Digital

What You Need To Know About Today’s Luxury Watch E-Commerce Landscape

by

Dino Auciello | April 29, 2019

Not all luxury watch brands have been quick to adapt to direct-to-consumer e-commerce, but those who have have been reaping the rewards in more ways than one.

The State of Luxury Watch E-commerce

The state of luxury watch e-commerce is a sphere that has been quickly changing and growing in recent years. Industry leaders like LVMH and Richemont are spearheading the e-commerce initiative by accelerating their online strategy and widening the gap, while others have been slower to jump on the bandwagon.

Over 40 percent of luxury watch brands are presently offering direct-to consumer e-commerce, and not only relying on third parties or wholesalers, according to insights from Geneva and Shanghai-based digital marketing agency DLG (Digital Luxury Group)*.

But besides the obvious, what advantages can expanding into e-commerce offer already well-established luxury labels like Cartier, Louis Vuitton and Dior?

“More than just selling online, their direct-to-consumer approach allows them to significantly grow their knowledge on consumers, grasp fast-changing behaviors, adapt services on a client-centric basis, and overall master the customer experience, from online to offline,” Christopher Peterson, Head of Data & Analytics at DLG, explains.

Primary research conducted by DLG reviewed more than 60 luxury and premium watch brands to analyze market distribution and online shopping behavior and see how this plays a role in the overall strength of various luxury brands.

E-Commerce Landscape

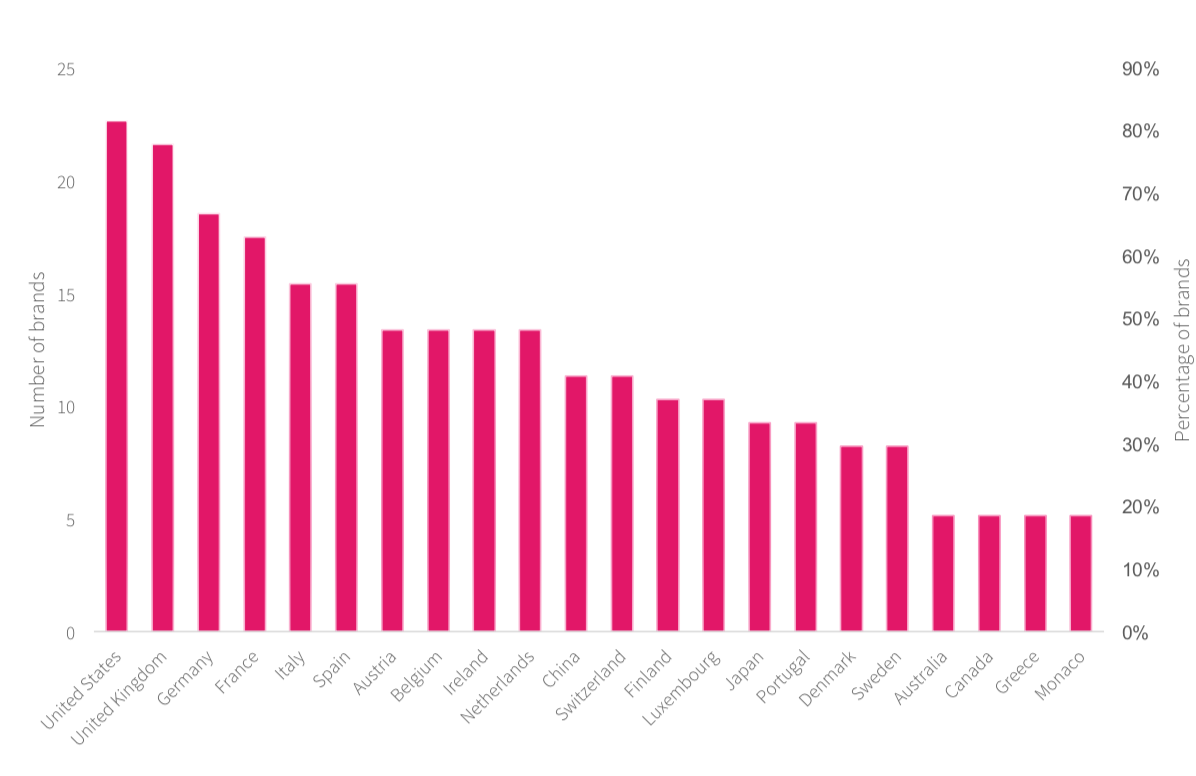

Research indicates that luxury watch brands cater to an average of 13 different markets. That being said, luxury watch brands remain relatively consolidated, with half of brands only venturing into Western Europe and the United States.

Top Markets. Image courtesy: Digital Luxury Group.

The U.S. and the UK are the markets which most brands offer direct-to-consumer services, with demands and consumerism playing a key role in both region’s economies. About 80 percent of luxury watch labels offering direct-to-consumer services cater to shoppers in these two markets.

This is in contrast to the 41 percent of brands selling on their own platforms in China.

E-Commerce Services

How can luxury watch brands help take the customer experience to the next level? It’s a question many industry leaders are contemplating as they try to grasp a tighter grip on consumer behavior and consumer satisfaction.

Product discovery, product localization, product tailoring, consumer service, payment, omni-channel, feedback and app features all play a vital role in a company’s overall health and e-commerce success.

Image courtesy: Digital Luxury Group.

The two most leveraged features regarding e-commerce performance are pick-up in store and videos on product pages, according to DLG’s most recent research.

Omni-channel experiences across e-commerce brands prove to be a priority among consumers, from picking up products in stores to returning them. Watch brands are learning quickly that in order to thrive in a dynamic market, they'll need to prioritize seamless and global experiences for customers going forward.

To learn more:

The State of Luxury Watch E-commerce

*Luxury Society is the business intelligence arm of DLG (Digital Luxury Group)

Cover image courtesy: Net-à-porter.