Digital

What Luxury Brands Can Learn from the Beauty Industry’s E-Commerce Boom

by

Andrea Simone Silva | June 17, 2020

The third set of insights from DLG’s latest report, “The Online State of Skincare Brands,” sheds light on how a thoughtful e-commerce strategy can lead to frictionless consumer experiences.

The beauty industry has been evolving and transforming at a rapid pace for the past few years, with direct-to-consumer new players disrupting the market and heritage brands going through an internal digital transformation process, all in order to meet consumers’ increasing needs. In this competitive environment, beauty brands are forced to innovate and differentiate themselves in order to create great digital experiences for the consumer.

Skincare brands in particular have been steadily increasing, with Statistica estimating a 3.5 percent annual increase in the global skincare market through 2023, reaching a predicted $180 billion in global spend by 2024.

Even in the current context, beauty giants such as L’Oréal have communicated that, while the makeup category has been the most affected by the COVID-19 crisis, skincare brands like Kiehl’s, Lancôme and SkinCeuticals have proven more resilient.

Skincare seems to be more relevant than ever for beauty brands, leaving important e-commerce learnings for luxury brands to pick up on. While it is essential to understand how consumers search and what concerns they express, it’s equally important to deliver an outstanding e-commerce experience to truly connect with them.

What are the best practices in terms of User Experience (UX) when it comes to purchasing products on brands’ websites? What are the features that will take the experience to the next level?

These are some of the questions that the third set of insights from “The Online State Of Skincare Brands” report answers.

