Digital

The Luxury Social Selling Boom in China: What's Driving it?

by

Alexander Wei | October 15, 2020

In China, social selling is taking transactions and customer engagement to the next level. How should luxury brands seize this digital opportunity?

The rapid recovery of the Chinese market since the second quarter this year has been reassuring for brands – LVMH reported a strong rebound in Asia, particularly in China, in its results for the first half of 2020; beauty giant Estée Lauder’s fourth quarter results for 2020 showed that the APAC region (led by China) was the only market globally where growth was observed.

The resurgence of the retail environment in China has been attributed in part to the state’s effective control of the epidemic, which has resulted in the steady recovery of offline touch points and growth stimulation in the market. While the first and second quarters of this year saw brands losing store traffic, most major luxury brands mitigated their offline losses through e-commerce, as well as social selling – a tactic made possible with WeChat. This helped to bridge the gap between sales associates and customers during the period.

While the concept of social selling has been gaining traction in recent years as brands continue to expand their digital offerings, this strategy is not new in China. In the early years, when luxury e-commerce had yet to take off, sales associates from luxury brands were already driving transactions outside stores with SMS and messaging platforms. Although the CRM infrastructure in China was less developed than the West back then, this form of communication would go on to form the foundation of the highly lucrative social selling industry in China.

The “Chinese Model” of Social Selling

Scale and stickiness are two critical factors in sales, which is one of the reasons why social selling is rapidly gaining traction for brands.

First coined by Nigel Edelshain in 2006, the term “Sales 2.0.” is defined as the use of World Wide Web technology and CRM applications that aim to improve the speed, collaboration, customer engagement and accountability of the sales process. By leveraging these tools, brands and retailers can more effectively access and use information from existing clients and prospects to enhance communication and cultivate brand stickiness through SMS and emails.

However, this practice wasn’t fully adopted in China. “The early efforts of global luxury brands at marketing automation and social selling were severely impaired by inflexible attempts to use standard global practices and tools in the Chinese market,” explains Aaron Chang, Founder and Chief Experience Officer at JINGdigital, a leading marketing automation platform in China. In spite of this, sales associates in China never stopped trying. The solution to this soon came in the form of WeChat – China’s ubiquitous social App – as anyone on the platform could easily tap into social selling. WeChat soon became central to the Chinese social selling rubric.

“As the Chinese market gained an ever-bigger seat at the table, and COVID-19 forced new digital flexibility, local teams have been able to more freely utilise Chinese native platforms and practices that are now generating significant value,” Chang adds.

WeChat is not just a social tool. Although brands in the West also sell socially on Facebook and WhatsApp, platforms like these are unable to cope with the needs across the entire consumer journey. On the other hand, WeChat’s ecosystem – which includes everything from Moments and Mini Programs to Channels and WeChat Pay – easily spans the full consumer journey (awareness, interest, purchase, and loyalty) and allows brands to reach consumers at different touch points. Coupled with its powerful messaging functionality, WeChat has is now the most crucial vehicle for social selling in China.

Social Selling at Scale

On top of facilitating real-time communication between sales associates and consumers, the WeChat ecosystem can also improve conversion rates when properly leveraged. However, as brands gradually enhance their e-commerce and CRM infrastructure on WeChat, a more scalable social selling model is required.

