Events

LS Keynote Shanghai 2020: Seeking New Areas of Growth in China’s Digital Ecosystem

by

Alexander Wei | December 02, 2020

The sixth edition of Luxury Society’s Keynote event in Shanghai took place at The Sukhothai and explored opportunities and challenges within China’s fast-paced digital commerce landscape.

On 26 November, over 140 representatives from leading luxury brands, service providers, platforms, and top media gathered at The Sukhothai in Shanghai for the latest edition of the Luxury Society Keynote. It marks the sixth time the event has taken place in the bustling Chinese city, and its second edition for the year 2020 (an earlier edition was staged in Geneva this February).

Over the past few years, China’s digital landscape has undergone a significant transformation in terms of platforms, digital offerings and even consumer behaviour. This has impacted the way which customers interact with brands and in turn, brands have to keep pace with these changes to stay relevant. As such, this year’s Luxury Society Keynote in Shanghai threw the spotlight on The New State of Commerce in China. Keynote speeches, in-depth interviews and panel discussions were built around this topic and examined the opportunities and challenges within China’s ever-changing digital ecosystem.

In the event’s first keynote speech, Pablo Mauron, Partner & Managing Director China of DLG (Digital Luxury Group) gave the audience an overview of the development of China’s online platforms. As these digital platforms evolve and become more multi-faceted, the touchpoints they cover along the consumer journey have shifted as well. This has resulted in a tipping point for brands in terms of marketing – platforms do not only serve to help them generate awareness, but allow them to directly drive conversions too. “Content marketing for luxury brands has evolved from content that resonates, to content that sells,” Mauron said.

Of all the social platforms in China, WeChat, with over 1.2 billion monthly active users, is undoubtedly one of the main client acquisition channels for brands in China. Official Accounts, Mini Programs, Channels, advertising options and the newly-revamped search function on WeChat has allowed the platform to solidify its reach along the awareness, interest and purchase stages of the consumer journey. With its enterprise solution WeCom, its influence on the loyalty front has also been strengthened. In 2020, 30 per cent of luxury purchases are expected to be made purely online, which opens up new areas of opportunity for brands on social touchpoints. George Xie, Planning Head of CPG Industry at Tencent Marketing Solution, analysed the key areas in which WeChat has been building the online journey from discovery to purchase, including advertising, content, e-commerce and through WeCom integration.

Morgan Stanley projects that China’s GDP growth next year will range between 7.5 to 9 per cent, and private consumption could emerge as the economy’s key growth driver – in replacement of exports and infrastructure investment – with luxury consumption playing an important role in the equation. Buy Quickly’s Founder, Chairman and Chief Executive Officer John Liu weighed in on the potential of China’s online luxury market in his presentation. Online channels now offer brands a greater degree of autonomy, allowing them to avoid promotional events and discounts and attain higher profit margins. Due to the shift of consumer habits, the proportion of consumers researching online and purchasing offline (ROPO) will continue to grow in China’s luxury market. As such, luxury brands need to consider online channels for more than their sales potential, but also in how they can fit into the brand’s over omnichannel offering, allowing them improve both the online and offline experience.

Beyond e-commerce pure players, the summit also examined how brands can leverage alternatives sales channels to stimulate their performance in this market. One such way is to work with influencers (KOLs), helps brands to better engage with consumers through the use of rich media (such as short videos and livestreaming).

Luxury Society Editor Alexander Wei sat down for a fireside chat with top Chinese fashion blogger Mr. Kira on this topic, and discussed the demand for influencers to break new ground in China’s fast-changing digital ecosystem, and the importance of recognising one’s strengths and weaknesses – something that applies to brands as well. “Of course, brands want to capture new audiences across more platforms – but first of all, they need to understand who these audiences are, and how to appeal to them on these platforms,” said Mr. Kira. He took Bilibili – the most popular video platform for Generation Z in China – as an example, noting that when brands choose to dive headfirst into a new platform, they should not only focus on traffic acquisition but also take the time to understand the platform’s cultural context and user preferences as this demonstrates its sincerity in engaging the audience as well.

