SPONSORED CONTENT: As the push to go cashless intensifies across the globe, countries have upped the ante on card and mobile payment solutions. We take a closer look at how China-based WeChat does it.

According to the recent World Payments Report 2017 by technology consulting firm Capgemini and banking group BNP Paribas, the number of global non-cash transactions will increase at a compound annual growth rate of 10.9 per cent until 2020, at which it will hit 726 billion.

Presently, the Nordic territories are at the forefront of this transition (Sweden sees less than two per cent of all its transactions in cash). However, analysts have predicted that China will be the first country to reach a full cashless state thanks to its high uptake of mobile payment options. In fact, a 36 per cent growth in non-cash transactions within the Middle Kingdom is projected over the next five years.

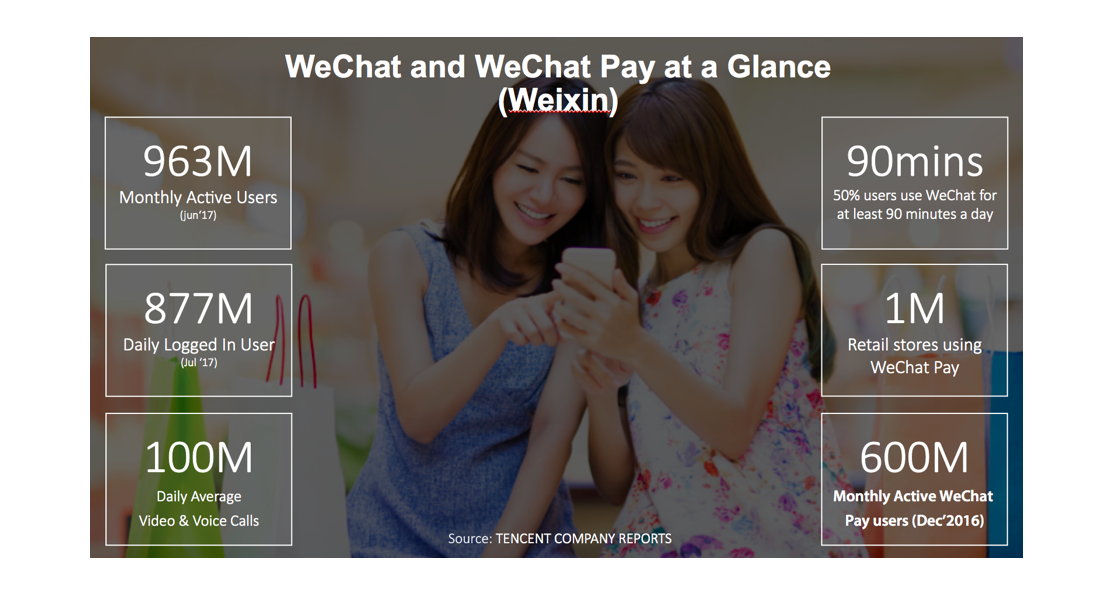

This steep growth trajectory is made possible largely due to the market’s two main mobile payment players – one of which is tech giant Tencent, with its WeChat Pay service. First launched in 2013, WeChat Pay now holds 40 per cent of the mobile payment market share in China.

So what exactly is WeChat Pay and how does it work? Here are 10 things you need to know about it now, as presented at the recent Money 20/20 conference in Las Vegas.

1. An Integrated Ecosystem

For the uninitiated, WeChat is the nation’s all-in-one answer to Facebook, Instagram and Twitter, and then some. Besides its social networking capabilities, users can do everything from paying for utilities and making financial investments to booking air and rail tickets on this mobile application (accessible through the WeChat wallet). Given its ease of use and integrated ecosystem, statistics show that of the total amount of time the Chinese spend on their mobile phones, 35 per cent is spent on WeChat.

