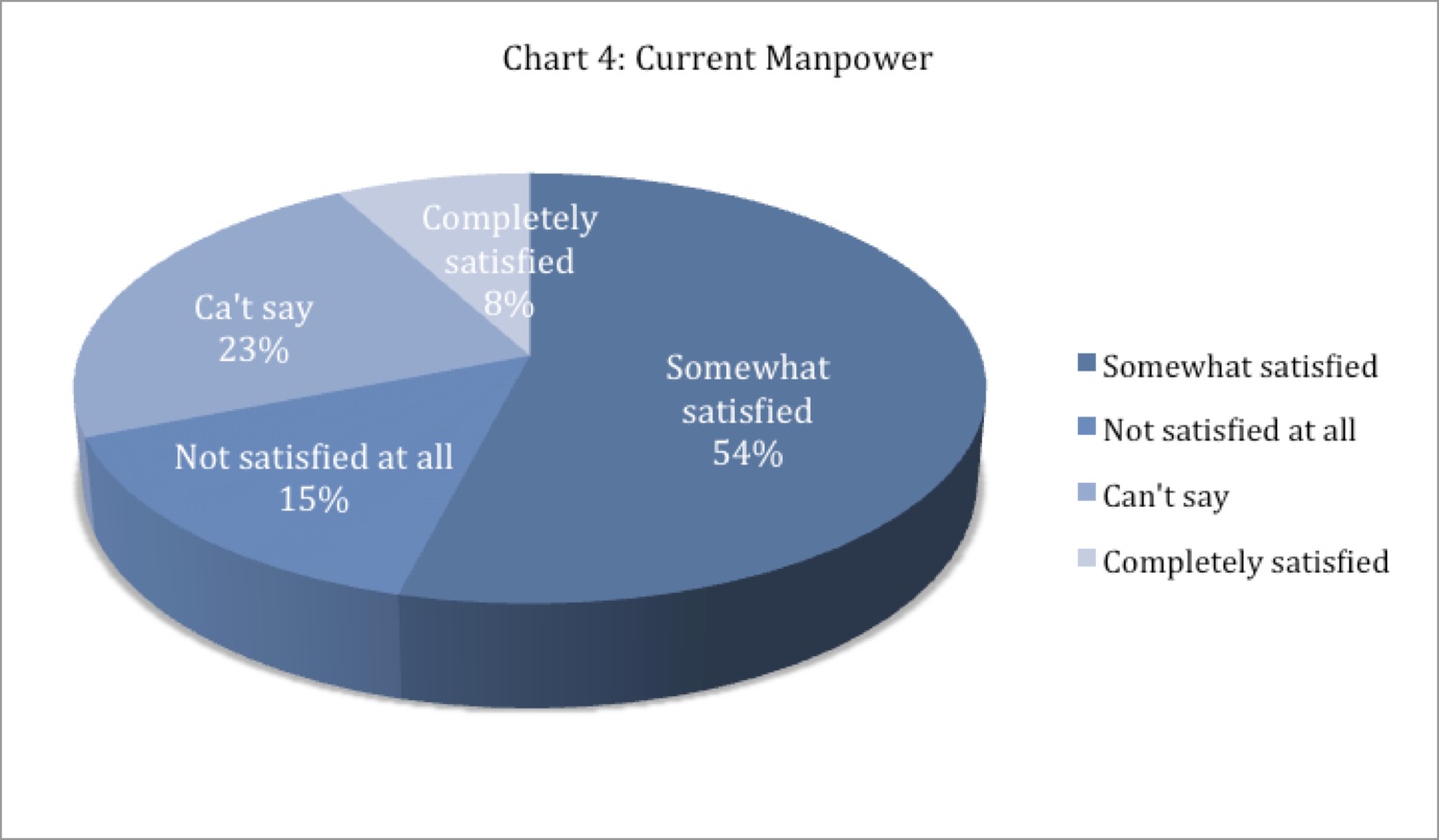

In addition to it, approximately 54% of the top management in Luxury firms find their manpower “somewhat satisfactory”. So, it can well be deduced that the satisfaction levels are yet to build up in India as far as expertise of the manpower handling Luxury products services are concerned.

This also serves, as an indication that trained quality manpower is not available in India. 69.2% of firm owners & top manager would also want to hire professionals who are specifically trained for Luxury. Dearth of such professionals leave no other choice for the top managements of Indian Luxury Firms but to hire the best from amongst the available “somewhat satisfactory” personnel from the available pool.

