Five must-know insights from The World Wealth Report 2012 by Capgemini and RBC Wealth Management

Five must-know insights from The World Wealth Report 2012 by Capgemini and RBC Wealth Management

According to Capgemini and RBC Wealth Management, going into 2012 there was little reason to expect the year would end on a positive note for investors. “Widespread investor uncertainty, even fear, emanated from all corners of the globe, undermining investor sentiment,” explained the duo in The World Wealth Report.

“Additionally, global economic growth was decelerating, with emerging markets slowing and some mature markets threatening another bout of recession.” Yet despite the turbulence of the global economy, particularly in the Eurozone, both the population and wealth of global HNWIs reached significant new highs in 2012,

Even though the year got off to a shaky start, HNWIs ultimately benefitted from strong market returns in spite of sluggish global GDP growth. Here we present five key insights for luxury brand executives, uncovered in the 2013 World Wealth Report by Capgemini and RBC Wealth Management.

“ HNWI wealth is forecasted to grow by 6.5% annually to US$55.8 trillion by 2015 ”

Global Wealth Reaches Record Levels

High net worth individuals (HNWIs) are defined by those with US$1 million or more in investable assets. The world’s population and aggregate investable wealth of HNWIs grew strongly in 2012, reaching record levels.

The global HNWI population increased by 9.2% to reach 12.0 million individuals, after remaining flat in 2011. Aggregate investable wealth increased 10.0% to US$46.2 trillion, after declining slightly in 2011. HNWI wealth is forecasted to grow by 6.5% annually to US$55.8 trillion by 2015.

North America and Asia-Pacific, the two largest HNWI regions, drove global growth. North America expanded 11.5% in HNWI population (3.73 million), and 11.7% in wealth, reclaiming its position as the largest HNWI market. Asia-Pacific expanded 9.4% in HNWI population (3.68 million), and 12.2% in wealth.

