Consumers

Amid Growing Luxury Market, Top Brands Have Their Eyes Set on a New Kind of Customer

by

Meaghan Corzine | April 24, 2019

This year's sixth edition of Global Powers of Luxury Goods indicates that 76 percent of luxury companies reported increased sales, with nearly half recording double-digit year-on-year growth.

The luxury goods industry has no plans of slowing down, and that’s in large part thanks to the millennials and Gen-Zers who define the future of the steadily growing market.

Top luxury companies are paying close attention to the needs of potential buyers, that includes tech-savvy marketing strategies, AI, big data, and a constant balancing act between the old world of luxury and the new world of luxury.

In Deloitte’s recently released sixth edition of the Global Powers of Luxury Goods Report 2019, we see how luxury brands are managing to thrive despite an economically gloomy market.

The HENRYs

One of the study’s key takeaways is the emergence and focus on a new kind of client deemed the “HENRYs” (High-Earners-Not-Rich-Yet). While data on the industry has in the past repeatedly stressed the importance of cash-rich millennials, the most recent findings indicate that luxury brands are now focused on sustaining relationships based on potential.

But who exactly is this ambiguous group of consumers that has now been given its very own acronym? HENRYs have an average age of 43, earn between $100,000 to $250,000 a year, embrace digitalization and are likely to become some of society’s most elite shoppers.

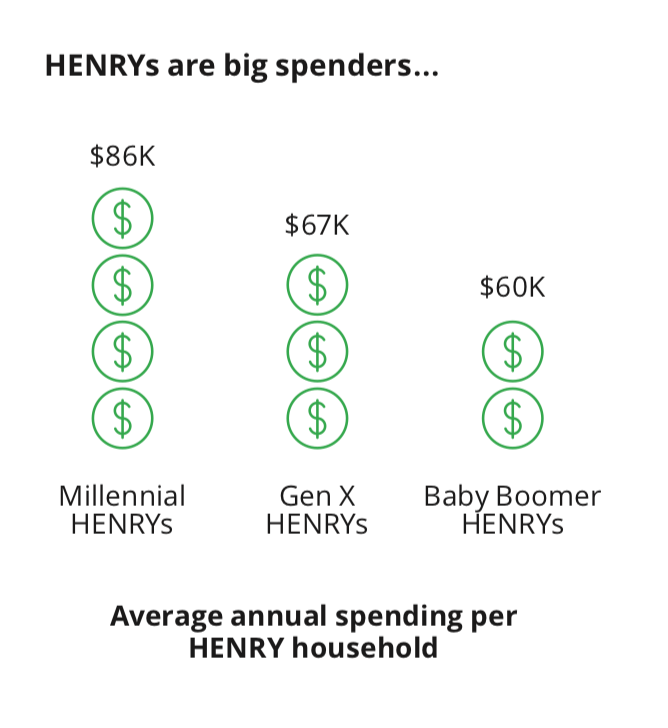

Average annual spending per HENRY household. Image credit: Deloitte

“The potential benefits of on-boarding this demographic to luxury brands’ product and service portfolio are twofold: securing valuable present customers and building client relationships and business with those most likely to be amongst the most affluent consumers in future,” Deloitte says. “Finally, since HENRYs are heavily influenced by modern technology and use of social media to form their buying decisions, luxury brands have started to engage with these customers by leveraging on social media platforms.”

Statistics At A Glance

The proof is in the numbers. This year’s report offers industry leaders unique insights due to its data-driven findings.

- The world’s Top 100 luxury goods companies generated aggregated revenues of $247 billion in FY2017, up from US $217 billion in the previous year (an increase of $30 billion).

- 76 percent of the companies reported growth in their luxury sales, with nearly half of these recording double-digit year-on-year growth.

- The ten companies in the multiple luxury goods sector are by far the largest, with an average company size of US $7.59 billion, outperforming the average size of companies in Top 100. These companies together accounted for 30.8 percent of the Top 100 luxury goods sales.

Industry Trend Takeaways

Similar to last year’s report, a shift in brand ideology toward sustainability and ethics has proven to be key in winning new customer generations over. The days of excess, high costs, and needless waste are dwindling more and more as moral values and green strategies have become increasingly important. Burberry, Kering, Prada, Rolex and Tiffany are among the top labels in the report who have evolved toward new models of sustainable luxury.

The report also found that social media continues to play a huge role in market strategy for industry leaders. How well brands not only perform, but communicate, with current and potential shoppers has a huge impact on keeping brand value intact.

“Nowadays, almost every brand has its own distinct social media strategy that is carefully designed keeping in mind their traditional customers preferences and choices. Some of these strategies include unveiling the collection on social media platforms,” Deloitte points out.

Mr. Bags x Tod's Collaboration. Photo Credit: Tod's.

Gucci, Louis Vuitton, Montblanc, Prada and Tod’s are some of the key players when looking at capitalizing on social media strategy in inventive and accessible ways.

The massive amount of content and influx of platforms has, however, made the power of the influencer more delicate, raising into question who should be trusted to represent products. In the past year, several countries have began enacting rules of transparency in advertising between brands and influencers.

Global Outlook

According to the report, by 2020 more than 50 percent of consimers will be categorized as "middle class." The luxury market is expected to continue growing to accomodate this rising new class.

"This market is dominated by Millennial HENRYs and Gen Z, with high disposalincome and are very prominent within the rising economies of theemerging markets. Both China and India are attractive markets forbrands in this regard, but each require in-depth market knowledge," Deloitte notes.

Although the Chinese economy experienced a slowdown in 2018 for the first time in 28 years, the sale of luxury goods saw steady growth in both mainland China as well as abroad, with Chinese consumer now dominiating the consumption of luxury goods both at home and outside.

For additional insights on today's luxury landscape and more, download the full report here.

Cover image credit: Pexels.