The team behind Digital Luxury Group’s latest WorldWatchReport™ Benchmark reveal which luxury watch brands were the winners and losers on Facebook during Baselworld; the world's biggest luxury watch & jewelry event.

This year DLG introduced a new evolution of the WorldWatchReport. For the first time ever, luxury and prestige watch brands have the ability to measure their digital performance versus the industry. The analytics team behind the report looked at the 62 watch brands in the study to reveal the social media winners and losers from Baselworld, the week-long annual event which sees over 1,500 brands battle for attention as they reveal their latest luxury pieces.

Beyond the show itself, brands battle it out on the digital field too, through the use of Instagram stories from the booths, press conferences played live via Facebook, and websites set up specifically for Baselworld. So which watch brands won on social this year?

We know that beyond vanity measures such as number of fans, that can be easily tied to budget increase, the focus is more and more on the post engagement rate (Engagement Rate is a metric that to measure a brand's effectiveness at engaging their audience, for Facebook it is defined as when people like, share, click a link or comment).

In terms of Facebook engagement rate, the data revealed the Top 3 brands were:

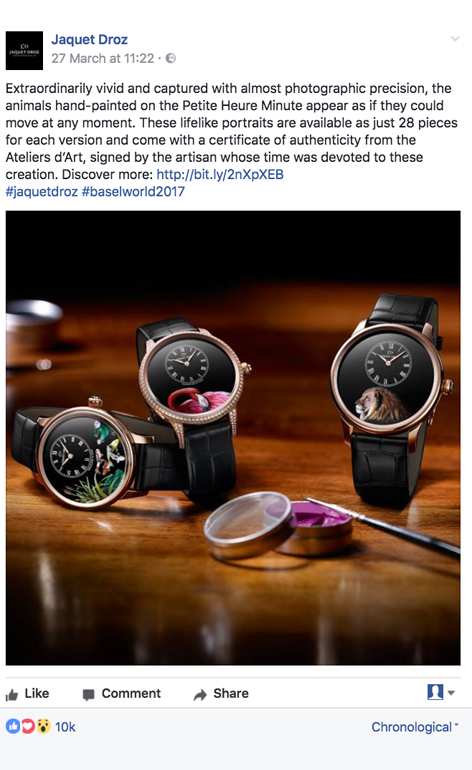

- Jaquet Droz (1.6%) with a community size of >48k

- Carl F. Bucherer (1.2%) with a community size of >148k

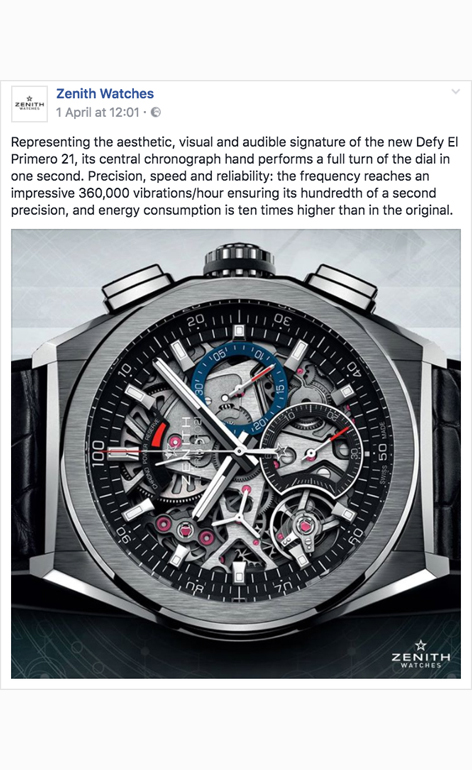

- Zenith (0.8%) with a community size of >268k

As the results are based on size of follower base, it is unsurprising to see smaller niche brands making the list, showing that with a large audience size, engagement rate does not necessarily follow. Interestingly all three brands communicated through the medium of art and craftsmanship during the fair.

Both Zenith and Carl F. Bucherer are in a period of ‘brand refresh’. For Carl F. Bucherer it started last year when they revealed a new golden look, cementing this more premium brand identity further at Baselworld this year.

Zenith, under the helm of interim CEO Jean-Claude Biver, have this year taken a much more streamlined approach to their product offering, and marketing communications, by reducing the number of collections.

Their much anticipated Defy El Primero 21 launch, the 21st century update to the famed El Primero, has come with much praise from the industry and fans alike. TAG Heuer Head Engineer Guy Semon, who was part of the team assigned to developing the new movement for Zenith, teased during the press conference that the news was “only the beginning…” with an even bigger announcement promised to come in summer.

The Facebook posts featuring the Defy El Primero 21 received the best reactions from Zenith fans.