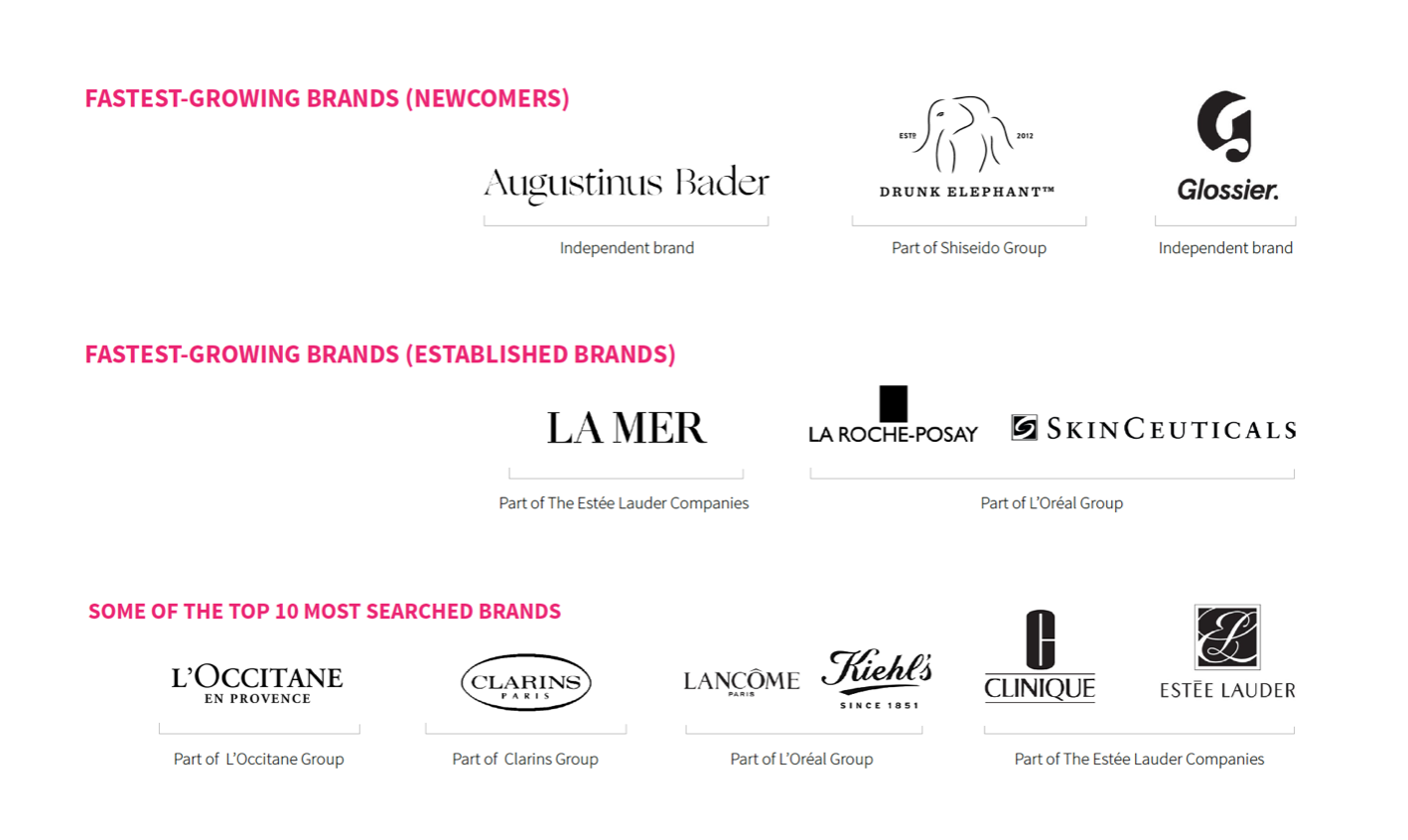

We analysed a selection of website features from 12 skincare brands: the top 6 fastest growing brands and 6 from the top 10 most searched brands. We focused on the offering of the U.S. market, the biggest for most of the skincare brands.

12 brands considered for the e-commerce analysis.

With the objective of defining best practices when it comes to experiencing a brand's e-commerce service, 24 criteria based on 7 main pillars were used for the analysis:

1. Product discovery

2. Consumer feedback

3. Consumer service

4. Incentives

5. Payment

6. Omni-channel

7. Check-out experience

From our extensive analysis, these are some of the highlights we consider key to both the consumers and brands.

Make It Easy to Find What Consumers Want

Consumers value frictionless experiences, and being able to find the product they are looking for quickly carries a lot of weight.

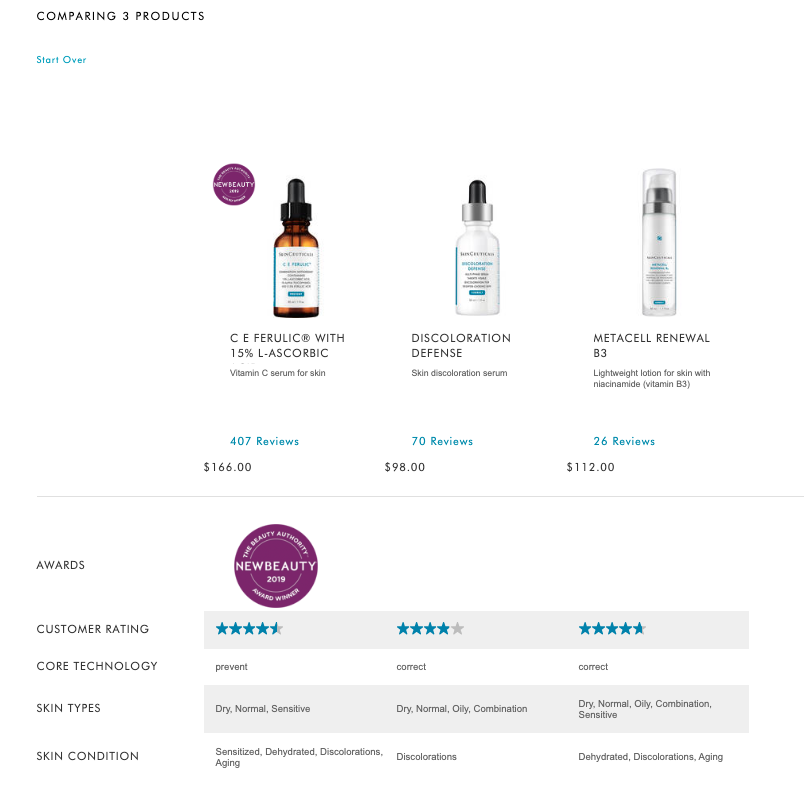

Multi-filtering options by price, skin type, category, skin condition and best sellers are expected by the consumers in order to make it easier for them to make better choices. Most advanced brands offer a great mobile UX by including app-like navigation to their mobile site. Consumers want to make better choices, and helping them compare products easily allows them to reduce choice paralysis.

