Digital

For Luxury Watches, E-Commerce Represents Fastest Growth in Customer Conversion

by

Limei Hoang | September 02, 2019

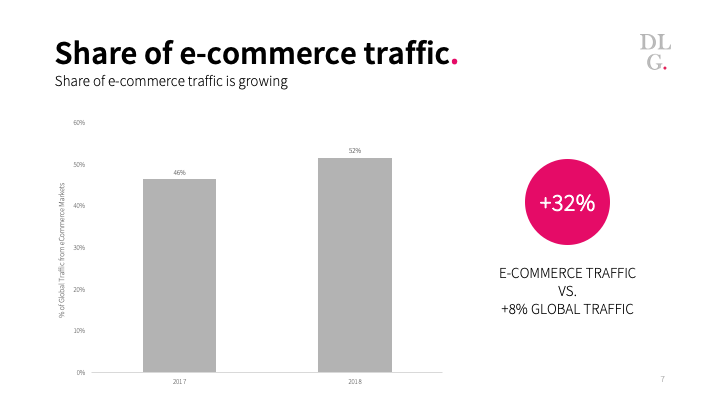

Last year, growth in online traffic from e-commerce markets outpaced that of non e-commerce markets by almost 4 times, according to the WorldWatchReport Benchmark, an exclusive industry indicator of the luxury watch and jewellery sector.

When it comes to customer conversion in the luxury watch market, e-commerce represents the fastest path for brands in terms of growth for online traffic, according to a dedicated e-commerce segment of the WorldWatchReport Benchmark (WWRB) by DLG (Digital Luxury Group), a digital marketing agency based in Geneva and Shanghai and publisher of Luxury Society.

The study found that growth from online traffic in e-commerce markets outpaced that of non e-commerce markets by almost 4 times in 2018, signalling the growing momentum that e-commerce has in terms of customer conversion.

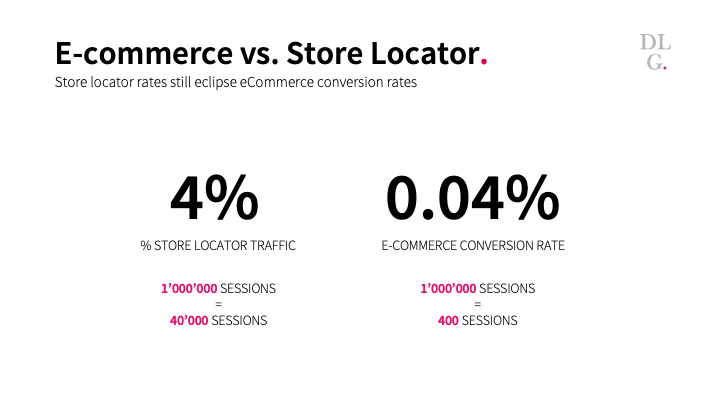

However, the report also found that store locator traffic, which is used to help convert online visitors into offline customers, represented a larger share of customer conversion rates of 4 percent, compared to e-commerce which accounted for 0.04 percent. Meaning that brands still need to maintain the right balance of both online and offline strategies when considering their customer conversion channels.

The findings are part of a wider study called The WorldWatchReport Benchmark, which anonymises, aggregates and harmonises data from more than 15 luxury brands, to provide an exclusive industry indicator of the luxury watch and jewellery sector each year. Published by DLG since 2005, the WWRB is a leading benchmarking tool that offers brand invaluable business insights, data and solutions.

“The traffic and conversion rates of e-commerce are eclipsing online-to-offline, so it's gaining traction. It’s not the main mechanism for sales but we are seeing it grow and this is is a reflection of how we see brands beginning to capitalise on that momentum,” said Christopher Peterson, head of data and analytics at DLG, who oversaw the study.

“Brands are showing that they are wanting to be there for the next generation of purchasing patterns which will be e-commerce, but online to offline is still important,” he added. “Right now, the conversion hasn’t materialised online, but it will and brands are preparing for it. But online to offline and omnichannel is still a necessary way to amplify these sites.”

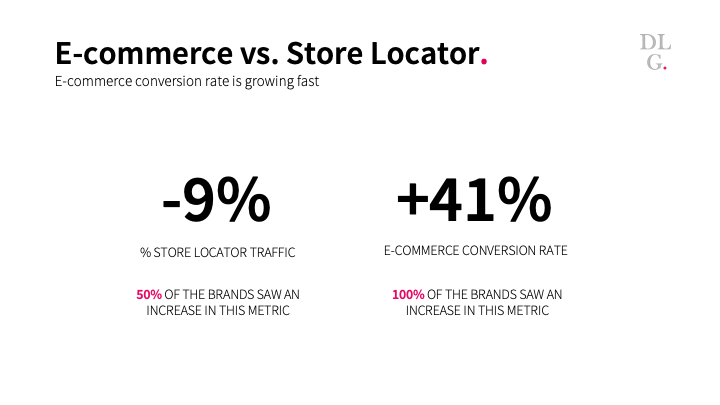

Global traffic from e-commerce markets grew at a rate of +32 percent to reach 52 percent of overall traffic last year, up from 46 percent in 2017 (whereby global traffic overall merely increased by +8 percent.) E-commerce transactions also experienced increases, growing at a much faster pace of 41 percent than store locator traffic, which softened by 9 percent.

Geographical Opportunities

Of the markets with the highest representation of e-commerce across brands, the United States had the highest conversion rates, followed by the UK, France and Germany.

“Both France and Germany lagged significantly behind the United Kingdom in terms of conversion rates (both half the rate of UK); however, France has as much traffic as the United Kingdom, surfacing an opportunity to consider re-allocating investments between these markets or alternatively, thinking about France differently in terms of the role that dotcom plays in the path-to-conversion,” said Peterson.

Greatest Channel for Conversion

The report unsurprisingly found direct traffic, while only account for 16 percent of overall e-commerce traffic, represents the highest customer conversion channel. “Direct traffic being such a high channel for conversion, means that you want to ensure your site and digital activations are sticky enough to drive repeat visits and brand recall.”

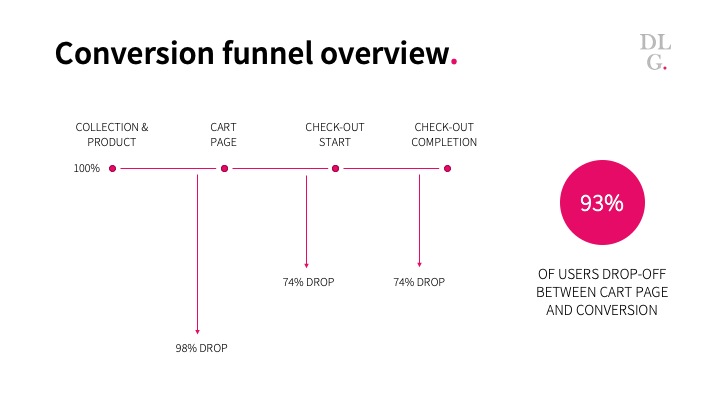

“From a site-optimisation perspective, the checkout funnel represents the greatest opportunity for driving e-commerce rates (with completion only being around 25 percent) as consumers at this point display a clear purchase intent,” said Peterson. “Short, mobile-friendly, guest check- out capabilities, with clear communication like purchase limits and delivery times, as well as broad payment options will reduce churn in this section of the site,” he added.

If you are a luxury watch or jewellery brand, you can access the full e-commerce segment from the WorldWatchReport Benchmark 2019. Contact DLG for further information.

Welcome to Data Digest, our weekly breakdown of the latest data releases and reports focused on the luxury industry.