Mall customers desire high-end experiences, but luxury brands would be best served elsewhere.

While many high-end brands remain invested in a shopping center presence, a new report suggests that most mall visitors are uninterested in luxury.

A new survey from Morning Consult places luxury experiences much lower on the scale of desired amenities at a shopping mall than more traditional features such as better food options and nicer movie theaters. The research suggests that luxury brands may want to move away from shopping malls in favor of a combination of flagship locations, boutiques and online stores.

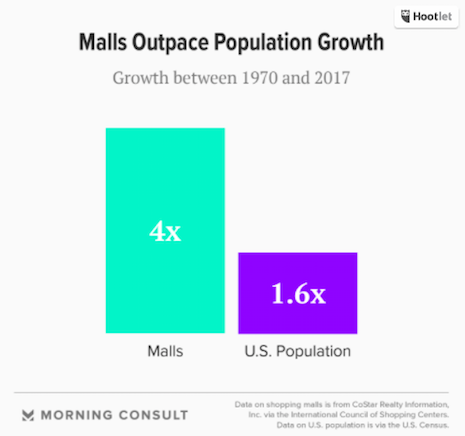

Image credit: Morning Consult

Mall attractions

The overall landscape of bricks-and-mortar retail mirrors many of the ideas that are common throughout the luxury world.

For one, experiences are becoming increasingly important over objects and things. For example, Morning Consult found that many shopping centers are increasingly offering features such as meeting places, pools and concert venues in an effort to bring customers in for more than just shopping.

Image credit: Morning Consult. Image: Malls have grown more than the population.

Overall, shoppers today want a higher-end experience, with high-quality food and dining and a desire for clean, beautifully designed spaces over the dirty, sterile environments of the malls of yesteryear.

But one area in which today’s shoppers do not seem to want more luxury is in the actual brands represented at the mall itself. Instead, customers want cheaper items for sale combined with nicer experiences.

Luxury focus

Shopping malls are not usually considered centers of luxury retail, but recent research shows that mall owners are pouring money into redesigns and renovations to be more accommodating to different types of consumers and communities.

Join Luxury Society to have more articles like this delivered directly to your inbox

Over the last three years, malls in the United States have poured more than $8 billion into renovations with an eye on turning the mall experience into something more upscale with options beyond the usual shopping mall fare. This research comes from real estate management and investment firm JLL in a report outlining the future of the new U.S. mall.

But as mall shoppers seem uninterested in bringing more luxury into their lives, luxury department stores are thriving.

Department store chain Nordstrom came out on top of new fashion retail rankings by Market Force due partly to its atmosphere and selection.

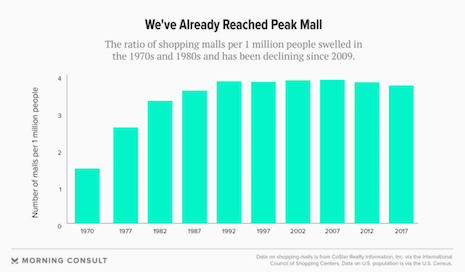

Image credit: Morning Consult. Image: We've reached peak mall.

Nordstrom’s loyalty index was 56 percent, placing it above more mass players such as Lane Bryant and Dillard’s. While consumers' decisions of where to shop are largely driven by value, 37 percent consider customer service a key differentiator, showing the continued importance of sales associates.

Harrods is already one of the most prestigious department stores in the United Kingdom, but a new report finds that the store is also a huge draw for real estate purchases in the surrounding neighborhood of Knightsbridge.

Interested in gaining better consumer clarity?

Harrods Estates, the luxury real estate arm of Harrods, released a report revealing that the majority of buyers who moved into the neighborhood of Knightsbridge near Harrods’ location in Central London specifically asked to be closer to the store. The report shows that Harrods’ physical presence is still a massive draw and can drive not only business but also people's choices of where to live.

These examples show that physical retail is still a hot commodity outside of shopping malls, meaning luxury retailers are better off focusing on their own stores or boutiques.