Chanel has become the #1 most sought-after global luxury brand in China, according to the World Luxury Index™ China – 2nd Edition

The brand overtook Louis Vuitton thanks to rising interest in various product segments, particularly beauty. Interest for Louis Vuitton on the other hand originated mainly from the fashion segment, accounting for almost three-quarters of total interest in the brand.

“Louis Vuitton has reported a disappointing first quarter, while brands from different segments ranging from Chanel to Coach or Burberry are continuing to grow," explains David Sadigh, founder & CEO of Digital Luxury Group.

“ In order to stay ahead of the game, brands must have the ability to adapt quickly thus reducing the risk of brand saturation ”

“Though rapidly evolving, the Chinese market is still developing. In order to stay ahead of the game, brands must have the ability to adapt quickly thus reducing the risk of brand saturation. In the case of Louis Vuitton, LVMH has already shifted gears, putting the brakes on its global expansion, whilst raising prices and developing more leather upmarket products.”

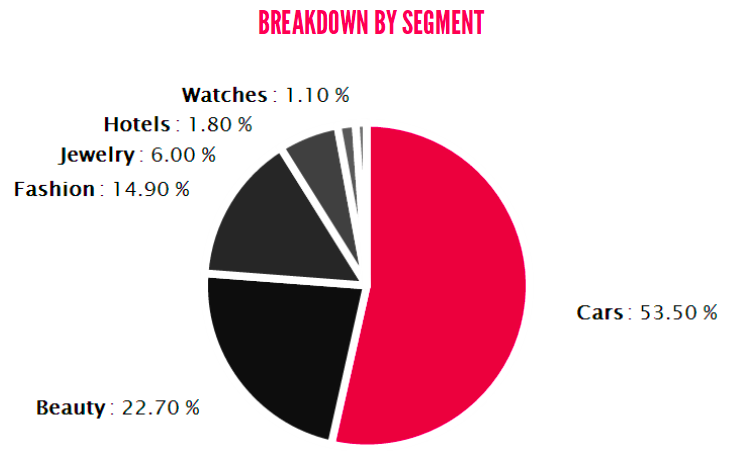

This year’s report reveals that Chinese consumer interest in the luxury market is dominated by heavyweights: Cars (53.50%), Beauty (22.70%) and Fashion (14.90%). New brands to enter the Top 50 are: Elizabeth Arden (#43) and Rado (#50), whilst Salvatore Ferragamo and Moncler are “out” of this year’s rankings.

Top 3 brands by segment (© Digital Luxury Group)

“Many brands expected that an increase in Chinese sophistication would reduce the cultural gap with their overseas consumers," comments Pablo Mauron, General Manager China at Digital Luxury Group.

“In some cases, it actually contributed to the development of unique local preferences, independent from Western tastes, thus challenging luxury brands in terms of product offering but also opening up the way for new opportunities to grow in the Chinese market.”

“ Language barriers continue to create complexities between Chinese consumers & Western luxury brands ”

“Language barriers continue to create complexities between Chinese consumers and Western luxury brands," continues Echo Zhiyue Zhou, China Digital Strategist at Digital Luxury Group. "Almost 40% of searches are for either non-official or original brand names, whilst the remaining searches are for their official Chinese name.”

Chinese consumers search for brands in various ways, reflecting how they are being recognized and remembered in the mainland. They should keep this in mind when developing their China communication strategies, especially for new brands entering the market.

Share of search by segment (© Digital Luxury Group)

Fashion

The Top 3 Most Sought-After Fashion Brands in China are: Chanel (#1), Louis Vuitton (#2) and Gucci (#3). Giorgio Armani, is the fastest growing fashion brand, up +17 spots since last year. Bags and wallets dominate the fashion market in China accounting for almost 90% of total interest. Celine’s “Luggage,” consolidates its iconic status in the mainland as the #1 most popular handbag model, followed by Hermès’ Birkin and Chanel’s 2.55.

Cars

Audi (#1) and BMW (#2) maintain their leadership position in the luxury car segment. Lexus (in 3rd place), breaks the German trio, moving ahead of Mercedes (now 4th). Jaguar is the rising star, showing the fastest evolution (+5 places since last year) followed by Cadillac and Lincoln. Maybach, Ferrari and Maserati experienced the biggest losses in the category.

“ Audi (#1) and BMW (#2) maintain their leadership position in the luxury car segment ”

Beauty

Estée Lauder, Lancôme and Dior retain their spot as the three most desired beauty brands in the Chinese market – Lancôme overtaking Dior as #2. Skincare accounts for almost 60% of all Beauty searches. American beauty brands Estée Lauder and Clinique are popular with skincare products, whilst European brands Dior and Chanel are more popular for fragrance.

Watches

Omega, Rolex and Longines lead the Chinese luxury watch segment. Classic, elegant models dominate Chinese consumer interest lead by Omega’s De Ville, which becomes the number one most sought-after model (up 3 spots).

The World Luxury Index is an on-going international ranking and analysis of the most searched-for brands within the luxury industry, covering over 400+ brands within six key segments.

The unbiased information is derived from 680 million consumer online searches originating from leading search engines Baidu and Google. Please see previous editions below:

- Hilton, Ritz Carlton & Four Seasons Lead Share of Online Luxury Hotel Search

- Luxury Auto Brands Lead Share of Online Search in Brazil

- The Most Sought-After Luxury Watch Brands in China

The full report is available to download from: dlgr.com/wlichina2. More detailed data and analysis on a particular segment or brand is available upon request.

For any further enquiries regarding the index or research, please contact Laetitia Hirschy of Digital Luxury Group