As the luxury industry farewells another eventful year, Euromonitor International reviews its 2014 luxury goods predictions to see what really happened

Mulberry CEO Bruno Grillon exited in 2014

Of the twenty predictions made by Euromonitor International in January 2014, twelve of them came true. Despite the accuracy of more than half of our predictions, it proved difficult to find a cohesive message within our findings other than the industry continues to rapidly change.

What these findings did highlight is the different ways in which luxury brands are managed and the impact this has on their sales, consumers and ubiquity. In 2014 we saw luxury brands actively chase the middle-market with affordable mass products and succeed beyond our wildest dreams.

Then we saw a number of iconic historic luxury houses take their product offering further upscale to little short-term gain. Many revenue figures were disappointing and executives were moved along, as the industry proves that there is no one science to managing a luxury brand.

“ The industry continually proves that there is no one science to managing a luxury brand ”

Where we saw less than expected activity was in the M&A; sector, as many big name independent luxury brands remained independent, despite rumors of conglomerate takeovers, private equity investment or big IPO’s.

Based on previous years of rampant purchasing and currently overflowing cash reserves, we expected to see conglomerates look into new industries and geographical regions for their next big-buy.

But aside from minority investment in a handful of up-and-coming designers, the M&A; space was relatively quiet in comparison to previous years.

We invite you to discover our review below and look forward to sharing our 2015 predictions in the coming weeks.

Cosmetics proved to be a new growth driver in 2014

The Hits

A change in leadership at Mulberry

Bruno Guillon quit in March after two years as Chief Executive. His strategy was flawed, we believe, from the start. His biggest mistake was in pushing Mulberry too upmarket and then refusing to change tack despite oodles of market pressure.

The U.S. was the largest growth market

In absolute terms. There has been a pivotal shift in geographical growth this year, from Asia Pacific to the US. It has been a recurring theme in the quarterly financial results of the leading global players.

India was the fastest growth market

In percentage terms and based on markets with an annual retail value of more than US$ 1 billion. Rising prosperity in tier 1 cities coupled with a big shift from the black market to the formal retail market has turned India into one of the world’s most attractive markets for new luxury goods investment.

Spain, Italy and France grew at the weakest rates

They constitute three of the five weakest-performing luxury goods markets of 2014. It has not been all bad news, though. Luxury accessories, for example, have shown a high level of resilience.

Luxury goods spending in China accelerated

China’s total luxury goods market is on course to grow 7% this year (at fixed US dollar prices), double the rate of last year. Gift-giving categories are still under downward pressure, but designer apparel and luxury accessories are resurgent.

“ Michael Kors has taken affordable luxury to new heights ”

Michael Kors spearheaded dynamic growth in affordable luxury

In the US, especially, Michael Kors has taken affordable luxury to new heights. But, growth rates on a comparable stores basis have slowed in the second half of the year. Is this a sign, perhaps, that the “Kors bubble” is about to burst?

Luxury cosmetics was one of the fastest growth categories

Designer labels, in particular, have built strong new positions in super-premium cosmetics (the likes of Burberry, Marc Jacobs, Jason Wu and Tory Burch). Beauty care is now Burberry’s fastest-growing business segment, for example.

Hermès rose from strength to strength

Hermès, in particular, has shown great skill in navigating the tricky operating conditions in China. Discreet branding and an untarnished reputation for exclusivity go to the heart of its competitive edge.

Online discount activity grew for luxury brands

Discounting is widespread in the online channel and reflects a glut of supply in some categories. It poses a potential image problem for some of the mid-market brands that are looking to push their portfolios upmarket.