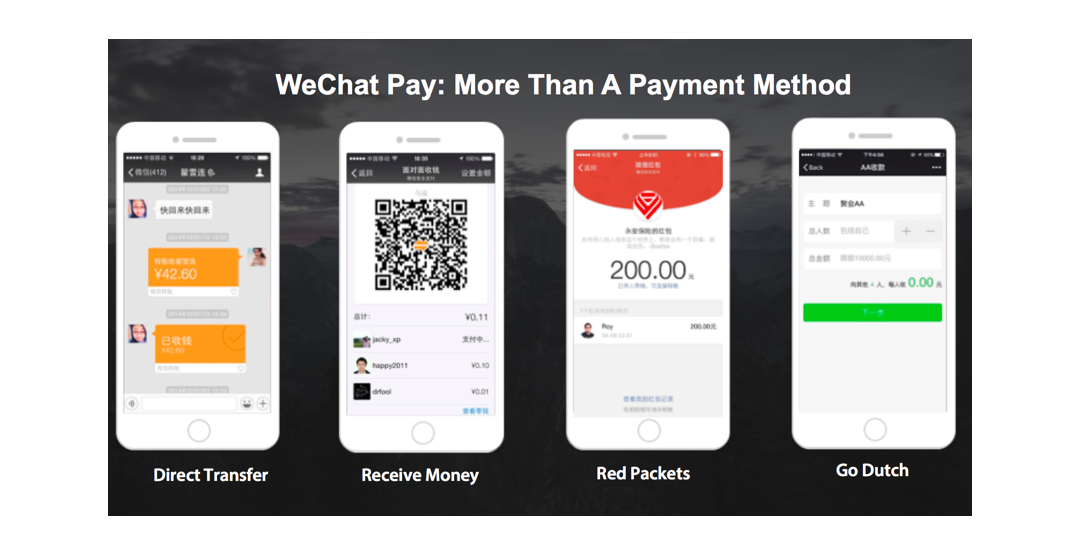

2. A Holistic Mobile Payment Solution

Like most other mobile payment services, WeChat ties a user’s account to his/her specified local bank account. But besides acting as a payment method for both online and offline purchases, it also allows for the easy transfer of funds between users. Users who are friends on WeChat can directly send funds to each other through chat windows, while those who are not can simply scan another user’s uniquely generated QR code to make a transfer. Users can also split bills and send red packets (monetary gifts that are usually sent during festive seasons) to each other through the application.

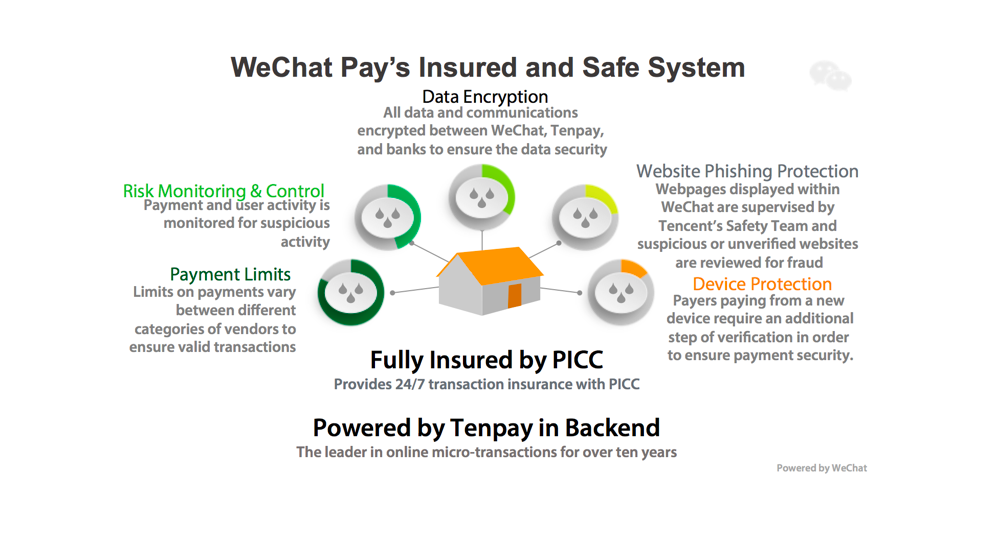

3. Completely Safe and Insured

In order to protect users, WeChat Pay provides full transaction insurance 24/7. It also includes security features like data encryption, website phishing protection and payment limits. User activity is also constantly monitored for suspicious activity and multi-step verification processes put in place ensure users are able to make payments securely.

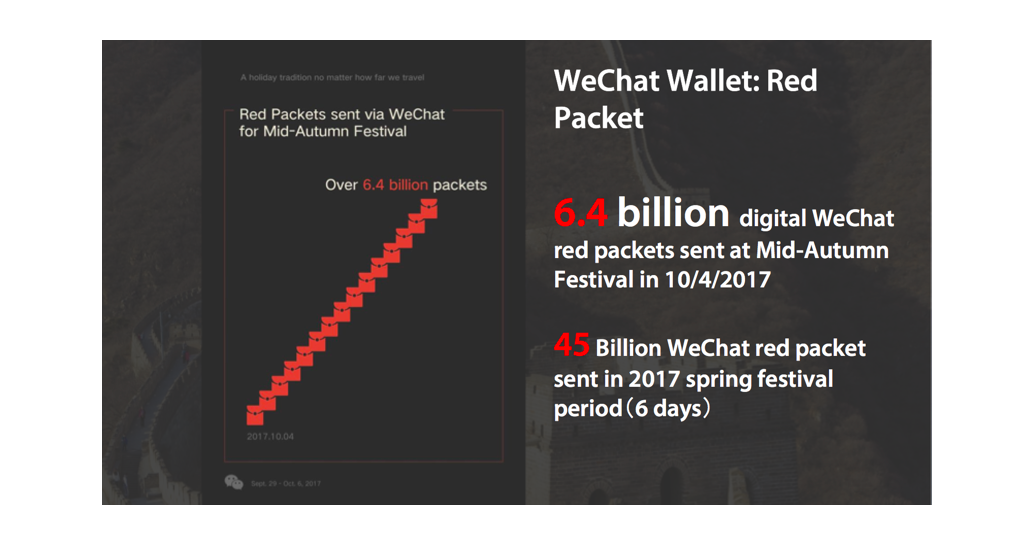

4. Reshaping the Way the Chinese Transact

Usually given out during festive seasons such as the Spring Festival (or Chinese New Year) and Mid-Autumn Festival, or on special occasions like birthdays and weddings, red packets are seen as a sign of good luck by the Chinese. Previously presented in physical red envelopes, the Chinese have since taken to sending them to friends and family via WeChat Pay. Over the Spring Festival period in 2017, 45 billion WeChat red packets were sent out, and another 6.4 billion during the Mid-Autumn Festival.

5. Charting Exponential Growth

The volume of mobile payments in China has been skyrocketing over the years, hitting a high of $5.5 trillon in 2016, making it about 50 times that of the United States. Though having only made its debut in 2013, WeChat Pay now holds 40 per cent of China’s mobile payment market share.

6. Rising User and Vendor Numbers

Currently, over a million retail stores across the globe accept WeChat Pay. The payment method also has over 600 million monthly active users, and continues to display great potential for growth in both the local Chinese market and abroad.

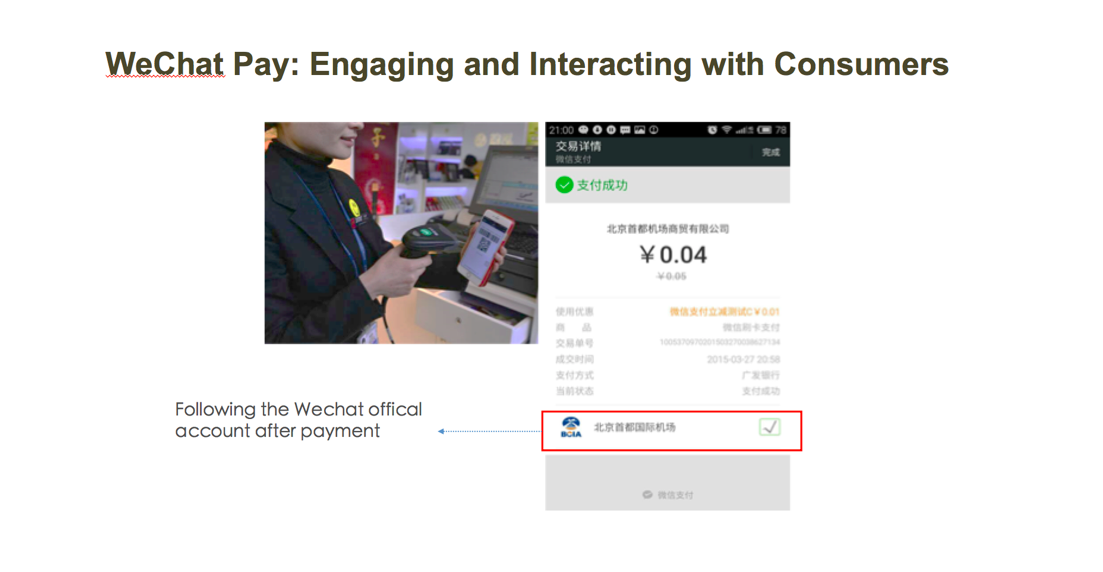

7. Easy Follow-Up With Customers

On top of being a payment method, WeChat Pay enables brands and vendors to interact with and engage its clients. After payment is made, users have the option of following the brand’s official WeChat account. This not only helps with client profile building, it also serves as a platform for brands to manage customer relations.

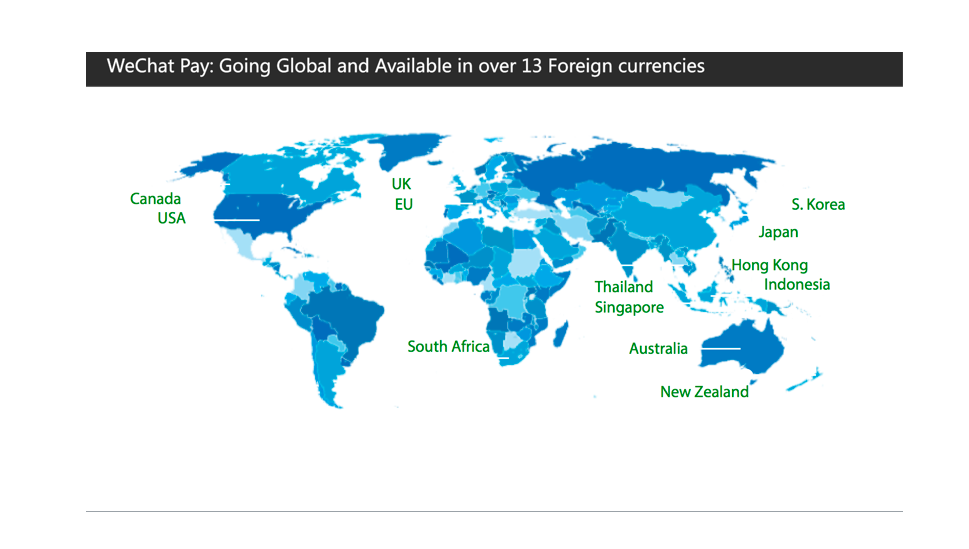

8. Global Expansion

WeChat Pay is currently available in 15 countries and regions for payment, in 13 different currencies. This number is set to grow steadily as WeChat continues its expansion into other markets around the world.

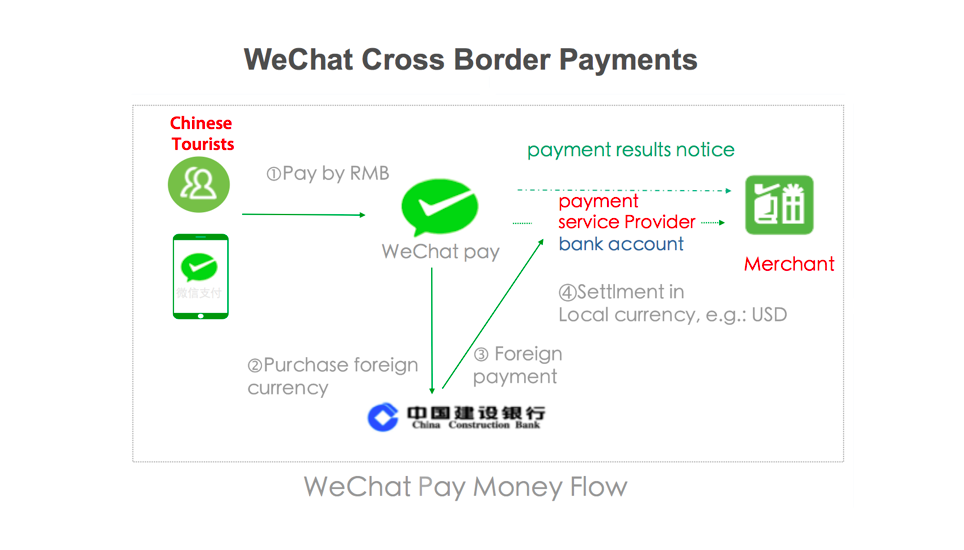

9. Simplifying Cross-border Transactions

For Chinese users purchasing items overseas, WeChat Pay presents itself as a convenient, fuss-free and cashless solution. The service automatically converts the local currency into RMB based on real-time rates, allowing Chinese shoppers to pay accordingly in RMB, through WeChat Pay.

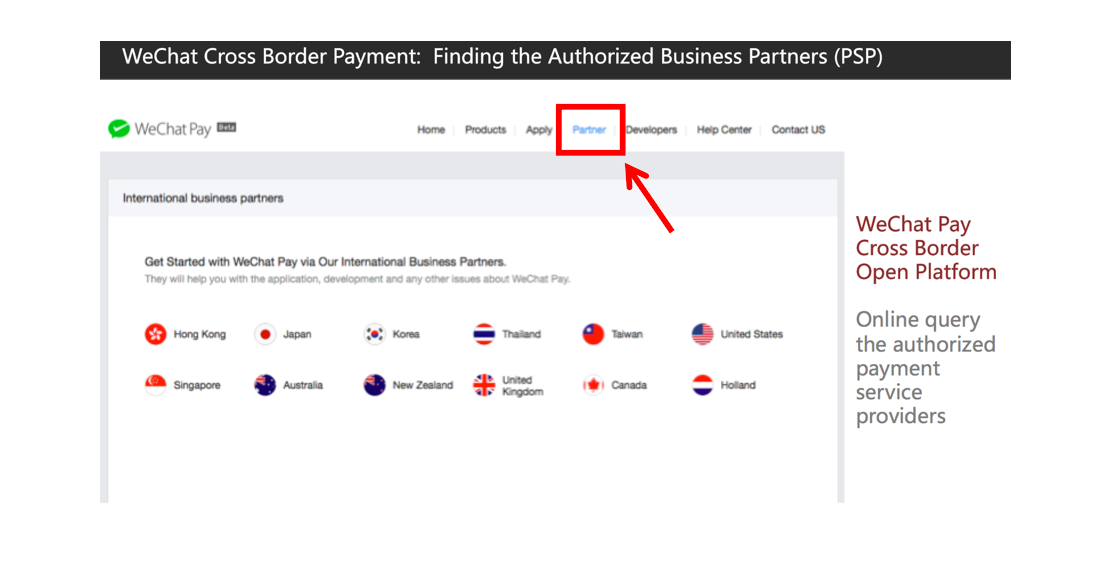

10. Wide Network of Authorised Business Partners

For brands, getting on WeChat Pay is also made that much easier now given its network of authorised business partners in 13 countries. Besides helping with the application and development of WeChat Pay as a payment solution for vendors and brands, these partners will also aid in sorting out any related issues in their respective territories. A full list of partners can be found here.

For more information on WeChat Pay and its capabilities, visit the official WeChat Pay site or scan the QR code below.

Originally published on WeChat Life. Republished with permission.

Follow the official WeChat Life account by scanning the QR code provided in the profile below.