H1 2014 results are in for LVMH, Kering and Swatch Group

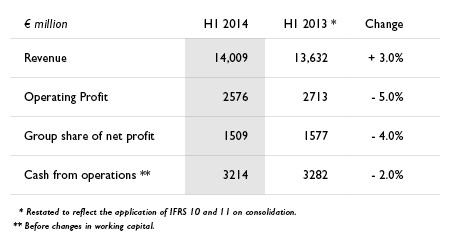

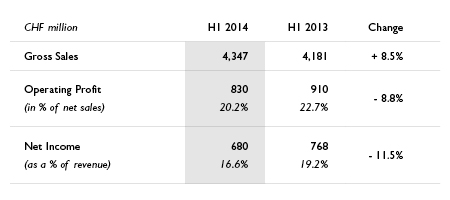

For all three conglomerates, revenues climbed, albeit at various paces. Swatch Group lead the charge (at constant exchange rates), registering an increase of 8.5% on H1 2013. LVMH’s Group sales increased by 3%, lead by sales increases in its Fashion & Leather Goods division (up 7%) and Selective Retailing (up 4%).

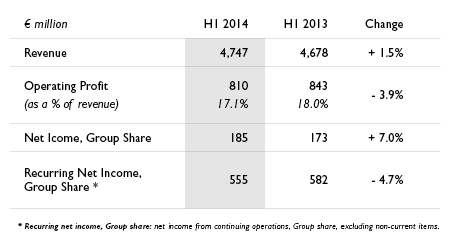

Kering Group sales inched up just 1.5%, yet its Luxury division posted year-on-year revenue growth of 5.7% based on comparable data, reflecting solid performances by directly operated stores across all geographic areas. The group also announced the acquisition of Haute Horlogerie brand Ulysse Nardin, as a ‘Luxury – Watches & Jewellery’ division was created, headed by Albert Bensoussan.

All three organisations suffered a drop in Operating Profit. The hardest hit was Swatch, dropping by 8.8%, though the Group believes that, due to the somewhat seasonal pattern of the Watches & Jewellery segment, slightly higher revenues and operating profits are usually expected in the second half of the year.

Operating profit at LVMH dropped by 5%, as Kering’s decreased by 3.9%. Most of the conglomerates attributed decreases to exchange rate fluctuations, which, at LVMH, had a negative net impact of 235 million euros on Operating Profit, compared to June 30, 2013. At Kering, exchange rate fluctuations had a negative €196 million effect on revenue during the period. The extremely adverse exchange rate situation negatively impacted Swatch Group sales by CHF 188 million or 4.5 percentage points.

Despite a relatively muted performance by the groups, all were confident that H2 2014 will deliver more positive growth figures, as integration continues from newly acquired businesses and exchange rates are better managed. Though with sales of €14 billion in just six months at LVMH, it seems like the world is still prepared to spend on luxury.

KERING

“Kering delivered a sound performance in the first half of 2014, with revenue up 4% and improved recurring operating margin on a comparable basis. The Luxury activities reported further sales growth, driven by a solid performance from directly operated stores, and their recurring operating income rose in the period.”

“In an unsettled operating environment, we are pursuing the implementation of our strategy, all the while keeping tight control over costs and safeguarding our gross margins. This enables us to anticipate an improvement in our operating performance in the second half of the year.” François-Henri Pinault, Chairman, Kering.

The Luxury activities posted year-on-year revenue growth of 5.7% based on comparable data, reflecting solid performances by directly operated stores across all geographic areas The Group’s balance in terms of geographic presence and sales formats makes it more resilient to changes in the economic environment despite the volatility in the global economy over the last several quarters.

Revenue generated outside the Eurozone climbed 4.9% in the first half of 2014 (based on comparable data) and accounted for 78% of the Group total, versus 79% in 2013 (on a reported basis). Growth in mature markets was sustained at 3.1% (based on comparable data), driven by Japan and North America.

Emerging markets were up 5.6% on a comparable basis, and accounted for 38.1% of sales, including 26.2% generated in the Asia-Pacific region (excluding Japan).

LVMH

“The results of the first half demonstrate LVMH’s excellent resilience, thanks to the strength of its brands and the responsiveness of its organization in a climate of economic and financial uncertainties. The first half of the year also witnessed the smooth integration of Loro Piana into the Group.”

“Following the first half’s good resilience, it is with confidence that we approach the second half of the year and rely on the creativity and quality of our products, and the effectiveness of our teams, to pursue further market share gains in our traditional markets, as well as in high potential emerging territories.”

- Bernard Arnault, Chairman and CEO of LVMH.

Highlights of the first half of 2014 include: Good resilience in Europe and continued growth in Asia and the United States. Strong negative exchange rate effect, particularly on Fashion & Leather Goods and Watches & Jewellery activities. Wines & Spirits’ performance impacted by continued destocking by distributors in China. Cash from operations before changes in working capital of €3.2 billion. Net debt to equity ratio of 23% as of the end of June 2014.

SWATCH GROUP

As expected, operating profit of CHF 830 million was 8.8% lower than the previous year due to the negative currency situation, the high level of marketing expenses for the Olympic Games in Sotchi and the fire at ETA; nevertheless, operating margin reached 20.2%.

Net income was CHF 680 million, 11.5% below the first half of 2013, with a 16.6% return on net sales. Positive outlook for the second half of the year, with a better comparison basis for exchange rates and an already improved situation at ETA as of July, after recovery from the fire.

In the Watches & Jewellery segment (including production), Swatch Group recorded gross sales growth of 8.8% at constant rates and 4.3% at current rates compared to the previous year. This growth was generated by the Group’s strong brands and broad distribution network. In local currency, all markets except for a small number of European countries remain on a growth course compared to the very high prior-year figures.

The outlook for the Group in all regions and segments remains very good and a promising second half of 2014 is expected. Particularly in the USA and Japan, sales continue their very positive development. Also, the stronger sales trend noticed on the Chinese mainland continues.

In contrast, the situation in Hong Kong is affected by a number of uncertainties. In the second half of 2014, due to the anticipated lower comparison basis of exchange rates to the Swiss franc, negative currency impact should be less dramatic than in the first half of 2014.

To further investigate conglomerates on Luxury Society, we invite you to explore the related materials as follows:

- 2013: Another Significant Year of Revenues for LVMH, Hermès & Kering

- Taking Stock: An Inventory of Consolidation in the Luxury Industry

- Little Sign of Slowdown for Luxury’s Big Three