The smartwatch segment is flexing its muscle and poised for phenomenal growth. Here, extracts from the WorldWatchReport 2015 provide an insight into the impact on traditional luxury watchmakers.

The smartwatch segment is flexing its muscle and poised for phenomenal growth. Here, extracts from the WorldWatchReport 2015 provide an insight into the impact on traditional luxury watchmakers.

When in 2012 an unknown start up called Pebble started a Kickstarter campaign for a smartwatch, few would have anticipated the brand would raise more than 10 million dollars by selling 70,000 smartwatches in little more than one month.

Three years later and the number of smartwatches released has increased strongly, particularly in 2014, with the value of the smartwatch market estimated at 1.3 billion USD* (*Smartwatch Group, Fall 2014 Report).

That value is expected to skyrocket and even surpass the conventional watch industry over the next four years, according to the latest WorldWatchReport, released by Digital Luxury Group (DLG).

To put this into perspective, for the smartwatch market to surpass the conventional watch industry the growth would need to be more than 139% each year over the next four years, the smartwatch market value would need to more than double each year through 2018.

With this in mind, the DLG WorldWatchReport 2015 comprehensively analyses the smartwatch phenomenon, rising consumer appetite for the product, and how this relatively new entrant to the global watch market is impacting traditional luxury watchmakers.

On that note, in terms of luxury brands, while some high-end players – such as Patek Philippe, Cartier, Hermes and Chopard – seem unfazed by the rising trend, others have acquiesced.

The first official luxury brand launch in this direction was Montblanc’s E-strap in January 2015, with others, such as TAG Heuer, following suit and even partnering with technology providers such as Intel and Google, as announced at Baselword this year.

“ While some high-end players seem unfazed by the rising trend, others have acquiesced ”

This move by some luxury brands to capitalize on the smartwatch appeal is clearly on the back of market demand, with consumers eagerly awaiting luxury players to cater to their growing thirst for technology.

As Robin Hurni, Research Analyst at Digital Luxury Group points out: “Even before any luxury brand announced a smartwatch or other smart features, consumers worldwide were already researching this kind of product.”

The DLG report also confirms that online searches for smartwatches have increased around the world, with consumers in the United States, China and the United Kingdom identified as those that search for them the most.

In particular, consumer interest for smartwatches picked up following September 2014, the month of the announcement of the Apple Watch, and while Apple still reigns supreme in this sector, interest for smartwatches from luxury brands is also rampant.

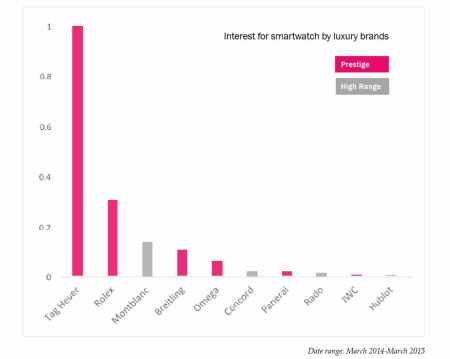

Looking at the luxury brands with the most searches related to the keyword “smartwatch” during the past year Tag Heuer is the first, according to DLG’s findings. The second is Rolex and the third is Montblanc.

Even so, the Apple Watch Edition collection (starting at $10,000) could ruffle a few feathers in certain markets, says David Sadigh, Founder & CEO at Digital Luxury Group.

“The Apple Watch Edition collection is an attempt to convey the image of Apple as a true luxury brand but the business reality is different. We anticipate Apple to generate 80% of their sales with Apple Watches priced under $700, a segment that will have more impact on American and Japanese watchmakers than on Swiss ones,” he says.

What lies ahead no-one can predict for certain, but what is absolutely evident is that insights into consumer interest in the space can provide luxury brands with invaluable indicators as to demand, uptake, opportunities and key markets to tap.

As the WorldWatchReport 2015 states, smartwatch segment is gaining momentum, and this pace is likely to accelerate, so “whether they have chosen to enter the battlefield or not, luxury brands will be impacted by consumer interest for smartwatches”.

Best be prepared.

For further insights, download the WorldWatchReport™ 2015 Smartwatch Feature here.