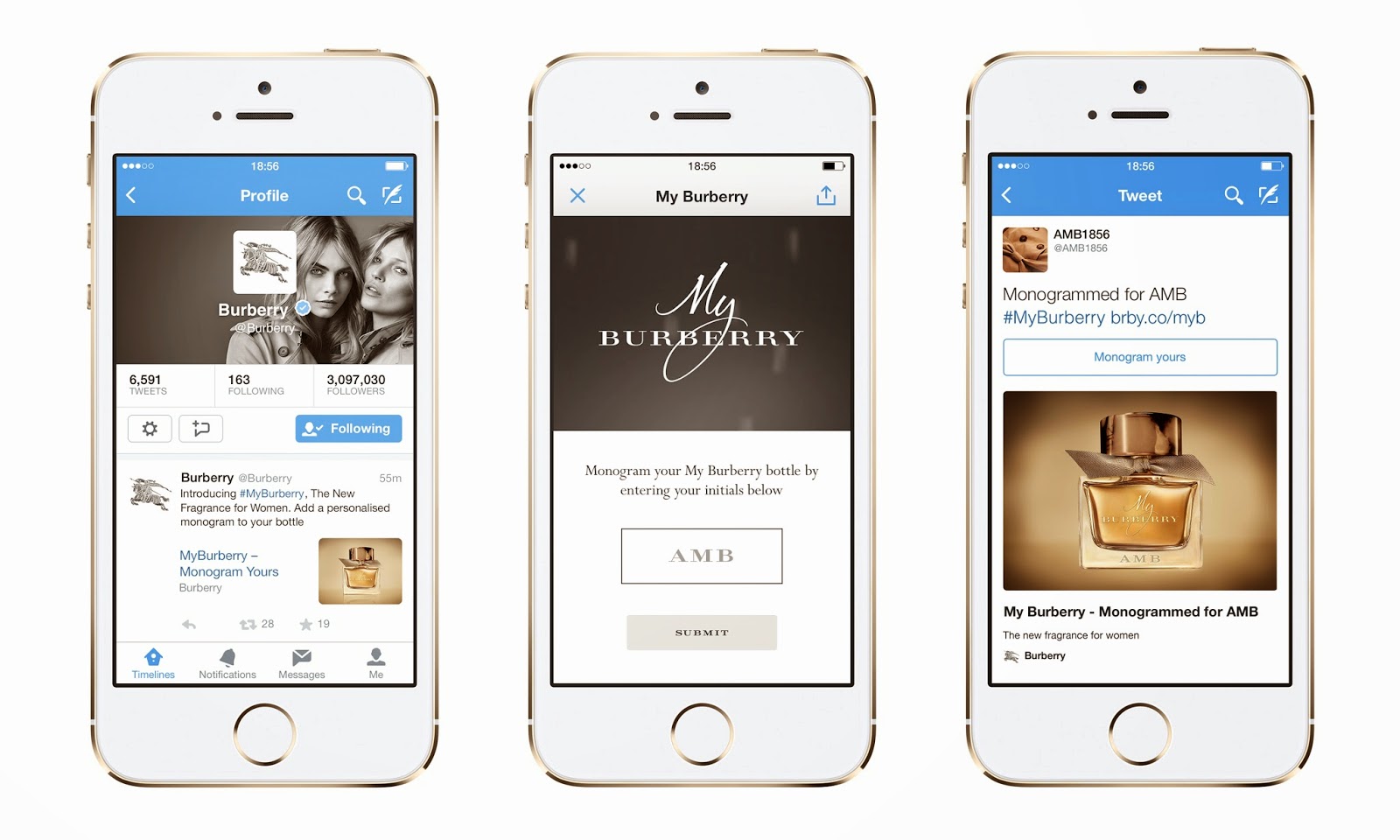

Burberry’s continued to lead innovation on social media

Luxury brands began to engage proactively with social media platforms

High-profile digital innovations include the “buy now” button, piloted by Burberry in a tie-up with Twitter, and Michael Kors’ efforts to unlock the sales potential of Instagram. Most global brands have forged a stronger social media presence this year.

Leading luxury goods players invested in young fashion designers

LVMH took a minority stake in Italian designer Marco de Vincenzo, for example. Niche investments have not been all about young fashion designers, though. Kering teamed up with Kelly Slater, a professional surfer, to bring a new line of surf apparel to the market.

World Cup tourism drove up luxury spending in Brazil despite the cooling economy

Affluent Brazilians largely stayed at home in June and July rather than travel abroad. Additionally, there was a big influx of international visitors, fuelling a spike in shopping mall footfall. Brazil’s luxury goods market is on course to grow 10% in 2014 (at fixed US dollar prices), its strongest performance in three years.

“ Big M&A; activity was quiet in 2014 ”

The Misses

Luxury jewellery was not the target of a major M&A; deal

There was more interest in vertical over horizontal acquisitions. Leading jewellers want greater control over the whole route-to-market process, from raw materials to retail. A current example is Chow Tai Fook, which is sizing up stakes in diamond mines.

Private equity did not acquire one or more of the following brands: Salvatore Ferragamo, Brunello Cucinelli, Tod’s, Ermenegildo Zegna

In fact Tod’s has latterly been eyeing up its own acquisitions, notably of footwear brand Roger Vivier. Private equity was still a mover and shaker in the industry, though. Blackstone bought a 20% stake in Versace and Russia’s VTB Capital came close to a 70% stake in Roberto Cavalli. The latter deal fizzled out in November due (mainly) to economic instability in Russia.

There was no surprise or off-the-radar mega deal

Big M&A; activity was quiet in 2014. The focus was on organic growth and niche investments. Asian buyers, in particular, seemed ready to pounce at the start of the year, but a cocktail of unfavourable external pressures held things back.

The boom in real fur did not fizzle out

Fur was still high profile on the winter catwalks, especially in London and New York. The fur industry has sought to rebrand itself as ethical as well as luxurious, and consumers – young women especially – are buying in.

Luxury wines and spirits were not the weakest luxury categories as expected

Global sales recovered quite well in 2014 despite a continued slowdown in China (due mainly to the clampdown on gift-giving). Demand was notably upbeat in Brazil, Japan (first quarter of the year), Russia (first half of the year) and the US.

Despite persistent m&a; rumours, Roberto Cavalli remains independent

The Jury’s Out

Global luxury brands will build new positions in sub-Saharan Africa

Yes and no. The region continues to generate huge investment interest, fuelled by its burgeoning wealth and highly favourable demographics. However, global luxury brands have been reticent about building stronger positions – in part because they are concerned about the legitimacy of Africa’s new wealth and how this might impact on brand image.

The over-65s will be the target of high-profile advertising and marketing campaigns

Yes and no. This is the fastest-growing demographic for internet connectivity and e-commerce, and widely recognised as a key market for luxury goods. However, most advertising and marketing this year has been age neutral rather than age specific.

Mexico will be the focus of some of the strongest emerging market investment

Yes and no. Mexico has the biggest luxury goods market in Latin America, and there has been significant new investment in Mexico City and a host of mid-size cities. However, the economy has struggled in 2014, which has tempered some industry initiatives.

To further investigate the industry year by year on Luxury Society, we invite your to explore the related materials as follows:

- 2014 Luxury Industry Predictions from the Experts

- 5 Trends That Defined The Luxury Industry in 2013

- 2013 Luxury Industry Predictions from the Experts