Today, individuals in higher income categories no longer feel the need to consistently upgrade into luxury as income and wealth rises. It's a concept known as "post-luxury" and Wealth-X's Winston Chesterfield explains.

Luxury is in a state of flux; whilst there are many opportunities for the industry, there are also many threats to growth. In their Global Powers of Luxury Goods study, professional services firm Deloitte highlighted four ‘horsemen of the luxury apocalypse’; reputational risk, regulation and stakeholders, external events and inertia.

Whilst valid and certainly points for consideration, these issues reflect the underlying problem with the luxury industry – much in the same way that an ostrich thrusts its head in the ground, luxury tends to relate only to itself.

One thing that the report does not address has been an elephant in the room for the last decade – how luxury relates not just to itself but also to non-luxury. Luxury organisations can no longer ignore that the age of high-low consumption is actually a long term threat to luxury.

Luxury and the income-upgrade phenomenon

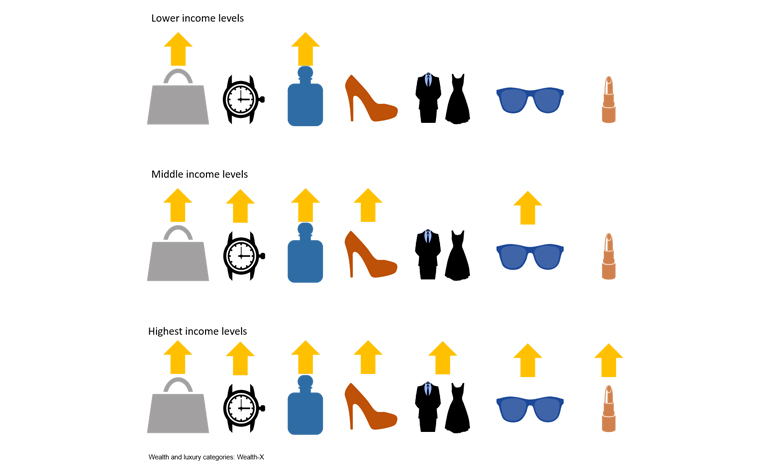

Luxury’s connection to exclusivity and price relates most closely to income and wealth dynamics. The original ‘luxury price’ concept relates to the income-upgrade phenomenon; in other words, whenever income and wealth increases for a particular consumer, likelihood to spend on luxury in more categories increases. Below are examples of how this manifests across the different luxury categories for different income groups of luxury consumers (L-R: Handbags/leather goods; watches; fragrance; footwear; apparel; accessories; makeup and skincare)

However, whilst it is broadly true that greater income leads to greater spend on luxury, increasingly there is a trend that luxury is not upgraded to in all categories – and that non-luxury goods are relied upon instead.

Post-Luxury

This is the post-luxury concept, which relates to the decline of the income-upgrade phenomenon. The post-luxury consumer no longer needs to upgrade as they progress through income categories – therefore they select categories remain non-luxury.

There is a trend away from the income-upgrade phenomenon associated with the luxury market. Some of the most important examples are the ready to wear and soft accessories categories, where design has been democratized and has devastated the perception that good design always costs money.

What this means is that individuals in higher income categories no longer feel the need to consistently upgrade into luxury as income and wealth rises.

Join Luxury Society to have more articles like this delivered directly to your inbox

Luxury goods are sold on promises of improvement over mass-produced goods. This is backed up by the process through which they are made and the value of materials used. However, many luxury brands have assigned their name to products which are not commensurate with this concept of luxury.

The upgrade cost relative to income can force individuals to relegate that category to non-luxury – particularly in an inflationary market, where luxury goods prices reflective of a global rather than local audience of luxury consumers. Shoes are a common category for cutting back, due to the sheer cost of buying the very best luxury brands – which then often require as much repair and care as non-luxury.

"Obsolescence and generational irrelevance can make some core luxury categories subject to downgrade."

Similarly, obsolescence and generational irrelevance can make some core luxury categories subject to downgrade; some consider Swiss watches to be on the brink of this, having been a core category of luxury product for so many generations.

When consumers flirt with luxury brands, a sense of no-improvement or disappointment can result in permanent downgrades. Additionally, lower-end, non-luxury brands have improved their credentials in areas once exclusively owned by luxury brands.

