Once the hallmark of streetwear labels, luxury brands are starting to see the merits of product drops to fuel excitement in the country.

Dropping limited edition product lines to build hype around a brand is nothing new for streetwear labels around the world, but this sales model is now gaining traction with luxury brands in China. Louis Vuitton, Burberry, and Balenciaga are just some of the luxury brands employing the product drop retail model in the country. These brands have realised that by creating a sense of urgency and scarcity, through both online and offline product drops, it creates a buzz amongst tech savvy, millennial Chinese consumers and helps drive e-commerce sales in the country.

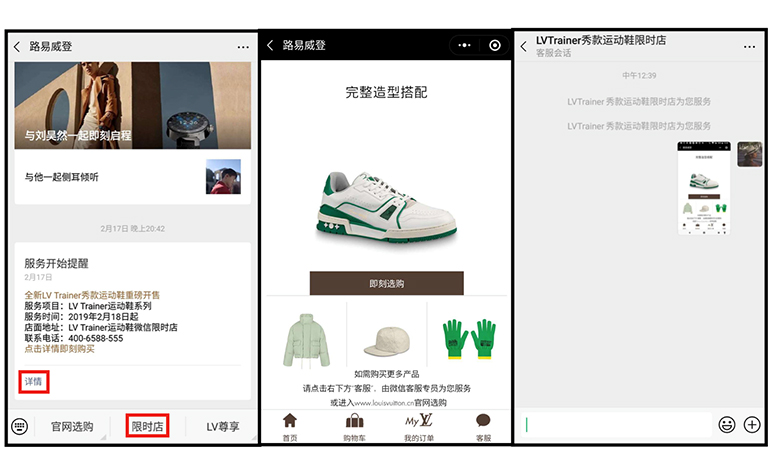

Louis Vuitton’s latest sneaker drop was done via a WeChat Mini Program

Image: Jing Daily

Benjamin Cavender, principal at China Market Research Group, believes that by creating a sense of urgency and scarcity, through limited edition product drops, luxury brands have been able to intensify engagement with Chinese consumers.

“Brands are looking at ways to increase the level of active engagement they have with consumers and by dropping limited products they create a kind of ongoing dialogue with their customers. This can lead to sustained discussion about the brand and also a higher likelihood of continued purchases from consumers who might otherwise just shop other brands in an effort to find something new,” said Cavender.

One champion of the product drop scene in China is influencer, Tao Liang, a.k.a. Mr. Bags, who has over five million followers on Weibo. Liang has collaborated with a plethora of luxury brands, including Montblanc, Givenchy, and Tod’s, on luxury bag lines that have been dropped, with limited warning, on social media channels. These limited-edition collections are then sold on the luxury brands’ websites, in store, and through Liang’s WeChat mini program, Baoshop.

Last month, Liang’s most recent product drop, a collaboration with Dunhill on a Chiltern drawstring backpack, sold out within 36 minutes on Baoshop, selling 200 pieces retailing at 6,580 RMB per bag.

Image: Mr. Bags

Liang believes that Chinese consumers have matured in their purchasing patterns and no longer just look for great design and quality, but also prioritize unique experiences, which in turn lead to treasured memories or exciting stories to share with friends.

“The drop model makes the purchasing process very special. The feeling that you might not get the bag or the shoes you want makes it like a game that you have to win. But above all, the most essential part within the drop model is a good product. The product itself needs to be very strong, attractive, and a statement,” said Liang.

WeChat Mini Programs, such as Liang’s Baoshop, have also proved to be extremely effective when it comes to the product drop retail model, acting as a pop-up store and offering new opportunities to foreign brands that may not have a cohesive footprint in the country.

Join Luxury Society to have more articles like this delivered directly to your inbox

“For brands that have already entered the market, but are unable to present their full inventory online for whatever reason, this model could be a very good opportunity for them to get in the game and test the waters without having to invest too much in terms of infrastructure,” said Pablo Mauron, partner and managing director China for DLG (Digital Luxury Group).

“From the consumer point of view, the plug-and-play functionality of Mini Programs allow brands to do just that in the online space. From the brand’s perspective, they can build Mini Programs very independently from their other e-commerce activities, making it a lot more efficient and flexible as well,” he said.

Another benefit of the drop retail model in China is that foreign brands can release product lines targeted specifically at Chinese consumers. This works well in a country that places a high premium on individuality and exclusivity, particularly among Chinese millennial consumers, according to Mauron.

One such targeted example is Liang’s Mr. Bags x Longchamp Year of the Pig capsule collection, which was specifically designed for Chinese consumers.

Image: Longchamp

“Drops have been popular in China because consumers want to feel that brands are making an effort to design or offer product specifically for them and drop retailing gives brands the opportunity to show that they are focused on doing something special specifically for China,” said Cavender.

Cover Image: Dunhill