This need has reached up to a brim point where 53.8% of the company heads and/or brand owners would even want to invest in Luxury Training & Education of their employees.

“ 53.8% of Indian company directors & brand owners want to invest in luxury training & education ”

Luxury Product Preferences

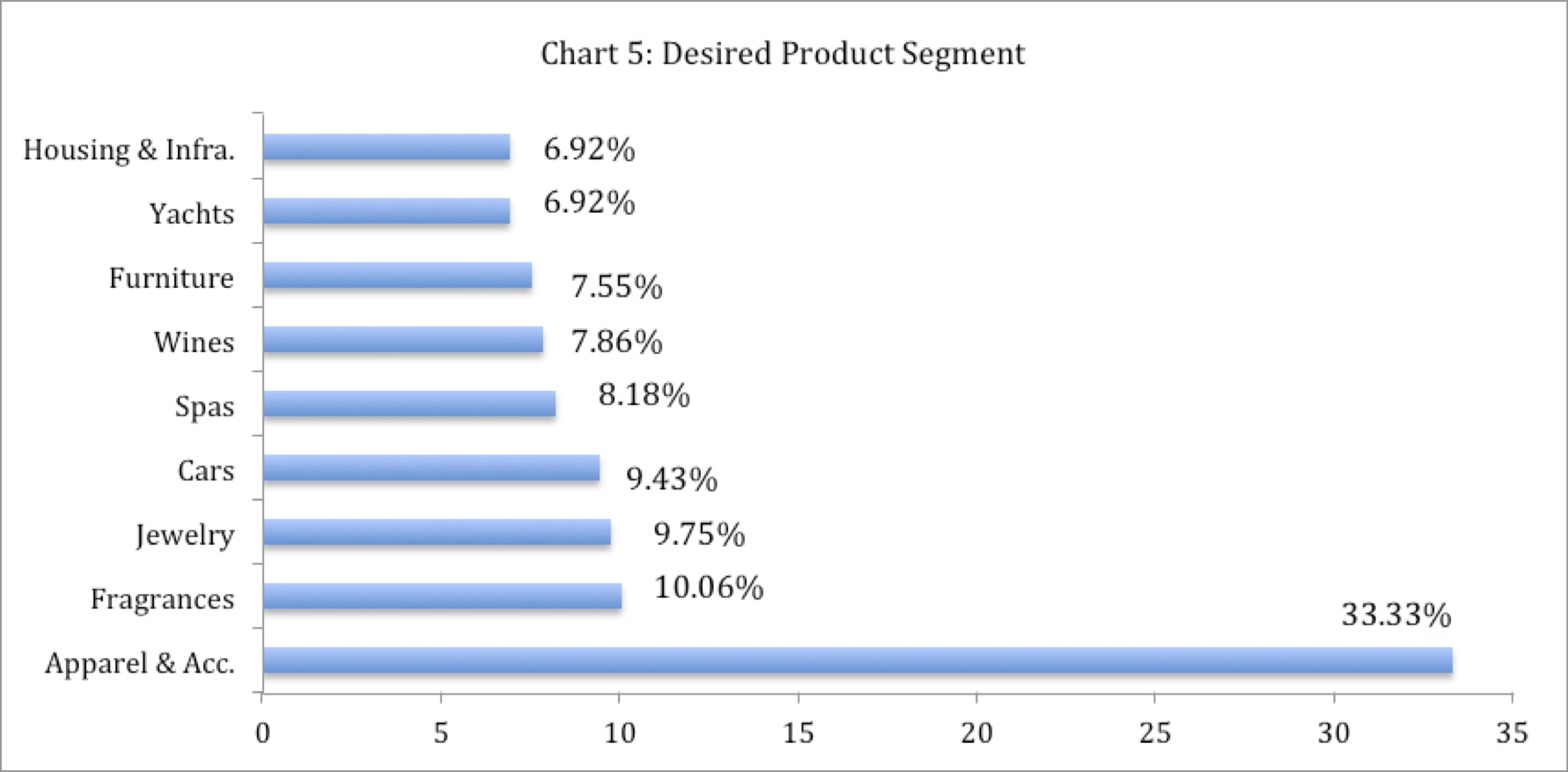

Since, the Luxury Segment in India is only in its first stage, there are possibilities that the existing Manpower will try and shift their focus on other products within Luxury. Chart 5 shows the respondent distribution amongst the product lines they would want to gain Luxury Training & Education in.

