The 2015 Global Powers of Luxury Goods report by Deloitte provides a refreshing market snapshot – and a hint of which brands are positioned to prevail in the year ahead.

The 2015 Global Powers of Luxury Goods report by Deloitte provides a refreshing market snapshot – and a hint of which brands are positioned to prevail in the year ahead.

These are the essential take-outs.

The 2nd annual Global Powers of Luxury Goods report, issued by Deloitte Touche Tohmatsu Limited (DTTL), has provided a snapshot of the global economy; an analysis of merger and acquisition activity in the luxury sector; and a forward look on the changing nature of the luxury consumer – notably through the impact of technology.

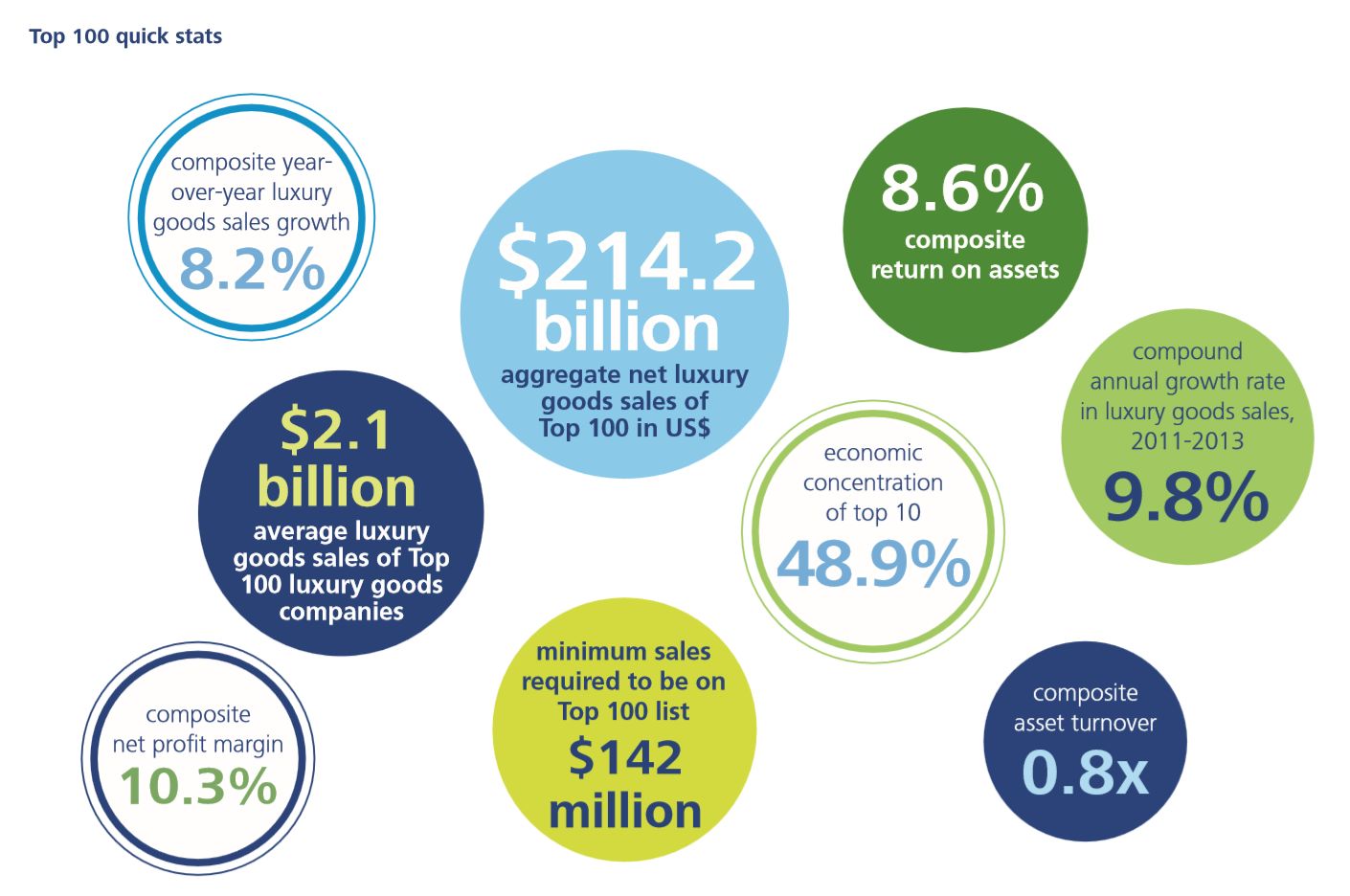

In a nutshell, the world’s 100 largest luxury goods companies generated sales of $214.2 billion through the end of the last fiscal year (fiscal years ended through June 2014) despite currency headwinds and intense technological disruption.

Looking ahead, the global economy in early 2015 offers luxury purveyors both cause for celebration and concern, but, coupled with the disruptions of a changing consumer, only certain brands will weather the storm ahead and profit.

The main disruptors are the recent usual suspects: currency fluctuations, the decelerating Chinese economy and weakening of another two BRIC markets (Brazil and Russia), the changing consumer, and – of course – technology.

On the celebratory side, some other key markets are showing signs of greater strength. The US economy is clearly performing better than in recent years, with employment growth up considerably and asset prices having strengthened substantially. In Europe and Japan, more aggressive monetary policies are boosting growth as well as asset prices.

“ The world’s 100 largest luxury goods companies generated sales of $214.2 billion ”

Push And Pull

Two of the five main disruptors mentioned are arguably both the biggest concerns for luxury brands, but also the most manageable.

While currency fluctuations and economies rise and fall, consumer habits and technology – while tricky to keep up with – currently go hand-in-hand, and can be met by adaptable and formidable brands with gusto.

To this effect, the Deloitte report adds that “consumer experience will be inextricably linked with innovative use of digital platforms to connect with the growing number of internet and smart phone users in leading luxury markets.

The ever-sophisticated luxury consumer is increasingly digitally savvy, time-sensitive, and socially aware. To engage such a consumer the luxury industry has three significant challenges.

1. The first is technology: 2015 so far has very much been a “smart” year in the luxury sector, and the sector needs to continue to forge a strong relationship with an ever-increasing array of technologies.

2. Second, the rapidly evolving consumer profile makes it critical for companies to understand the changing desires, buying behaviors and channels of luxury consumers.

3. Underpinning both of these factors is the luxury brand’s commitment to its history, provenance, and community. Supporting a shared history by giving back to the community can strengthen brand equity and create long-term strategic and financial reward for the business.”

Pushing Tech Boundaries

It’s a given that brands that can integrate technology into brand and product experience are well placed to engage future luxury consumers.

However, the Deloitte study goes a step further and points to some luxury players in particulat which are already raising the bar in this arena.

These companies are drawing on their artistic and innovative traditions, creating highly polished, visually enchanting online content.

Recent examples include Chanel’s short film “Behind the Scenes” by Karl Lagerfeld,9 which accompanied the brand’s 2014/15 Métiers d’Art show; Gucci’s “Making Of” films for some of their iconic products such as the “Lillian” boot10 and the “Jackie” handbag;11 Zegna’s “Rose Reborn” film that dramatically showcases the brand’s style, elegance, and sophistication12; and Louis Vuitton’s “Spirit of Travel” campaign launched via social media in February.

In the much-debated wearables sphere, Tag Heuer’s recently announced partnership with Google and Intel to build an Android Wear powered smartwatch scored a mention as one innovative collaboration breaking the mould.

Other smart partnerships and creations include:

• The MICA (My Intelligent Communication Accessory), launched through collaboration between Intel and Opening Ceremony,18 incorporates semi-precious gems with advanced technology that includes the capability of receiving SMS messages and meeting alerts;

• The Ralph Lauren ‘Ricky “smart bag”19 enables wearers to fully charge their phones; lifting one of the flaps activates an internal light. The bag embodies a classic luxury leather handbag while simultaneously integrating craftsmanship and technology; and

• Swarovski’s ‘Activity Tracking Crystal’, 22 designed in collaboration with Misfit Wearables, crystal can count a wearer’s steps, track sleep patterns, measure distance traveled, and show calories burned.

Swarovski’s ‘Activity Tracking Crystal’

Where, When And How

Reach and engagement of consumers through technology and digital mediums is also an important tech-barrier that brands must breach in order to truly excel in the evolving market.

Being able to identify the right channel for marketing, understand purchasing motivations of luxury consumers, and address the differences in benefits between shopping in-store vs. online will be a key focus for luxury brands going forward.

Using technology to their advantage to in-point exactly where, when and how their consumers are finding, investigating and purchasing their products can help brands not only foster loyalty from their traditional target markets, but also enhance their geographical and demographical reach.