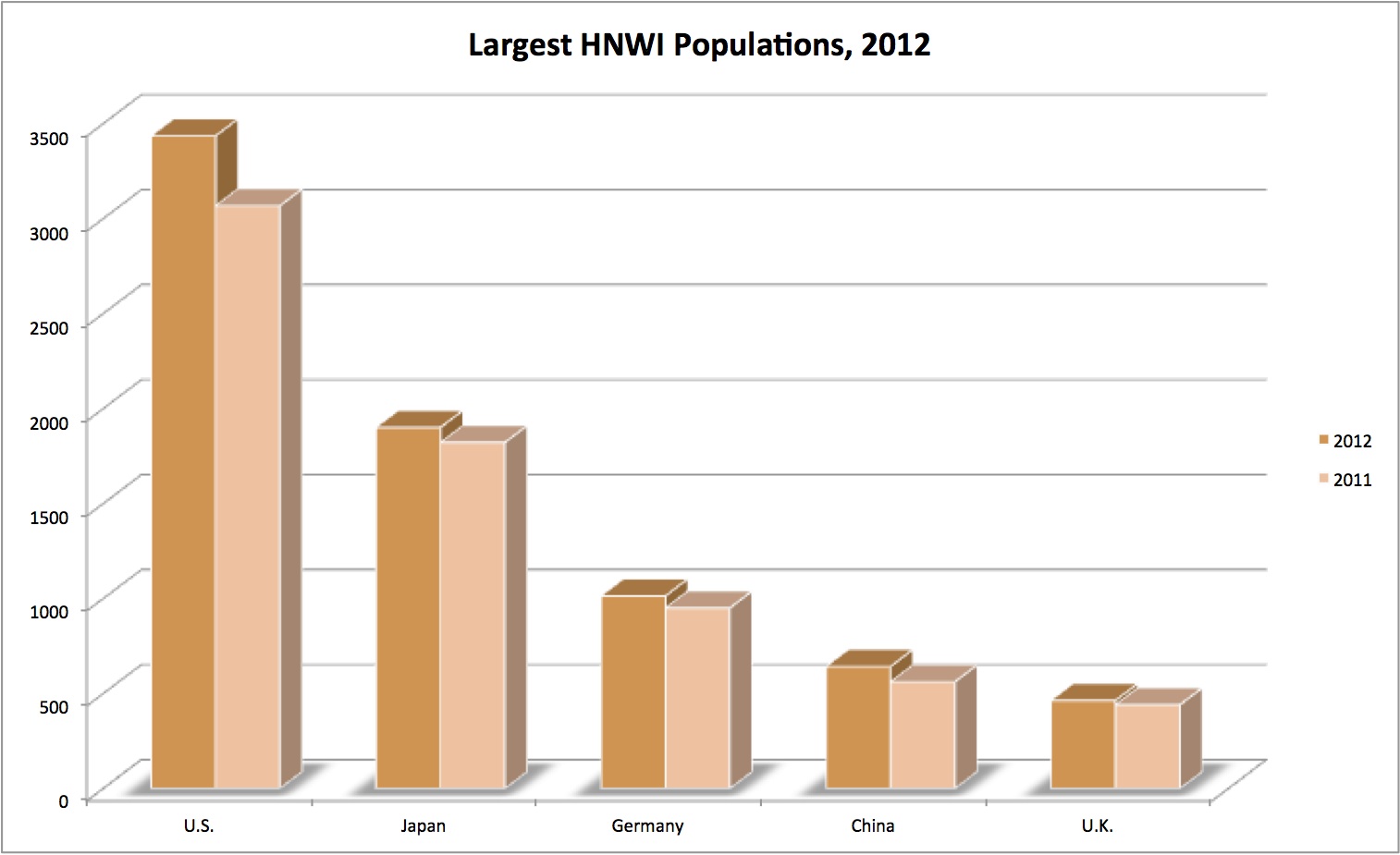

Top 5 Largest HNWI Populations, 2012

More Than Half of HNWIs Are Concentrated in 3 Countries

More than half the global population of HNWIs continued to be concentrated in the United States, Japan and Germany. For the past three years, individuals in these countries have accounted for roughly 53% of all HNWIs, down from 54.7% in 2006. The market share of the top three countries is expected to erode over time as emerging markets increase in prominence.

When compared to 2011, no new countries penetrated the ranks of the top 12 HNWI markets in 2012, nor did any shift occur in the rank-order of the countries. After the Top 5, the countries with the highest population of HNWIs are as follows: France (6th), Canada (7th), Switzerland (8th), Australia (9th), Italy (10th), Brazil (11th) and South Korea (12th).

“ More than half the global population of HNWIs are concentrated in the United States, Japan & Germany ”

Fastest-Growing HNWI Markets Are Located in Asia-Pacific

Looking both within and outside the top 12 countries, many of the fastest-growing HNWI markets are located in Asia-Pacific. Hong Kong experienced a 35.7% increase in its population of HNWIs, propelled by a combination of relatively less conservative investing behaviour among many HNWIs and strong equity markets.

India, with 22.2% growth, benefitted from positive trends in equity market capitalization, gross national income, consumption and real estate. Both Hong Kong and India overcame their poor performance in HNWI population growth in 2011 (Hong Kong lost 17.4% while India lost 18.0%).

By 2014, Asia-Pacific is expected to reclaim its position as the region with the highest HNWI population and also register the highest level of HNWI wealth. By 2015, HNWI wealth in Asia-Pacific is expected to reach US$15.9 trillion.

In another sign of strength in the region, the Asia-Pacific countries of Indonesia, Australia, China, New Zealand, and Thailand posted double-digit growth rates in their HNWI populations.

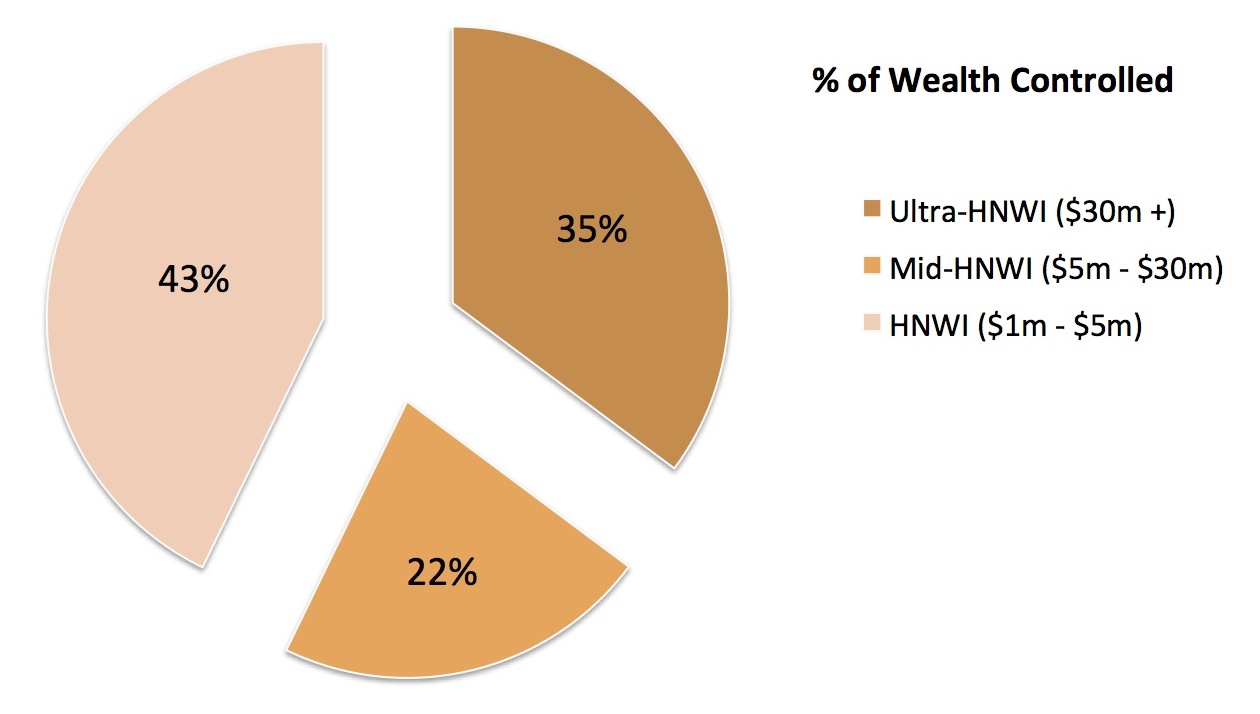

Control of Global HNWI Wealth by Tier

Ultra HNWIs Control 35.2% of HNWI Wealth

Ultra-high net worth individuals – defined as those having investable assets of US$30 million or more, excluding primary residence, collectibles, consumables, and consumer durables – increased in number and wealth by 11.0% in 2012, compared to a population loss of 2.5%, and a wealth loss of 4.9% in 2011.

Representing less than 1% of the global HNWI population, the world’s 111,000 ultra-HNWIs control more than one-third (35.2%) of HNWI wealth. Global ultra-HNWI wealth would have been even greater if not for the relatively lower growth rate of ultra-HNWI wealth in Latin America (7.4%), which makes up more than one third of this wealth band.

Mid-tier millionaires, with between US$5 million and US$30 million in investable assets, turned slightly negative growth in 2011 into roughly 10% growth in population and wealth in 2012. This segment of 1.07 million individuals comprises 8.9% of the HNWI market and owns 22.0% of its wealth.

Together, the ultra- and mid-tier markets control 57.2% of HNWI wealth. Individuals with between US$1 million and US$5 million experienced growth in population and wealth of about 9%, up from marginal increases in 2011.

“ Representing less than 1% of the global HNWI population, the world’s 111,000 ultra-HNWIs control 35.2% of HNWI wealth ”

Jewellery, Gems & Watches Lead Investment of Passion

HNWIs cited Jewellery, Gems, and Watches as their preferred Investment of Passion (IoP) with a 31.6% allocation among their IoP holdings. In the Middle East and Africa this allocation was as high as 35%, trailed by Latin America (34.2%) and Asia Pacific excluding Japan (30.8%).

“Other Collectibles,” representing coins, fine wine, antiques and the likes, are the second most dominant allocation across regions with the exception of Japan and Middle East/Africa.

In North America and Europe, HNWIs allocate more investment to Other Collectibles than they do to “Luxury Collectibles,” representing automobiles, boats, jets and the likes. Whereas in Japan, Latin America and Middle East/ Africa, HNWIs invest more heavily in Luxury Collectibles.

Whether driven by personal enjoyment or pure financial return, HNWIs continue to be drawn to art as an investment. Now in a rebound following the financial crisis, art is increasingly becoming a meaningful element of HNWI portfolios, comprising 16.9% of IoP allocations, making it the third most popular category.

To further investigate wealth & affluence on Luxury Society, we invite your to explore the related materials as follows:

- Renewed Optimism in the U.S. Luxury Market

- The Travel Habits of America’s Affluent

- London & NYC Most Important Cities for Super Rich