In terms of community growth (absolute) on Facebook during Baselworld, the report revealed the Top 3 brands were:

- Chanel (+104K) - translating to +0.6% growth

- Rado (+27K) translating to +4.9% growth

- Dior (+20K) translating to +0.1% growth

It is unsurprising to see Chanel taking the top spot, as with such a large follower base already, growth gets bigger exponentially. The most interesting observation was that although Chanel have one global Facebook account for all their divisions, the brand posted 5 times on the topic of Baselworld. In addition, they only posted watch related content throughout the exhibition week itself ensuring that all fans were exposed to only Baselworld related news.

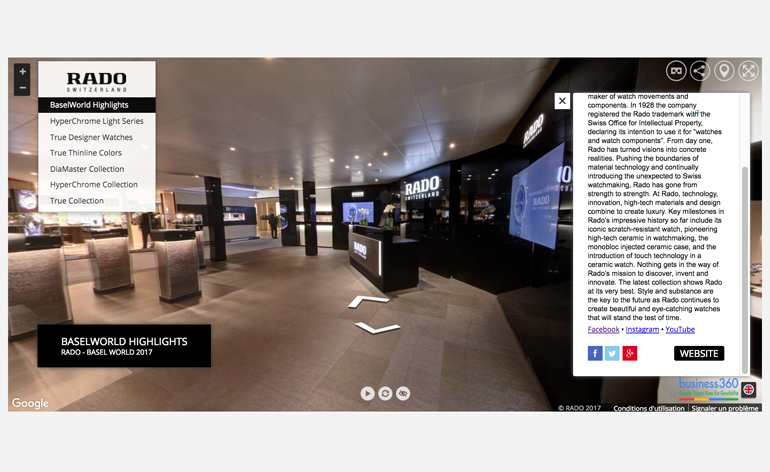

Swiss watch brand RADO, who lean towards innovative uses of high tech materials in distinct design, saw an impressive +4.9% increase in followers during Baselworld.

The RADO made use of technology to show fans their Baselworld stand

Dior, as with Chanel, are more known for their non-watch products, and similarly have a global Facebook page to share all Dior news. Dior and Chanel both hold a unique position as being haute couture fashion houses who have developed a strong identity in timepieces.

Surprisingly Dior posted only once during the show about their Baselworld products and the post did not feature the #Baselworld2017 hashtag. Their growth may have therefore been fueled by the launch of their Miss Dior campaign with Natalie Portman, as well as their new artistic director Maria Grazia’s first campaign for the brand.

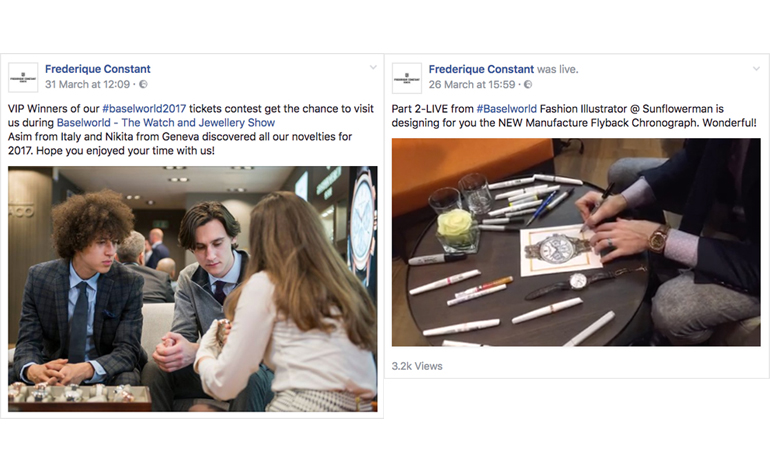

In terms of fan loss, the report revealed Hublot was the account which lost the most fans -800k, possibly down to removing of fake profiles, and the only other brand losing ground is Frédérique Constant who showed a loss of -0.3K fans.

Despite the loss in fans, Frederique Constant shared a variety of content during the fair. Like RADO the brand offered a 360-degree view of their Baselworld stand. They also ran a competition for fans to win a VIP trip to Baselworld, in the same spirit of other brands, such as Carl F Bucherer x HODINKEE.

Frederique Constant also communicated through the medium of art, a trend spotted at Baselworld 2017, with an artist designing from the stand, shared live via Facebook.

Baselworld vs. SIHH

When we look at Baselworld versus its biggest event competitor SIHH, the average engagement rate for Facebook content during Baselworld stands at 0.4%, higher than for SIHH at 0.3%. This is notably due to the size of the Baselworld event, but also could be explained by the fact that the public can visit Baselworld, whereas for SIHH the introduction of a public day was only created this year.

The average fan base growth (excluding Hublot) for Baselworld stood at +7K vs. SIHH +3K, showing the impact that Baselworld has.

It will be interesting to see how the engagement rate evolves for SIHH now that the public has more access and with the popularity of Facebook and Instagram Live for watch journalists and bloggers.

For more insights see the latest WorldWatchReport Benchmark, the leading market research in the luxury watch world.