Skinceuticals product listing page comparison.

Besides proposing a complete filtering options system, SkinCeuticals also provides a comparison option. The user can select a few products and collate them onto a page in order to compare their prices, ingredients, benefits and core technology to perfect their choice.

Be Transparent & Clear

E-commerce is about making sure consumers have all the information they need to buy a product. While in-store it is easy to receive advice from an expert, it is not always the case online.

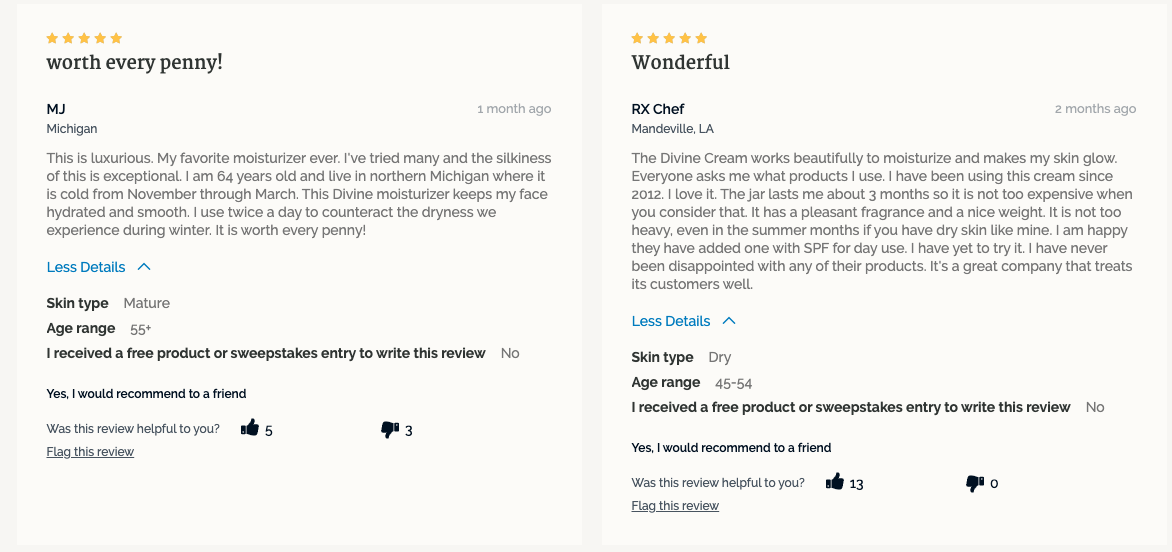

Brands should offer valuable product information and be fully transparent when showcasing consumer reviews, even when they’re not the most positive.

Some brands show when reviewers have received free items or give the option to filter reviews by most favorite or most critical.

Transparent rating and reviews by L’Occitane.

In its review section, L’Occitane has added a field where reviewers can mention if they have received a free product to write the review.