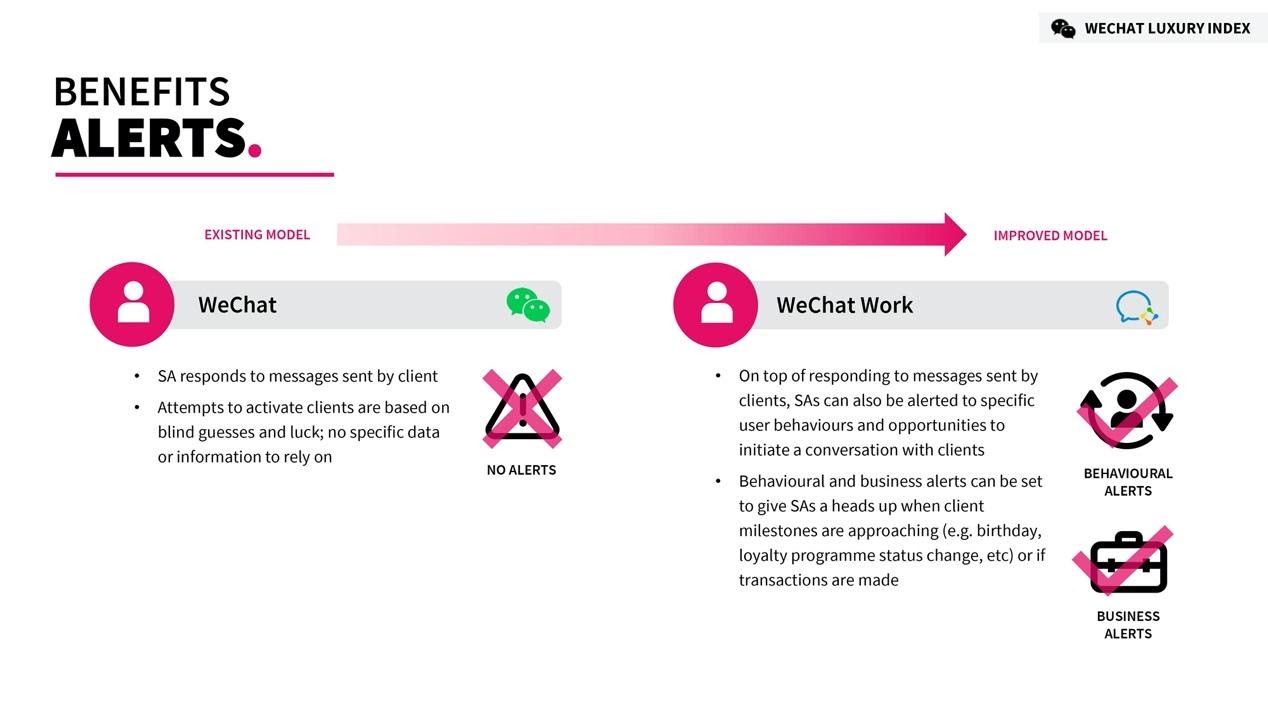

The latest WeChat Luxury Index (Jan-Jun 2020) jointly released by DLG (Digital Luxury Group) and JINGdigital in September this year examined the best practices and strategies for brands to scale up their social selling efforts within WeChat with the platform’s enterprise solution, WeChat Work. Unlike WeChat, WeChat Work serves as an anchor point “to provide brands’ sales force with an official communication channel and centralised customer and prospect database,” says DLG’s SCRM & Data Strategist Mario Juarez.

The platform is not only a communication outlet but also a system for predicting consumer behaviours. Through the platform’s built-in customer behavioural alerts and business notification alerts, brands can capture consumer actions and intentions more efficiently, removing the need for ineffective cold calls. “When fully integrated, WeChat Work can elevate the consumer lifecycle communication by blurring the lines between automated communications and personalised customer care. This allows sales associates to be more proactive, and clients to feel more valued,” Juarez continues.

At the same time, as an independent communication platform, it will not dilute or divert existing traffic from other channels. Instead, social selling with WeChat Work functions as a separate growth channel that further expands the brand’s reach.

How To Get In The Game

Luxury brands like Burberry, Omega and Chloé are all already using WeChat Work to grow their client service offering and social selling activities. But this business channel is not as simple as merely adopting new software and integrating it with a brand’s existing WeChat database.

