Consumers

Luxurious, Effective, And Highly Technical: Chinese Beauty Trends To Watch In 2019

by

Jiaqi Luo | January 07, 2019

As Chinese consumers grow increasingly well-informed and demanding when it comes to skincare and cosmetics, brands need to up the ante to stay relevant in the eyes of this generation of beauty junkies.

While marketing messages like “embrace the real you” are beginning to gain traction globally, the narrative in China appears to be headed in the opposite direction. Chinese consumers still subscribe to the notion of beauty being synonymous with youth and flawlessness. These ideals have historically dominated the Chinese perception of beauty, and this quest for skin perfection is showing no signs of slowdown or change. In 2019, we foresee strong consumer demand for products that focus on quality ingredients, are ultra-luxe, and very high-tech.

How Chinese Beauty Consumers Changed In 2018

China’s booming interest in luxury skincare presents both an enormous opportunity and challenge for brands. Chinese consumers for luxury skincare not only include middle-aged women, but women in their 20s as well. The local narrative is that the first signs of ageing start surfacing when one turns 25 years old. As a result, women are starting to buy into the notion that they should start implementing a strict regimen from their early 20s. A new term has even been coined about this Chinese millennial fervour for anti-ageing skin care in recent years – “kang chu lao 抗初老” – which means battling the first signs of ageing.

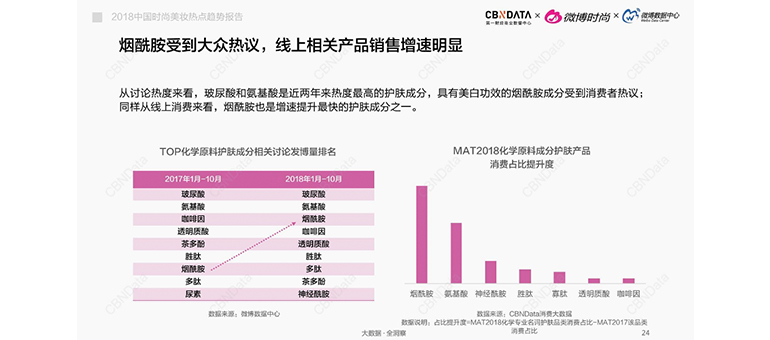

Due to the tremendous societal pressure to look young, Chinese women are also a group of trained “skintellectuals”. Their above average level of skincare knowledge, coupled with the habit of sharing everything online, has led to a boom in the number of social media posts evaluating a product by its ingredient list. In the past, a Chinese beauty blogger probably only needed a few “before and after” photos and some buzzwords to convince the audience to buy a product. But today, a blogger would need to explain the ingredient list in scientific terms and decode the chemistry behind the product. According to CBN Data’s “Unmasking the Secrets of Chinese Beauty” report, the number of such “decoding skincare ingredient” posts on Weibo from January 2018 to October 2018 has increased by 133% compared to the same 10-month period in 2017. Besides common skincare ingredients like hyaluronic acid and amino acid, niacinamide has also appeared on the top search list as the trendy ingredient of the moment. Niacinamide is known for its skin-whitening effect, as the Chinese beauty standard prizes fair skin over tanned.

Image: CBN Data

In this article, we identify 3 need-to-know consumer trends in China’s beauty consumption. These trends have been persistent throughout 2018 and are likely to stay on in near future. Brands should take this into consideration and formulate strategies accordingly to maximise conversion opportunities.

1. China’s Consumers Get Ingredient-Savvy

Many Chinese beauty consumers are amateur skincare scientists and ingredient gurus. The increasingly popular local term “chen fen dang 成分党” (meaning ingredient geeks) display how beauty consumers are increasingly valuing concrete ingredients over abstract marketing. These ingredient geeks are seeking ingredient-first concentrates, or “yuan liao tong 原料桶” (raw ingredients in Chinese), for more effective skincare. According to the CBN Data beauty report, the online sale of single-ingredient concentrates saw a 50% year-on-year increase in 2018.

