Taking a closer look at the coveted millionaire set, Agility Research & Strategy reveals insights from its freshly published HNWI Report on their appetite for luxury.

Taking a closer look at the coveted millionaire set, Agility Research & Strategy reveals insights from its freshly published HNWI Report on their appetite for luxury, as featured on the BBC’s Asia Business Report.

In 2015, the High Net-Worth Individual (HNWI) population of the Asia Pacific region surpassed that of North America. With Mainland China growing in wealth, and the US still dominating HNWI populations at a country level, these two markets will be an important target for premium brands and services over the coming years.

However, while HNWIs are different from their mass affluent fellow citizens, they also display unique characteristics when compared to their wealthy counterparts from across the Pacific. These differences play a significant role in the development of marketing plans for premium goods and services.

This is why winning brands should value the importance of identifying key differences across HNWIs from the US and key markets in Asia.

It is against this backdrop that Agility Research & Strategy surveyed 415 millionaires in Mainland China, Hong Kong, Singapore and the US to produce the ‘Millionaire Report’, chronicling “Asia’s Era of Young Millionaires”.

“ Winning brands should value the importance of identifying key differences across HNWIs ”

Key Highlights From The Millionaire Report Include:

• HNWIs in the US are older, past mid-life, while many in Mainland China have yet to hit 40.

• For all HNWIs in the US, Singapore, and Hong Kong, luxury is defined by the quality of their experience, but Mainland Chinese also require it to drive their status

• Besides offering high quality, across markets, HNWIs expect luxury products to be unique. Overall, craftsmanship and design/styling are the primary motivators for buying luxury.

• Many Mainland Chinese millionaires are new to buying luxury products, and they expect a level of social responsibility from luxury brands.

• Mainland China’s HNWIs demand exclusivity much more than those in the USA, Singapore, or Hong Kong

• Wealthy consumers in Mainland China and the US are likely to buy luxury online, while those in HK and Singapore prefer to shop in a physical store.

• Travel commands the largest share of wallet of HNWIs’ discretionary spending

• Luxury brand websites and print magazines are the most powerful information sources for most luxury product categories, however recommendations from friends and family often have more influence on the final decision.

• Mainland Chinese HNWIs are most likely going to drive the luxury market in the years to come

Outlook For The Future

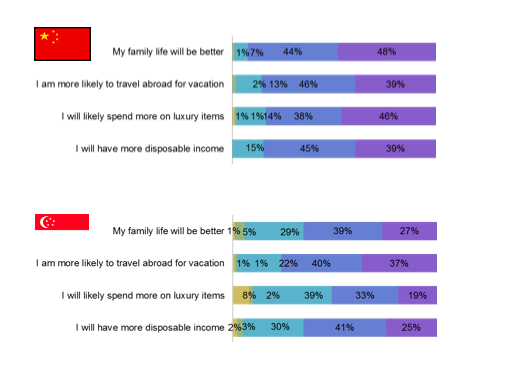

Despite holding a minimum of USD$1,000,000 in investable assets, not all HNWIs are confident about their spending habits. HNWIs in the US are more cautious than Asians in their view of the future. Less than half see an improvement in their family life and are split on luxury spending (See Figure 1).

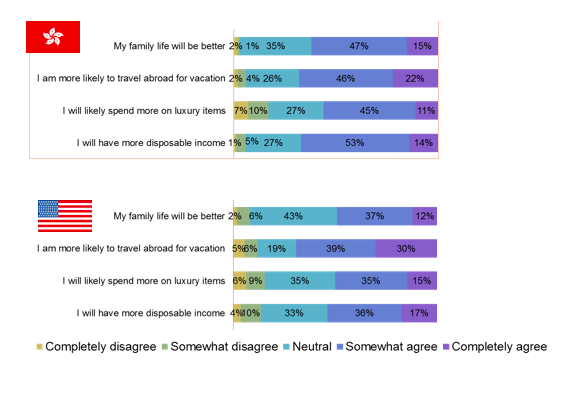

However, both Asian and American HNWIs look forward to a positive economy over the next year, as the majority agree on seeing a stronger performance from their investments* (Figure 2).

Figure 1 – Looking Ahead To The Next 12 Months

Figure 2 – Looking Ahead To The Next 12 Months

*Survey was conducted before the Yuan devaluation, but recent indicators show that this has not yet affected the HNWI Chinese as they have taken measures to ensure their investments remain stable.