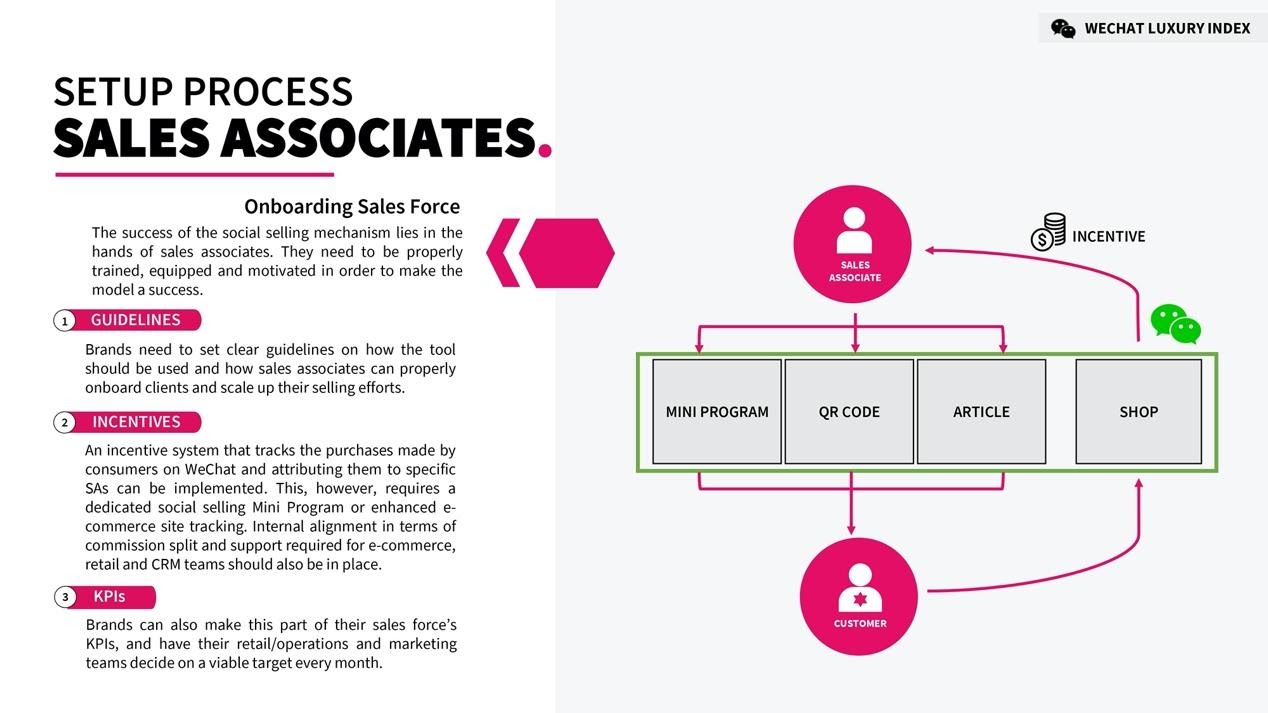

WeChat Work-powered social selling differs from e-commerce in that it not only requires investment in a comprehensive digital infrastructure and supporting platforms, but also full co-operation from the brand’s sales force on the ground. How sales associates leverage this platform to bridge the in-store and out-of-store sales ceremony will be key to the model’s success in the long run.

The WeChat Luxury Index (Jan - Jun 2020) lists several key elements for brands to note in terms of onboarding its sales force, including establishing the right guidelines on how to use the tool to acquire customers and increase conversions. At the corporate level, proper incentives and the setting of key performance indicators will further motivate salespeople to make use of social selling.

The impact of COVID-19 on offline retail has undoubtedly accelerated the digital efforts of brands within the industry. But that aside, given today’s technological advancements, luxury brands should be thinking more about how to replicate the offline human interaction, online. In addition, as the demand for personalised experiences and services continues to grow – especially in a massive luxury market like China – social selling will become increasingly relevant for brands that are looking to tap into new opportunities and stay ahead of the curve.

The WeChat Luxury Index (Jan - Jun 2020)

To find out more about how social CRM can benefit your brand and by extension, its social selling efforts in China, sign up now for DLG Webinar Series: China’s Digital Market #4 – The Key Principles of WeChat CRM. The webinar will take place on 28 October and see DLG’s Partner & International Client Development Director Iris Chan, as well as Social CRM & Data Strategist Mario Juarez, delving into the topic and offering practical tips on getting started.

DLG Webinar Series #4

The Key Principles of WeChat CRM

Cover Image: AFP