Even though the storied manufacture has no official brand presence on Chinese social media platforms, it remains as one of the most talked-about brands in China during Baselworld.

To generate exposure at large-scale industry fairs like Baselworld, brands are known to spend huge amounts of time and resources on marketing activities. Whether this manifests in the form of celebrity appearances or carefully planned digital content calendars, the end goal is the same: To garner public interest in the brand and its new product offerings.

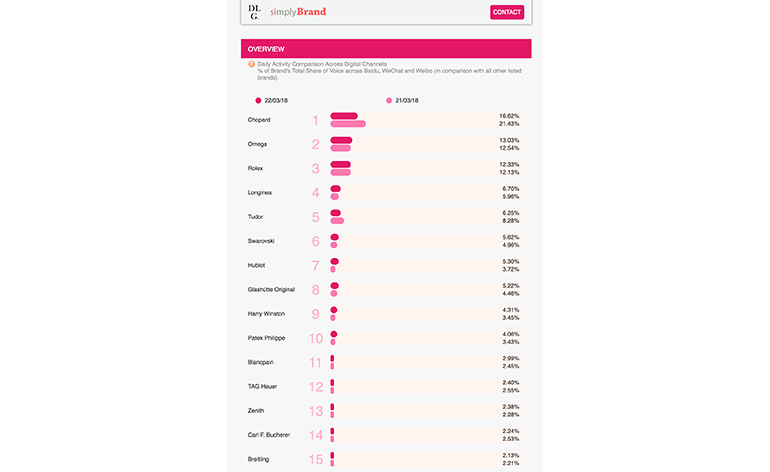

Brands like Chopard bring in A-list celebrities and generate huge amounts of exposure on social media in China, while others like Rolex and Omega bank on a solid content strategy to consistently drum up interest in its products in the Mainland. As displayed by the DLG China WOM Index, these brands topped the overall word-of-mouth charts in China on the Press Day and Opening Day of Baselworld 2018.

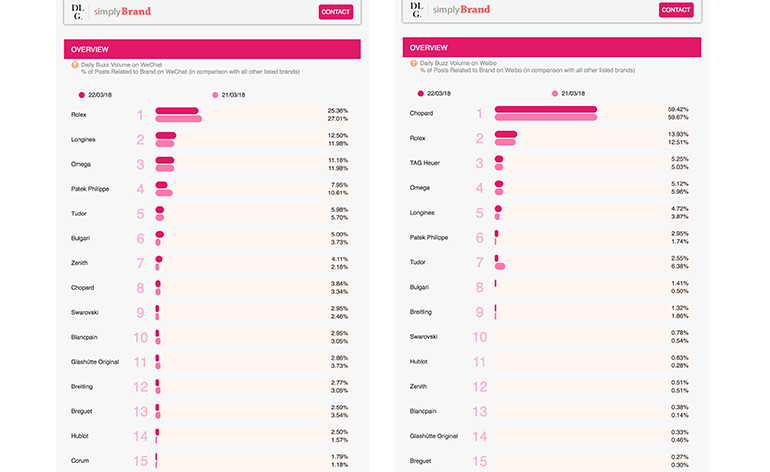

“These results further reiterate what we have always believed: That Weibo is the best channel when it comes to generating exposure in terms of celebrity or entertainment-related news, while WeChat is the channel that really drives product engagement,” says Pablo Mauron, Managing Director China and Partner at DLG.

Then there is Patek Philippe. Interestingly, the Swiss watchmaker has no official social media presence in China – yet continues to perform consistently well on such platforms, in terms of share of voice. It should be noted that every other brand listed in the China WOM Index has a social media presence in China, either on WeChat or Weibo (or both).

On WeChat, Patek Philippe had a share of voice of about 10.6% (out of the 23 Baselworld brands that are tracked with the Index) for Press Day, and 7.95% for the first day of the fair. This puts it just behind brands like Longines and Omega, who are known for their strong social media activities in China. Additionally, it had 1.74% of the total share of voice on Weibo on Press Day, and 2.95% on opening day. These results are exceptional, bearing in mind that Patek Philippe does not make use of these social platforms are brand communication channels in China – indicating strong interest from the Chinese audience about the brand in general.

This phenomenon drives home a strong point about how brands that have a solid product offering and compelling narrative naturally sell themselves. Social media platforms merely help to further amplify the brand story by serving as conduits through which they can reach a wider audience. But brands don’t necessarily need the elaborate HMTL 5 campaigns on WeChat or KOL posts on Weibo to generate exposure and interest, as displayed by the example of Patek Philippe.

In fact, Patek Philippe has always been known to steer clear of celebrity endorsements, and has cultivated an image of being a serious and traditional watchmaker over the years. That said, its biggest marketing win has to be its classic tagline: “You never actually own a Patek Philippe. You merely look after it for the next generation.” Introduced since 1997, it reiterated the longevity of each Patek Philippe product and generated huge amounts of public interest in the brand. Today, this compelling narrative, coupled with its strong product line, which boasts long life cycles (its tagline demands as such), has enabled the brand to sell itself even with audiences it does not actively engage with.

“For many brands, celebrities tend to be the key drivers of its word-of-mouth performance. While it is a positive thing – because exposure is always good – let’s not forget the real goal here: To sell watches,” concludes Mauron.

Edit: The free trial for the China WOM Index ended after Baselworld. More updates about the tool will be released at a later date.