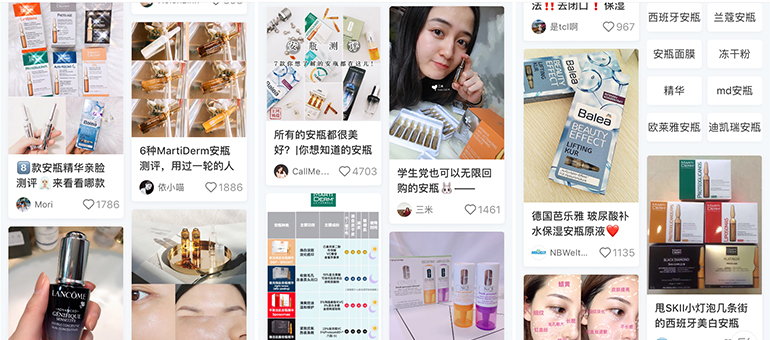

Ampoules, small glass vials featuring highly concentrated active ingredients, are a growing consumer sensation. In 2017, Spanish ampoule brand Martiderm sold 27 times more ampoules on Tmall Global than 2016. Ever since Martiderm’s success, the topic of ampoules started trending on Chinese social media. There are currently more than 90,000 entries on ampoules, on social commerce (and user review) platform, RED. Most posts analyse and compare different ampoules and their ingredients, effects, and suitability for various skin types. As more Chinese consumers decide to actively study a product’s ingredient list and constantly update their skincare knowledge, brands will need to upgrade their product offerings and increase transparency in marketing.

Martiderm, the Spanish ampoule brand that became a China’s beauty sensation since 2016

Image: Sohu

The RED #Ampoule community has more than 90k entries

Image: Screenshot from RED

2. Ultra-Luxe, Niche Beauty on The Rise

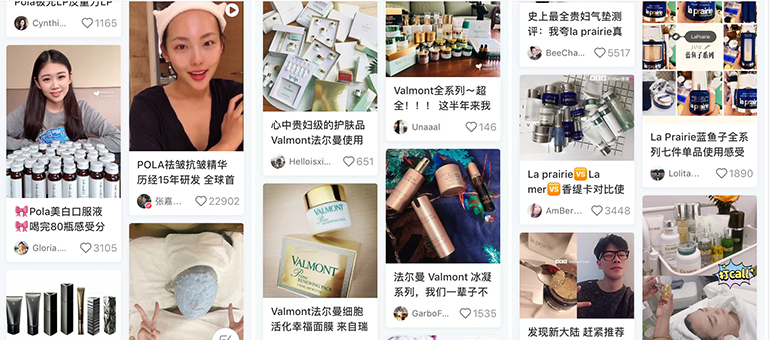

Facing tremendous social pressure to maintain their youthful looks, Chinese women see anti-ageing skincare as a priority and are willing to invest in products that deliver results. In recent years, they have started looking into foreign niche, ultra-luxe brands abroad for more exclusive offerings, such as Valmont and La Prairie from Switzerland, and POLA from Japan.

On RED, there are over 10,000 entries about Valmont, 30,000 entries on La Prairie, and 90,000 entries on POLA. While Valmont and La Prairie both offer luxurious anti-ageing products at a high price point, Japanese premium brand POLA, however, has garnered the attention of Chinese consumers because of its skin-whitening range. Many users have even flown from China to Switzerland or Japan to receive professional, luxurious treatments directly from brands, later sharing their experiences online.

Posts about popular brands POLA, Valmont, La Prairie on RED

Image: RED

3. Hi-Tech Disruption

To the West, the Asian multi-step skincare routine might seem daunting. In China, however, merely applying products on one’s skin is no longer seen as enough. Besides minor plastic surgery and cosmetic dermatology becoming the new norm in China’s millennial workplace, Chinese consumers have also started chasing highly advanced skincare solutions. Over the past few years, beauty devices, hi-tech gadgets, and home beauty treatments have become coveted “hot” items. Over 110k user entries about “beauty devices” have been posted on RED.

Designed to replicate the lymphatic draining massages performed by facial therapists, Japanese brand ReFa’s hi-tech facial rollers gained popularity for their efficacy and ease of use. According to data from CBN, Tmall sold more than four million USD worth of ReFa facial rollers in a day during the 2017 Singles’ Day shopping festival. Tmall Data also shows the average sale of beauty devices in 2018 reaching around 87 million USD per month.

ReFa appointed Chinese celebrity Fan Bingbing as ambassador

Image: ReFa Twitter

Largely influenced by K-Pop stars, local celebrities, and exacerbated by an age-shaming culture, young beauty consumers in China are ramping up their search for products and services to help them achieve perfect skin. Many Chinese women believe that a flawless external appearance is also key in helping to advance their careers and love lives.

想在你的邮箱中收到更多类似文章?请加入Luxury Society

Given the cultural context, it’s no wonder that consumers are becoming pickier. This boosts demand for more specialized products, and services of higher quality. For beauty brands to meet these expectations, they will need to react quickly to local trends, offer a heightened level of transparency alongside high-level offerings, advanced marketing, and tech innovation.

Cover Image: Jooinn