The global beauty market is growing and is on pace to reach a value of more than $800 billion in the next five years, propelled by consumers' appetites for innovative skincare and fun, new products.

Younger consumers, those between ages 18 and 24, are one of the driving forces behind the beauty market's growth, according to Fashionbi's new "Beauty Market Trend" report. Celebrity brands, natural beauty, personalization and gender-bending products are also becoming more popular among beauty buyers.

"There are many experiments in the field of the 'smart and tech beauty' products," said Yana Bushmeleva, chief operating officer at Fashionbi, Milan. "Another interesting trend is the customized beauty when the customer can literally create a perfect product for his or her skin type."

Personality-driven Products

For decades, luxury beauty brands have enlisted actresses, singers and models to star in their advertising campaigns. Today, however, celebrities have the agency and the following to launch their own beauty lines, sometimes with the help of more traditional industry players.

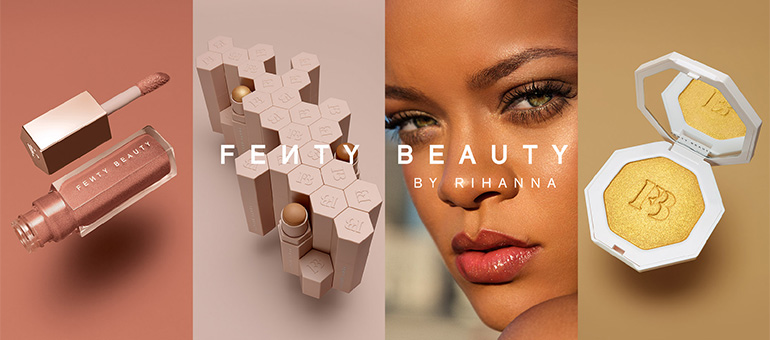

Created by frequent luxury collaborator Rihanna, Fenty Beauty launched following months of anticipation and two years of research and development in September 2017. The line of color cosmetics, including a staggering 40 shades of foundation, was developed in partnership with LVMH-owned Kendo, the company behind Bite Beauty and Marc Jacobs Beauty.

Available exclusively at retailers Sephora and Harvey Nichols, as well as Fenty Beauty’s ecommerce site, stock flew off the shelves as women gravitated toward the brands’s inclusive message and merchandising (see story).

Fenty Beauty was developed by LVMH's Kendo. Image: Kendo

Other successful celebrity brands include Kylie Jenner's Kylie Cosmetics, which made $420 million in 18 months, and sister Kim Kardashian West's KKW Beauty, which earned an estimated $14 million on its launch day. Model Miranda Kerr's Kora Organics has a focus on eco-friendly beauty, and actress and singer Lady Gaga is expected to introduce her own makeup line next year.

"Not all the beauty brands rely on celebrity endorsement," Ms. Bushmeleva said. "There are also those which diversify the risks, [like in] Dior's case, some makeup and skincare products are promoted by Bella Hadid, some by Natalie Portman and some have no celebrity endorsement.

"Those brands which believe that the celebrity endorsement is crucial for the marketing campaigns should choose the person who is 'new' to the market, which means is not involved in the promotion of the competitive brand or doesn't have its own line," she said.

Chanel's makeup line for men. Image: Chanel

Other makeup brands are collaborating with fashion houses for limited collections.

A Balmain x L’Oreal capsule collection was released in late 2017, and included a dozen shades developed by Balmain’s creative director Olivier Rousteing with the cosmetics maker’s team (see story).

Men are also buying more makeup products than before, and luxury brands are looking to capitalize on the trend.

This trend is becoming more popular in Asia especially, and French fashion label Chanel is getting in on the ground floor with its first men's makeup line. The collection will be comprised of three products, including an eyebrow pencil, lip balm and tinted moisturizer.

It launched in South Korea on Sept. 1, but will branch to ecommerce starting in November, where everyone can purchase (see story).

Keeping It Clean

The majority of cosmetics executives believe that health-inspired beauty along with personalization and digital engagement will be driving themes in the industry this year.

According to a survey by Euromonitor, skin health is a major factor within the beauty-manufacturing world today with an increase in brands creating topical probiotics. More than half of beauty execs believe that health in beauty, digital and personalization are the most important aspects of successful launches (see story).

Beauty brand Lancôme expanded its bespoke skin tone matching service within the United States in 2016. The brand’s Le Teint Particulier Custom Made Makeup uses digital readings of a client’s face to create a specially blended foundation at the counter (see story).

Eco-friendly personal care products comprise cosmetics that are organic, farm-to-face or cruelty-free.

A report from Perfect 365 found that a significant portion of Western consumers condemn the testing of beauty products on animals and will reject brands that do so. Nearly 50 percent said they would be happy if their state in the U.S. banned animal testing and nearly a quarter said they regularly use PETA’s Web site to see if a brand tests on animals before they buy it.

While Western consumers tend to reject beauty products tested on animals, China still requires such trials, putting luxury beauty brands in an awkward position (see story).

Clean beauty is becoming another key word within the personal care industry as sustainability and wellness take over in all aspects of retail, and luxury retailers are some of the first to take it on.

Consumers are more concerned than ever in regards to harmful chemicals in any product, but the beauty consumers as well as the luxury consumer are some of the most keen to these issues. (see story).

"There are a few possible ways for luxury brands to embrace clean beauty," Ms. Bushmeleva said. "Either to launch a new 'green' beauty brand, launch a special line under the current brand or through the acquisition of the existing company."

Cover Image: Marc Jacobs

Article originally published on Luxury Daily. Republished with permission.