This indicates that Americans are a bit more cautious with their wealth compared to Asians, and especially the Chinese, HNWIs. Part of this behavioural difference can be attributed to the wide average age gap between a HNWI in Mainland China versus one in the US. The HNWI population in Mainland China is predominantly below 40 years old, while it is quite the opposite in the US.

Luxury Motivations

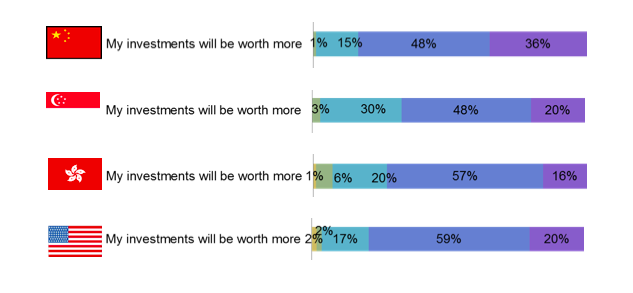

Needs around luxury goods are to a certain extent similar for HNWIs in the US and Mainland China, making design and craftsmanship hygiene factors for a luxury brand to succeed in this market. However, Chinese HNIs are more demanding in that they also require their products to deliver exclusivity and provide personalization options (Figure 4).

Figure 4 – Extremely Important Motivations for Buying Luxury

In a nutshell, American HNWIs are product focused and will mostly opt for a luxury brand that delivers in a superior fashion in design and craftsmanship. On the other side are Chinese HNWIs who not only require a product of high quality, but have emotional requirements that can be addressed by providing personalization service, and exclusivity. This can be achieved by offering product lines at high price points, limiting the number of people who can purchase, or providing limited edition models available only to the most loyal customers.

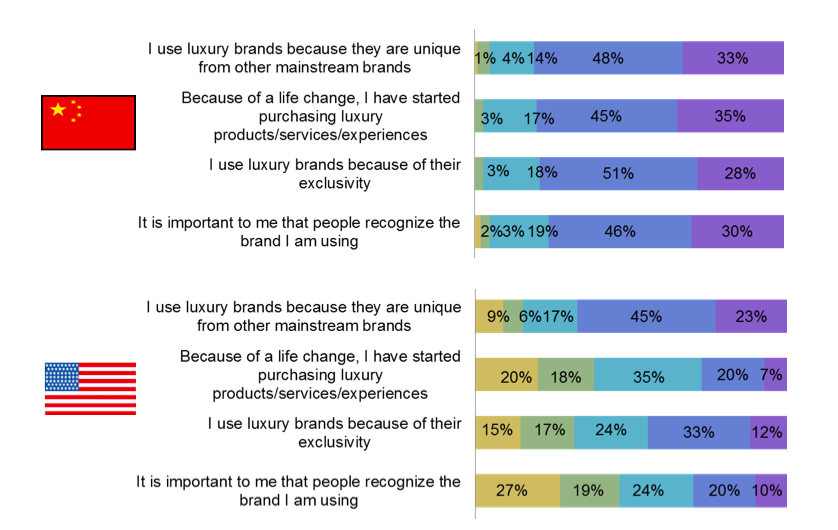

This becomes more evident when we delve into their luxury purchases influences where Chinese HNWIs need their luxury products to be not just unique, but also be recognised by others (Figure 5).

In contrast, while most American HNWI consumers appreciate the uniqueness of luxury brands, and some of them require the exclusivity the comes along with a premium product, most American HNWIs are not the type to overtly show off their wealth, and hence do not need other people to recognise the brands they are using. This is why logo free designer handbags are more likely to succeed in the US where individuality trumps conformity, than in Mainland China.

Figure 5 – Influences In Luxury Purchases

Final Word

For years, the HNWI market was driven by the US which has the largest population of HNWIs in the world. Times are changing fast, and Mainland China is quickly catching up.

Not only are their HNWIs growing in number, they are younger, more confident in the future and much more willing to spend on luxury goods than their counterparts across the Pacific.

Any luxury brand looking to grow in the next years must ensure their long term marketing plans guarantee a brand relationship and successfully appeal to Chinese HNWIs, or risk losing out.

Details for this article are taken from Agility Research and Strategy’s Affluential Insights 2015 study that was run from May to June 2015.

To learn more about the Affluent Insights ™ HNWI Report, and to purchase, go to: www.affluential.com/report/hni-report-2015.

The video of the launch of the HNWI report on BBC can be seen here: