Consumers

Why Chinese Consumers Opt For Luxury Goods Over Travel Experiences

by

Amrita Banta | November 10, 2017

Contrary to other Asia-Pacific regions, Affluent Chinese consumers prefer splashing out on luxury goods rather than leisure travel.

As we are preparing our presentation at the upcoming New York Times Luxury Conference in Brussels, one topic has been on our mind; one that has spurred intense discussions at both dinner tables and board rooms: do consumers prefer luxury goods or travel experiences?

Join Luxury Society to have more articles like this delivered directly to your inbox

Different reports and articles have stated that consumers, especially millennials, are spending more on leisure travel, preferring intangible experiences over material goods like handbags, jewellery, or watches as they believe that travelling gives them a more lasting memory and greater happiness. While this may be true in some markets, it is not entirely true in others.

Based our latest 2017/18 Affluent Insights™ Luxury Study, which interviewed 3,000 Affluent individuals across Mainland China, Japan, South Korea, Hong Kong, Singapore, Malaysia, Thailand, and Australia; the China story is a little different from the rest.

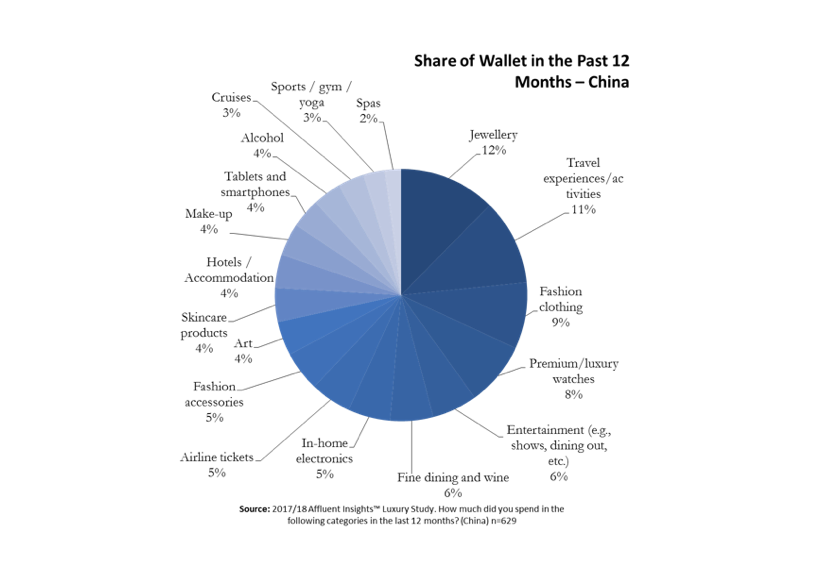

Affluent Chinese consumers are in fact spending a lot on personal luxury goods, as per the chart above. In total, their expenditure on travel in the past 12 months is at 23%, whereas their total expenditure on personal luxury goods (incl. fashion, jewelry, and watches) is at 34%, a significantly high margin. Jewelry is also the one category with the highest share of expenditure, at 12%, followed closely by travel experiences and activities at 11%.

In other markets like Singapore, Hong Kong, and Australia, travel expenditure takes a bigger chunk of the pie than luxury goods. The most drastic difference exists in Singapore, with travel at 36% and personal luxury goods at just 16%!

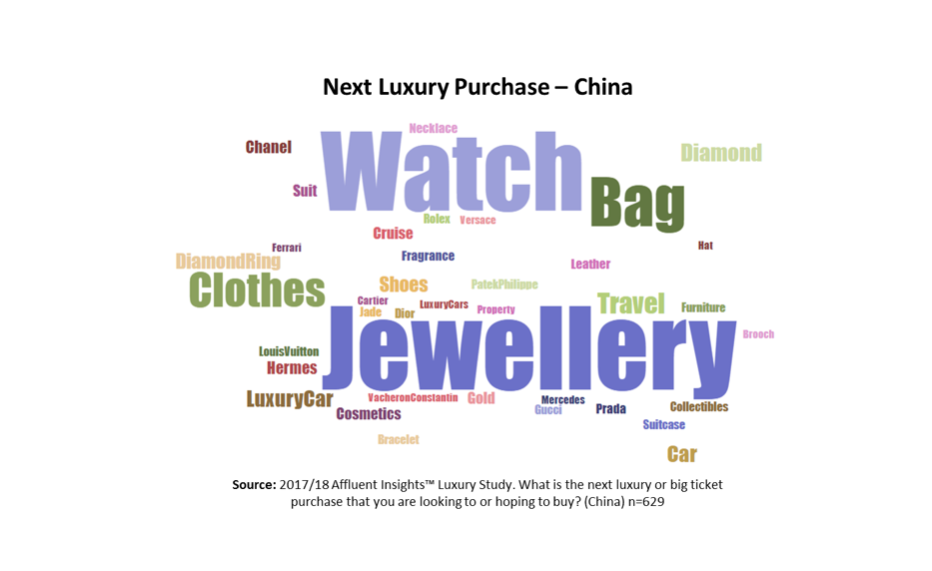

When asked about which luxury item they are planning to purchase in the future, jewelry and watches make up the top two answers by the Affluent Chinese, followed by handbags and clothes. It is interesting to note that their concept of “luxury” is still mostly embedded in objects or goods, as only few answered travel or other kinds of experiential luxury.

This is different in Australia, where the next luxury purchase is most likely to be travel related, including trips to Europe, staying at the Marina Bay Sands in Singapore, or taking a cruise to New Zealand.

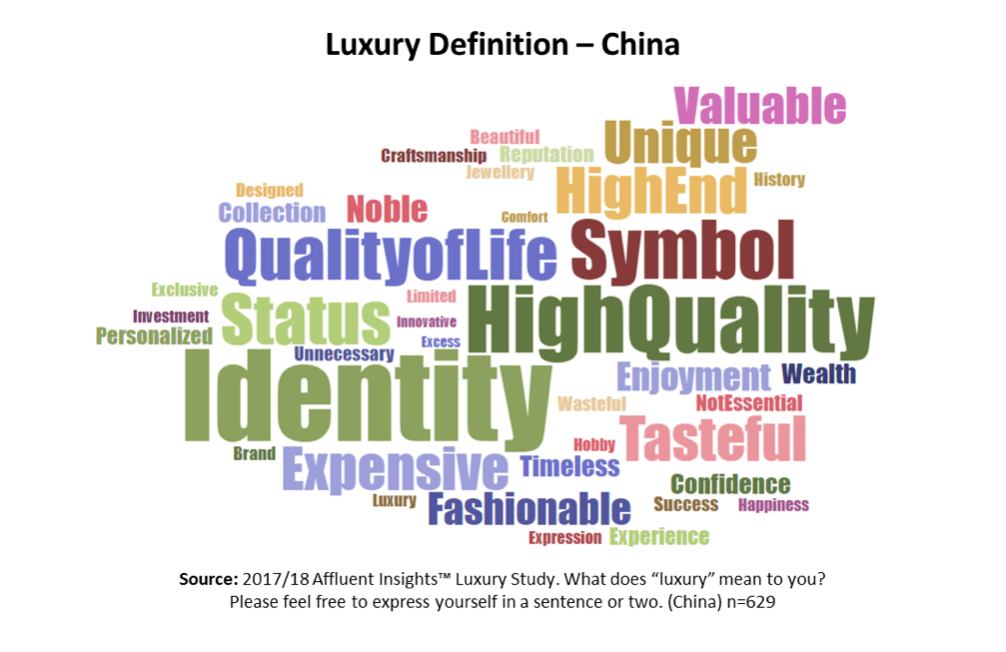

Yes, the Affluent Chinese may be travelling a lot, but our findings have shown that they might not necessarily associate the experience of travelling itself with the concept of “luxury”.

To them, luxury still revolves around identity and status symbols. Something might not be considered a luxury if using it does not directly instill a higher sense of self and increase social influence, which might explain why personal luxury goods like a leather handbag or jewelry are still highly purchased. For the most part, travel experiences are still an act of self-indulgence and self-reward that can only be displayed through photos and stories.

Luxury goods, on the other hand, can be conspicuously displayed whenever the consumer uses it at a social gathering, a business meeting, or even a date. A luxury watch tells a story of success about the owner without him having to even utter a word. A diamond necklace tells a tale of elegance. In addition, throughout early historic periods, the Chinese have shown their conspicuous display of wealth and power through material objects. Most notably through the use of gold, ornate jade and gilded objects. Is this trend simply repeating itself?

In neighbouring Hong Kong, consumers have a more perhaps realistic, definition of luxury. The most popular definition is “expensive”, or “not essential in day to day life”. This is an interesting finding considering both the Mainland Chinese and Hong Kongers share a common ancestry and culture. What exactly makes the difference? Economic euphoria in Mainland China vs slowed growth in Hong Kong could be one factor.

Therefore, consumers’ attitude and beliefs can shape how they spend their money and every market is different. Luxury marketers should access insights that uncover these differences in order to understand markets and their consumers more accurately.

The China Luxury Experience: A Balancing Act

Amrita Banta, Managing Director of Agility Research & Strategy will be speaking at the prestigious New York Times International Luxury Conference in Brussels next week alongside luxury leaders and experts like Stella McCartney, Jonathan Akeroyd (CEO of Versace), Reed Krakoff (CAO of Tiffany & Co.), and Merek Reichman (CCO of Aston Martin). The topic of this year’s talk is Chinese Millionaires’ luxury shopping behaviour based on the recently launched 2017/18 Affluent Insights™ Luxury Study.