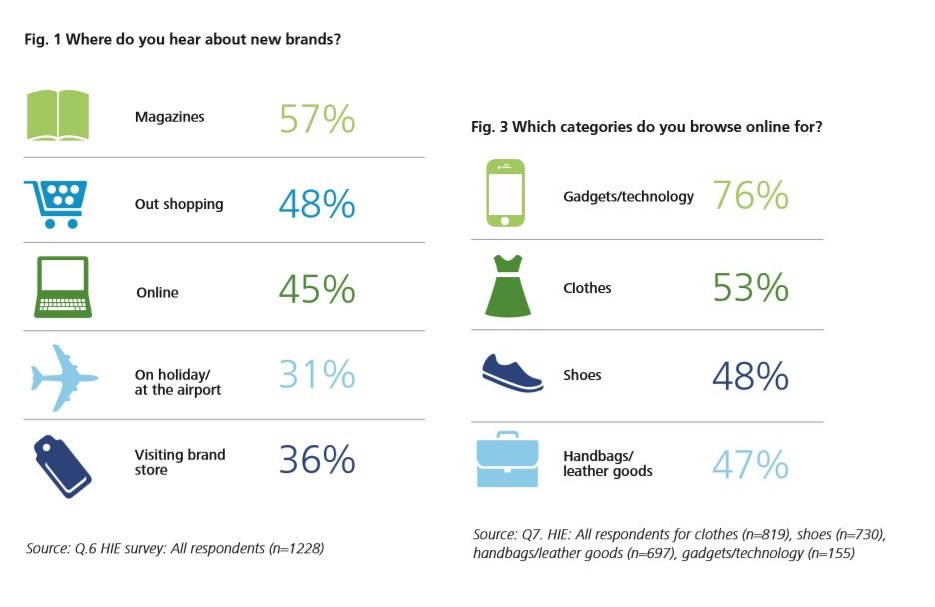

These factors are strongly aligned with the increasing importance of digital within the luxury space. Results from Deloitte’s 2014 survey of 1,000 HIEs27 (£/€100k+; CHF150k+) across Europe illustrates that while traditional marketing channels such as magazines and store browsing continue to be relevant for consumers gathering information on new luxury brands, 45% of participants indicated that they search online for information.

In this vein, CRM systems – effectively managing the way in which detailed consumer information is captured and then turning it to a brand’s advantage will also enhance the competitive positioning of luxury groups and brands.

According to research conducted by Exane BNP and ContactLab, Burberry in particular excels in their e-commerce strategic reach (number of countries, languages, product categories offered online), and digital customer experience, website navigation and the online purchasing process).

By using smart analytics, Burberry collects information on its customers’ shopping habits and tailors their in-store and online experiences.

However, in addition to learning about their evolving customer base, luxury brands must also ensure that they provide an exciting and engaging experience across all touch-points as opposed to a monotonous path to purchase.

Applications, such as Hermès’s “Tie Break,”14 – a game that immerses users in the brand experience – has pushed the envelope in terms of brand engagement, along with Gucci which has been highly ranked in digital customer experience and Coach, been recognized for its capabilities in both e-commerce reach and digital customer experience.

“ 58% of participants under the age of 34 go online to search for information ”

These skills, once mastered will also help to endear the elusive millennial market.

Deloitte’s 2014 HIE survey found that 58% of participants under the age of 34 go online to search for information (Fig. 1) and 31% use social media for gathering information around discounts and promotions, compared with 10% for older luxury consumers.

As a side-note, Deloitte’s HIE Survey also highlighted the importance of “impulse” purchasing, particularly relevant within the Fashion and Leather Goods categories.

“The spontaneity of luxury consumers – notably in emerging markets – will grow as these consumer societies become more self-assured and confident in their purchasing decisions, buying what they like as opposed to buying ‘on societal expectation’ or peer comparison. Addressing this change will require more market understanding and improved CRM systems enhanced by technological developments among luxury players.

“ The spontaneity of luxury consumers – notably in emerging markets – will grow ”

Travel Opens New Doors

Travel creates new opportunities to capture spend: Luxury spend by travelers accounted for 37% of the market in 2013.

As an example – Chinese tourist spending in Europe overall grew by 18% in 2014, with a spike of nearly 50% year-on-year in the month of December.

Again, technology can aid in pin-pointing key markets for the luxury traveller and analysing lucrative retail hotspots.