Zara is the most devastating example of this in ready to wear and accessories like scarves, where even members of the royal family such as the Duchess of Cambridge are noted for wearing the brand.

Post-luxury consumers are harder to impress

The result is that good design has been democratized – and is no longer the exclusive domain of luxury brands. Luxury brands now need more than just design credentials to sell in key categories, as style has begun its domination of fashion trends. Post-luxury consumers are wearing a variety of styles inspired by different eras; they’re happy to replace one trend with another quickly because the cost of doing so is low.

Additionally, social media, particularly Instagram, has increased exposure to new and smaller luxury brands due to the low cost-high-impact of creating brand awareness through such mediums. This has made the market more competitive, particularly for loyalty. As a consequence, luxury brands have to be more careful in how they communicate their story.

Luxury categories of importance

"For all income levels, luxury leather goods are often the symbols of a luxury brand."

Alpha categories: As a category, Handbags & Leather Goods is often cited as the key difference between luxury and non-luxury. For all income levels, luxury leather goods are often the symbols of a luxury brand. Brands without these sought after leather goods tend to be lower in the prestige ranking. At a luxury price point, the quality of material, stitching and finish is evident – and very different to non-luxury brands. And as a category, this truly defines ‘luxury’ for many individuals; they do not buy them often and they expect them to last with daily use.

Fragrance is also an important category for luxury, as luxury brands that are not originally fragrance specialists provide reassurance of quality and exclusivity. The prestige perfumes market is dominated by the likes of Chanel, Dior, Calvin Klein and Armani – brands whose original expertise was not in scent.

Beta categories: As a standalone category, ready to wear is of decreasing importance in luxury due to the growth of brands like Zara that make stylish garments more affordable, and have enabled consumers to buy more, and buy more regularly. However, its image remains useful in conveying luxury credentials for important buying categories (see above for fragrance).

Interested in gaining better consumer clarity?

Accessories are sometimes luxury brands – particularly eyewear – but they are often not (e.g. scarves, belts), and therefore this is a mixed category.

Beauty is an increasing expenditure for women particularly, but also men. However, though there is an occasional trade-up for lipstick or eyeliner, this is a category where people stick to what works and what they know; this tends to be a high-low mixture.

A return to luxury’s true value?

"Rarity is the driving force for valuable resources."

Over time, the intrinsic value of luxury and the external effects this provides have remained largely the same. Rarity is the driving force for valuable resources and is the driver for the luxury principle; the social effect of this is exclusivity, which is consequently the most resilient external quality of luxury.

Historically, luxury has been fundamentally rare and therefore exclusive due to the use of rare materials, imported goods which only a few could afford, dyes, stones and fabrics that were either produced at great cost or required great levels of investment, such as the Tyrian purple dye for Roman imperial clothing.

And before man-made materials and mechanisation changed what was possible in terms of manufacture, it was not only the materials but also the handwork of skilled craftsmen that defined luxury; their work, such as Gillows furniture making in the 18th century, was noticeably different. Only the wealthiest individuals could afford these pieces and they became their own symbols of exclusivity.

Currently, luxury is defined by the brands that offer goods in the price category associated with luxury. They are commercial organisations, many of which tread a fine line between providing lower tiers of access to the brand based on spending ability, and maintaining supply side control and therefore the rarity and integrity of the products.

However, in recent years, luxury brands, as commercial organisations, have needed to balance the cost of production with exclusivity, using materials which are more commonplace than those historically associated with luxury.

"The success of globalisation and capitalism has made what were once rare resources more available."

This is partly because the success of globalisation and capitalism has made what were once rare resources more available through international trade and economies of scale, but also because, as businesses, they have had to ensure that the manufacture of these products is profitable. And so instead of materials defining luxury, skilled manufacture processes and fine finishing often defines what is and what isn’t luxury.

Though the future is uncertain, the structural changes in the global economy, slower growth and the maturation of dynamic economies as well as the availability of information on a global scale and the saturation of the market with luxury branded goods all point towards a crash diet of true exclusivity, which could involve use of ever rarer materials or higher entry prices into luxury.

Brands and branding will still likely be very important. A rare resource without a brand signals nothing to others, which will limit luxury consumption to those who only value it internally. External recognition of exclusivity will be crucial for consumers – as history teaches us.