How to Gain Luxury Expertise

It is very clear now that students are ready to work for Luxury Segment and there exists a dire need of quality manpower in India to handle Luxury. Now the next question, which arises, is, as to how the students and working professionals can be imparted with international level of luxury training and education.

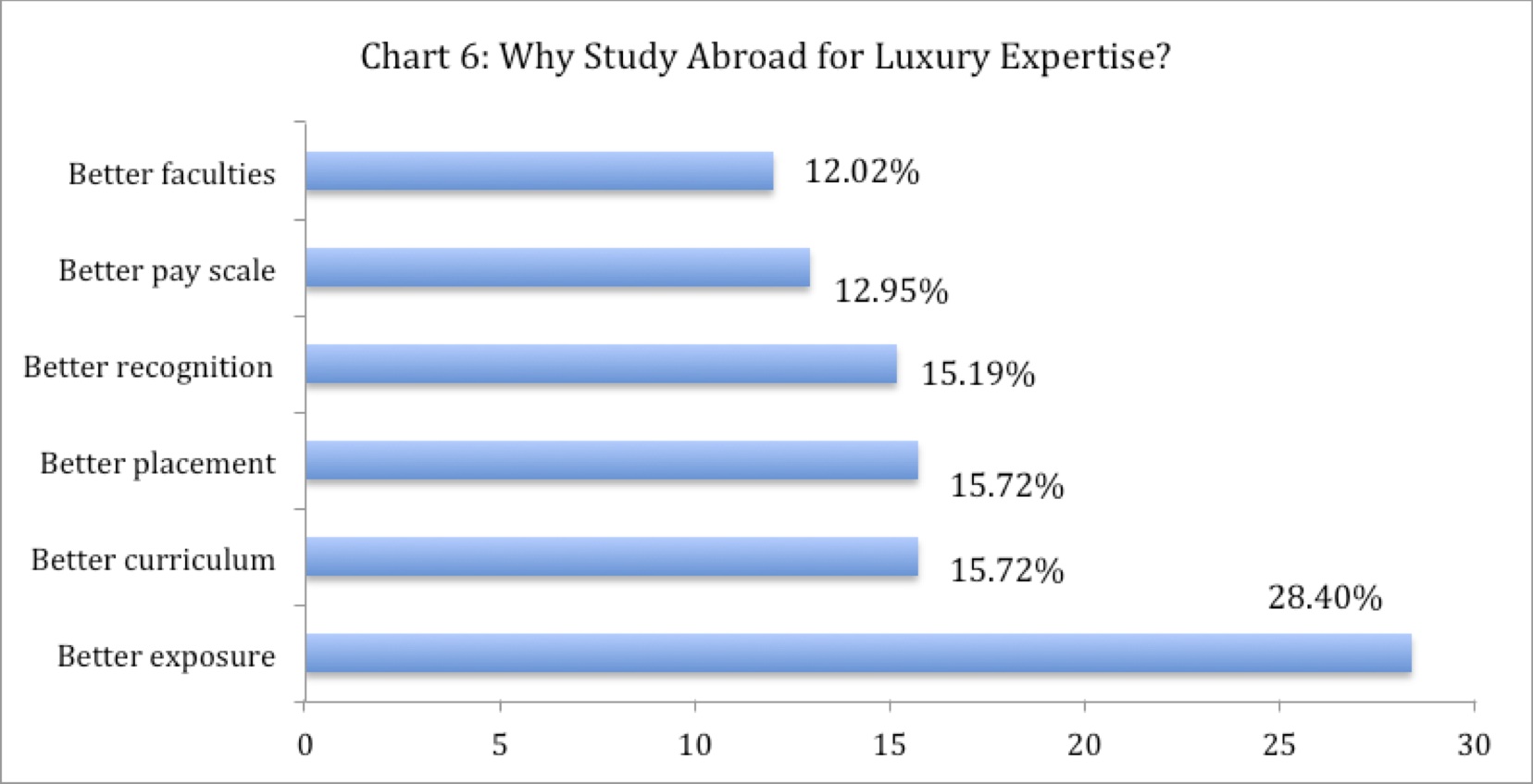

The solution so far lies with the respondents, as 82% of them are willing to travel abroad to gain luxury education & training. And ‘better exposure’, ‘better placement opportunities’ and ‘better course curriculum’ makes up the top 3 reasons for this (refer Chart 6).

Through this research survey we have analyzed that 70% of the respondents are likely to take up luxury educational programs in India if the foreign tutors and curriculum are made available to them on par with international standards.

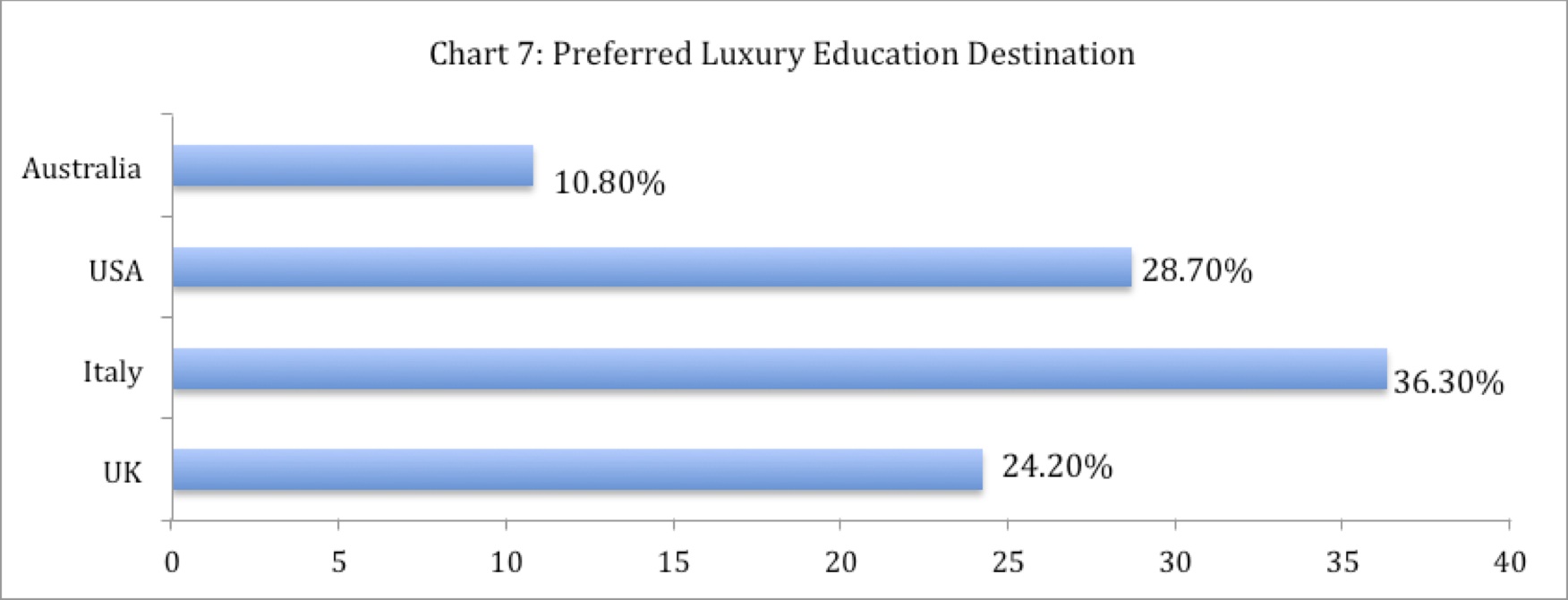

It has also been found that Italy has been voted as the most preferred luxury education provider by the respondents, followed up by USA, UK and then Australia as shown in Chart 7 below.

Luxury Program Preferences

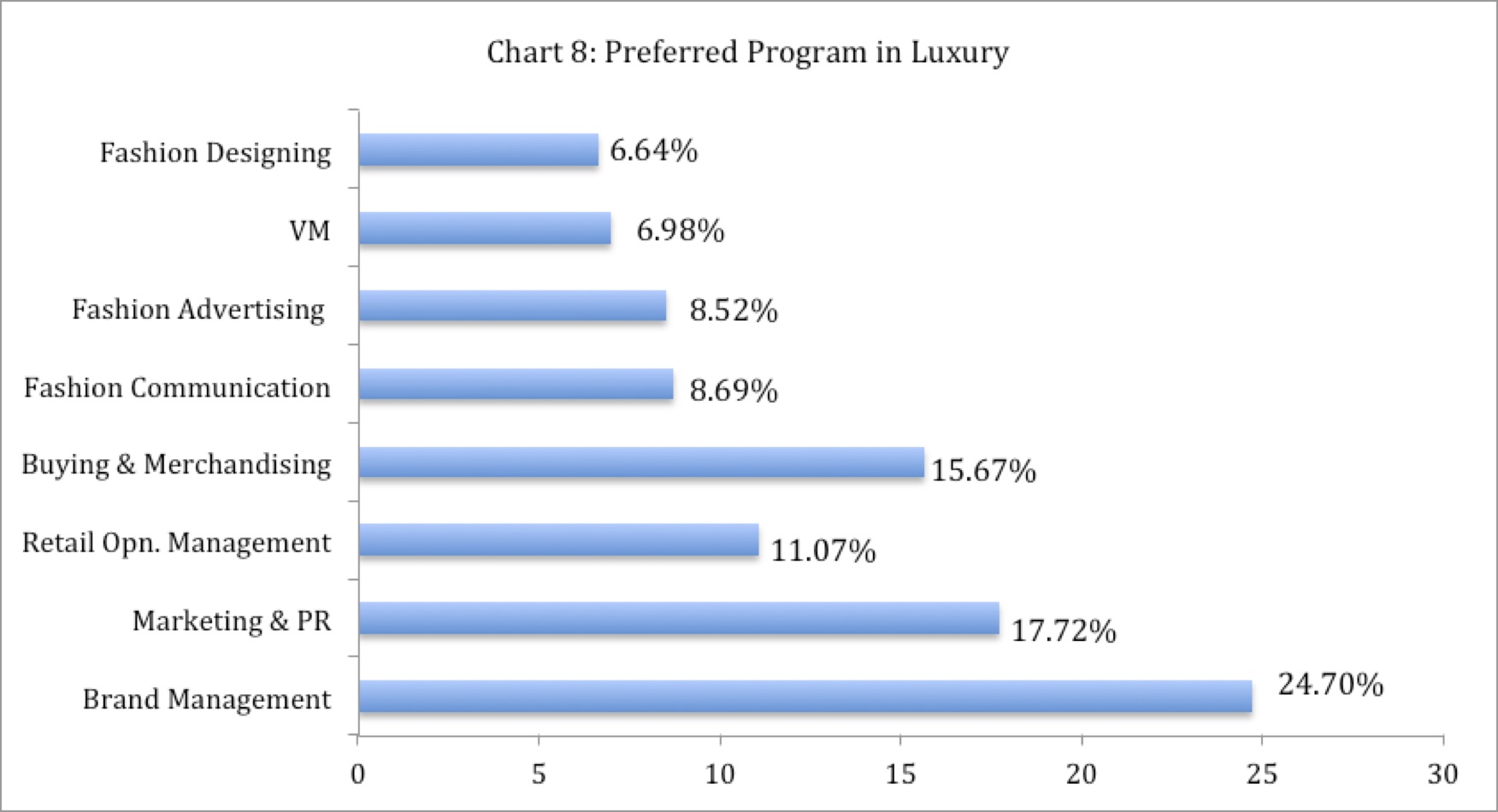

It is time we talk about the respondent’s preferences in terms of course selection within their chosen Luxury Product. Referring to Chart 8, we find out that the “Luxury Brand Management” has been found as the most desired program, with second spot taken up by “Luxury Marketing & PR” and buying & Merchandising Management taking the third place.

Most Recognized Foreign Colleges Imparting Luxury Education

From the most preferred luxury education destination-Italy, institutes like SDA Bocconi School of Management, Milan; Istituto Marangoni, Milan; and Polimoda, Florence emerged as the most popular schools recognized by the Indian respondents.

From other fashion capitals- Paris, ESSEC Business School and London College of Fashion from London were also amongst the most preferred schools for imparting luxury education.