Capturing this spend at tourist locations and during transit will present luxury brands with a valuable opportunity. However, this requires a flexible approach. By understanding the different services required by the various nationalities, brands will be able to create bespoke experiences, an ongoing requirement for capturing a greater share of luxury spending.

Louis Vuitton’s ‘Spirit of Travel’ Campaign

History Propels Brands Forward

As identified in Luxury Society’s recent summary of the Brandz Most Valuable Brands Report heritage again plays a major role in the future survival and differentiation of luxury brands from the norm.

Tied to this, Deloitte states that celebrating and promoting history and culture supports the general ethos of what luxury means by connecting it with artistic inspiration and heritage.

“One of the more visible ways in which luxury brands look to ‘give back’ to the cities that nurtured their creation is through the preservation of prominent cultural monuments and art collections."

Fendi, Bulgari, and Tod’s have all donated to Italian architectural icons such as roman fountains, the Spanish Steps, and the Colosseum, respectively.

Similarly, as the lead sponsor of the Prince of Dreams: The Medici’s Joseph Tapestries by Pontormo and Bronzino at the 2015 Expo Milano38, Gucci is able to showcase both their brand and their desire to protect and restore important cultural entities.

“ Promoting history and culture supports the general ethos of what luxury means ”

Fondazione Prada, Prada’s foundation to support the arts, architecture, film, and ‘philosophy projects’ is opening its newly expanded Milan complex to the public. The buildings themselves were part of a century-old distillery and have been transformed by architect Rem Koolhaas. The first exhibition in the new space, ‘Serial Classic’, examines the way Roman artists copied their Greek forebears.

Leveraging and promoting the craftsmanship behind quality and heritage luxury brands also goes a long way in differentiating luxury’s unique selling point (USP).

Deloitte has singled out LVMH, which through their Institut des Metiers d’Excellence (IME), has been developing specific programs to develop new professional talent in order to promote the longevity of brands.

This professional training program will allow the LVMH Group to build the skills of a new generation, thus ensuring the transmission of its luxury DNA through younger craftsmen.

The Heart Of Luxury

Millenials in particular seems to put much emphasis on the conscience behind brands, so the level and dedication given to sustainability, corporate social responsibility and charity will increasingly impact on brands’ bottom lines.

Supporting brand ethos through paying more attention to these factors provides an opportunity for brands to ‘give back’, become more transparent and foster trust and loyalty and raise awareness while creating value for the company.

Kering’s recently released report to measure the firm’s environmental footprint throughout its supply chain and calculate its monetary value, is an interesting case in point.

On a more charitable note, to celebrate the first anniversary of its ‘Chime for Change’ initiative, Gucci donated 10% of sales from its Fifth Avenue Flagship store during a specific period in June 2014 to raise additional support for girls and women around the world.

The Winners, The Losers And The Up-And-Comers

According to Deloitte, the growth of luxury goods sales for the Top 10 luxury companies was only marginally superior to the Top 100 in 2013 with composite sales for the Top 10 growing at 8.4% versus 8.2% for the Top 100.

This growth was driven by the two new entrants to the Top 10 – U.S.-based PVH Corp, with a 42.0% increase, primarily due to its acquisition of Warnaco, the largest licensee for Calvin Klein products; and Hong Kong-based jeweller Chow Tai Fook, with a 34.8% increase, attributable to improved market sentiment and consumer confidence as a result of the ‘gold rush’ effect driven by the slump in the international gold price.

Last year’s ninth and tenth ranking companies, Rolex and Shiseido, were pushed out of the Top 10 by these high performers. All of the remaining eight companies achieved less than 10% growth, with only Swatch Group beating the Top 100 average, with growth of 8.8%.

Although profitability declined for both groups compared with 2012, the Top 10 was also stronger on the bottom line, outperforming the Top 100 by 1.4 percentage points (11.7% vs. 10.%).

Six of the Top 10 companies shared in the group’s strong bottom-line performance with double-digit net profit margins. Swatch led the Top 10 in profitability for the second year running with a 2013 net margin of 22.8 percent, up from 20.6%. All of the Top 10 were profitable, although Kering had following their October 2012 acquisition of the remaining 51% of this business.

On average the ‘Fastest 20’ – based on compound annual sales growth over a two-year period – were similar in size to the Top 100, at $2,067 million versus $2,142 million.

However, half of the Fastest 20 had 2013 luxury goods sales less than $1 billion and only two, Chow Tai Fook and PVH Corp, exceeded $5 billion. Superior profitability accompanied superior growth for the 15 companies out of the Fastest 20 who reported net profits, with a 10.6% net profit margin versus 10.3% for the Top 100.