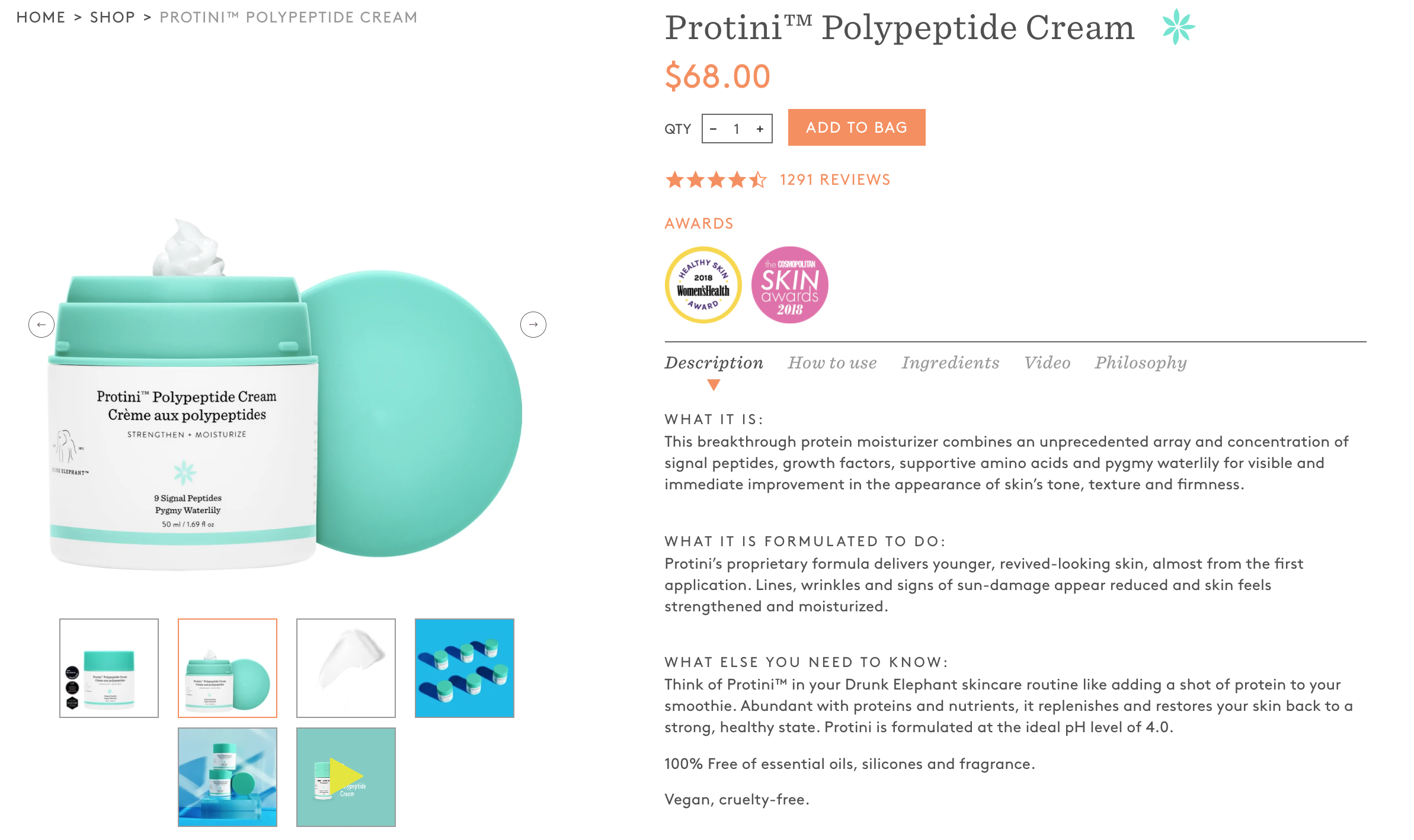

Does the consumer get all the information needed to make a purchase of an item? A simple product description is not enough: it is not about giving maximum detail; but the correct detail. Drunk Elephant is a good example.

Drunk Elephant’s product page containing all information consumers need to make a decision.

Their product page contains all the information consumers need to make a decision: photos of the product, ingredients and their benefits, practical advice on how to use it, the philosophy around the product, among other things. The brand creates and strengthens trust in their product with their “science proof section” and user reviews.

Set An Appealing Customer Retention Strategy

Offering text based re-order services, clear and engaging customer loyalty programs or the option to pick up at a nearby store on the day of an online purchase are also some of the best practices that companies need to consider. Creating auto-reordering, and offering a discount in case of auto-reordering, is an opportunity to increase customer retention. This will increase sales and help to partially forecast sales and incomes.

Waves of La Mer loyalty: La Mer offers a gaming-type loyalty program to encourage consumer loyalty.

Offering a seamless e-commerce experience, making sure all product-related information and consumer reviews are transparent, and personalising the online experience are all musts for brands striving to deliver the best-in-class experience.

The balance of these efforts underline the importance of brands offering an omni-channel experience to their consumers throughout all stages of the user experience.

To access Part II of “The Online State of Skincare Brands” report on E-Commerce Environment, download the report via the link below.

Skincare Report Part 2: e-commerce

Cover image credit: Drunk Elephant.