Customer Service and Satisfaction Standards

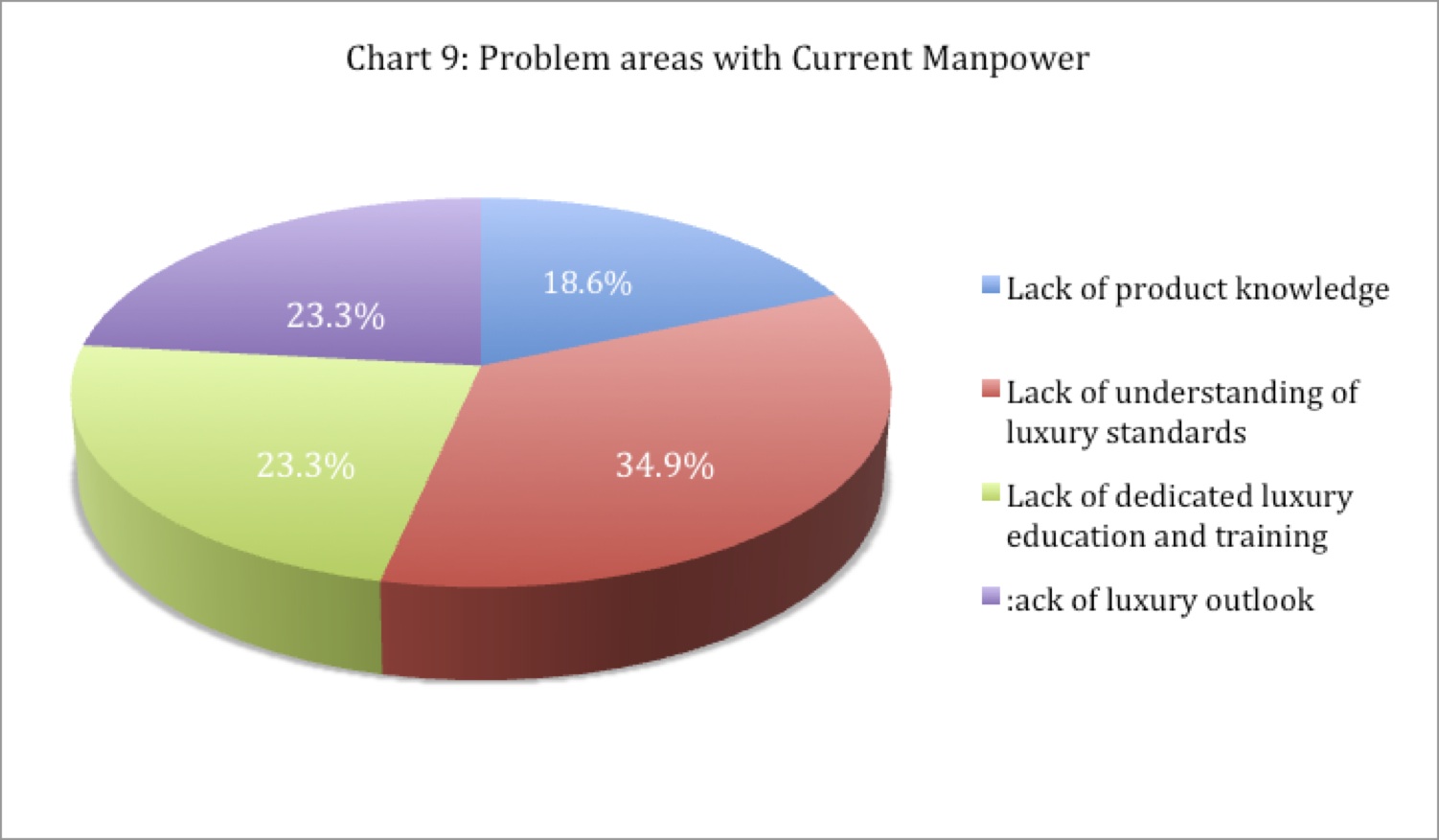

Questionnaire posed to respondent category 1 (Indian franchise company CEO’s) and Category 3 (brand owners) with regards to ‘Problem areas with the current manpower’ (see Chart 9) revealed that Indian manpower is unable to provide desired service standards on shop floor due to various factors. Lack of skills or knowledge has been represented below in percentile:

18.6 % – Lack of product knowledge

34.9 % – Lack of understanding of luxury standards

23.3 % – Lack of dedicated luxury education and training

23.3 % – Lack of luxury outlook

Whilst all efforts have been made to ensure that all the information and facts provided in this research report are authentic, Luxury Connect Consultancy and research wing however accepts no responsibility for any errors or omissions in such references.

Reference of this report findings may be used for media & industry reports, articles with due credit given to “The Status of Luxury Talent in India”, a Research Report by Luxury Connect.

To further investigate the Indian luxury market on Luxury Society, we invite your to explore the related materials as follows:

- India: Demystifying the Luxury Mantra

- In Conversation with Deepa Harris, Taj Hotels & Resorts

- Luxury Opportunities Abound in India, But How To Manage Challenges?