Pandora, a Danish “affordable luxury” jeweller and new entrant, was the most profitable of the Fastest 20, with a 24.6 % net profit margin. Michael Kors combined industry-leading growth metrics (both in 2013 and in the 2011-2013 CAGR) with superior profitability, with the second highest profit margin, at 20%.

“ Pandora, a new entrant, was the most profitable of the Fastest 20 ”

‘New’ Kids On The Block

The scope of the Global Powers of Luxury Goods study has also been extended from the Top 75 to the Top 100 companies this year, with new entrants throughout the ranking. The data was improved across all sectors and regions, particularly for luxury jewellers.

There were fourteen new entrants in the Top 75, compared to last year. The nine new companies which entered the top 50 were all jewellery and watch companies, with Hong Kong-based Chow Tai Fook taking the number four spot. Sometimes called “Asia’s Tiffany & Co.”, Chow Tai Fook is a household name in China, but is relatively unknown in the global market, despite its position as the leading global jewellery retailer.

Four major Mainland China/Hong Kong-based jewellers (Lao Feng Xiang, Chow Sang Sang, Luk Fook and Zhejiang Ming) joined their compatriot, as well as leading branded luxury Indian jewellers Gitanjali Gems and PC Jeweller, and Denmark’s Pandora. These companies have all benefited from the fact that the biggest US and European luxury brands have not traditionally focused on jewellery.

The five new entrants in positions 50 to 75 were all European fashion-related companies – iconic footwear brands Christian Louboutin, Jimmy Choo and Bally joined Italian bags & fashion brand Liu.Jo and German sports fashion brand Bogner.

Chow Tai Fook High Jewellery Campaign 2014

Combine And Conquer

Acquisitions have served as a driver of growth for many luxury goods companies over the years.

There were three deals valued at $1 billion or more in fiscal 2013:

• LVMH — acquisition of an 80% stake of Loro Piana SpA, the Italian textile brand known for its high quality cashmere and woollens;

• PVH — acquisition of The Warnaco Group, the intimate apparel company, reuniting the Calvin Klein apparel businesses from collection to underwear in one firm;

• The Swatch Group — acquisition of jewellery and watch brand Harry Winston Inc.

However, Deloitte reports that “M&A; activity in the luxury and premium goods sectors was relatively subdued in 2014 compared with the year before. There were no mega deals completed during the year. Instead, the big luxury goods companies continued to expand horizontally, snapping up innovative niche brands and acquiring stakes in promising young designers, thereby gaining access to additional— and potentially newer—segments of the market.”

As the luxury goods players look for sustainable growth, acquisitions—both horizontal and vertical—will continue to play a major role in the sector, with a few major acquisitions in luxury and premium goods sectors completed or announced through mid-April 2015, including those by Coach and The Estée Lauder Companies.

Top acquisitions in luxury & premium goods sectors completed or announced (mid-April 2015)

Ones To Watch

In this Deloitte report, the world’s largest luxury goods companies are ranked by revenue.

But as the study attests, while the size of a company is interesting, it does not necessarily tell anything about the prospects for future performance. Large size simply demonstrates that a company performed well in the past and has, consequently, achieved scale. Moreover, the market capitalization of a publicly traded consumer products company, examined alone, says something about past performance—even if only recently—but not necessarily about the future.

However, Deloitte has examined financial information in order to learn something about possible future performance.

Therein, lies the ‘Q ratio’ of luxury goods companies, which aims to identify how financial markets are evaluating the future prospects of the world’s largest publicly traded luxury goods companies.

The Q ratio enables Deloitte to infer whether companies are strong in such critical areas as brand, differentiation, and innovation.

The company with the highest Q ratio is Christian Dior Couture followed by L’Oreal Luxe, which is also the company on the list with the highest market capitalization. These companies reflect the strength of French luxury goods companies. Indeed of the top 10 companies on the Q ratio list, three are French and seven are European. Two are from Asia and only one is from North America.

In terms of product sector and location, apparel & footwear reigns supreme in Q Ratio, while Europe as a region holds the most potential in this ranking.

To further investigate brand research on Luxury Society, we invite your to explore the related materials as follows:

- What the 2015 BrandZ™ Top 100 Means for Luxury

- What the 2014 BrandZ™ Top 100 Means for Luxury

- What the 2013 BrandZ™ Top 100 Means for Luxury