Also part of this section about diversifying sales channels was a panel discussion about one of the hot topics of the year: Social selling. While it is by no means a new phenomenon, some brands have greatly improved and invested in their operations on this front – especially when COVID-19 was at its peak in China earlier in the year. Breitling’s Head of E-commerce China April Ren, leading marketing automation solution JINGdigital’s Chief Executive Officer Kai Hong and DLG’s Associate Account Director Layla Lee participated in the discussion, offering their opinions from the brand, service provider and agency perspective respectively. In Lee’s view, social selling is not just a sales channel; it is also a communication channel that can stimulate the performance of other channels. For brands that want to effectively tap into social selling, Ren gave her advice from a management standpoint as well: “The whole team, especially management, must keep an open mind. If the brand wants to launch innovative projects, the entire company must understand that it is our common responsibility to understand consumers and meet their demands."

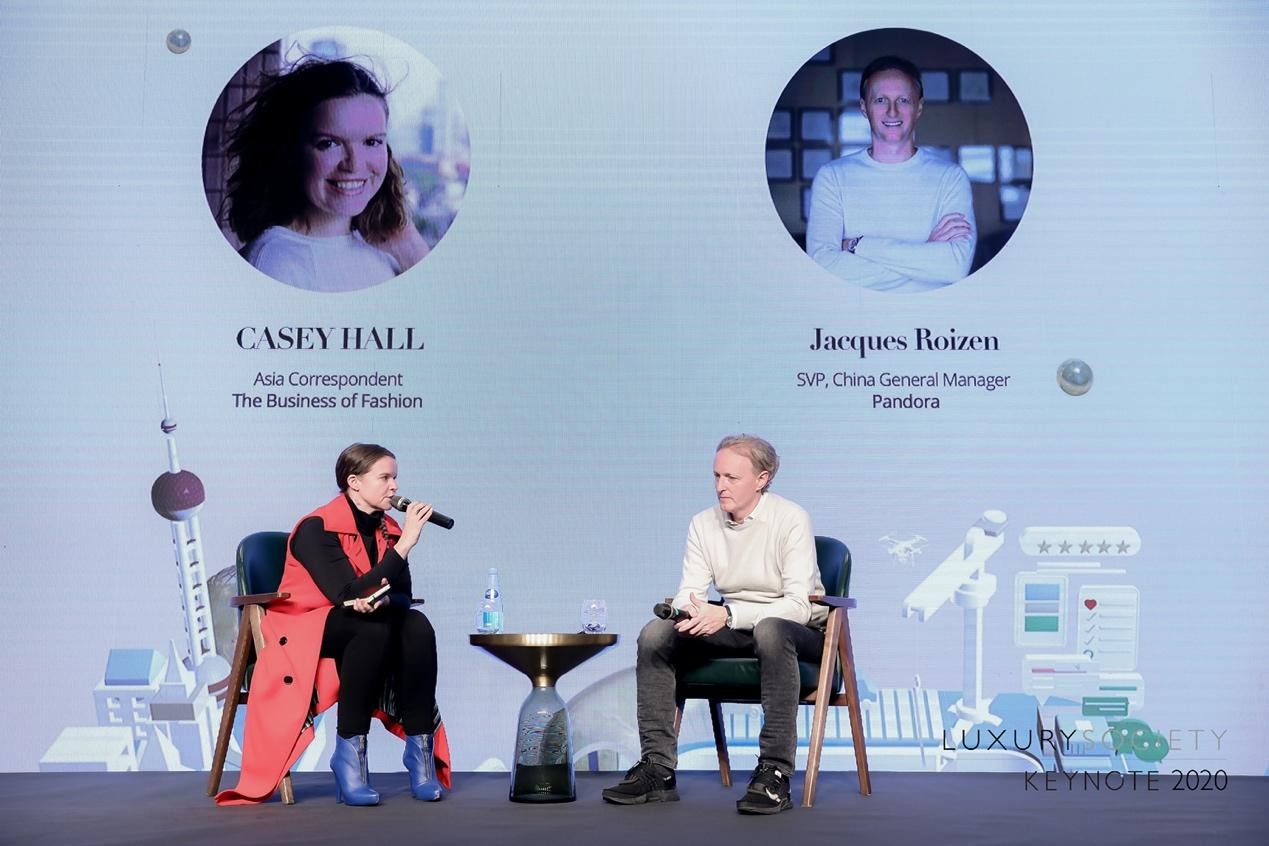

In addition, Casey Hall, Asia Correspondent at The Business of Fashion, and Jacques Roizen, Senior Vice President and China General Manager at Pandora sat down for a conversation about Engaging and Reactivating Consumers in China. In Roizen’s opinion, consumers in the market are far more sophisticated and demanding in terms of digital. He shared that digital in the West digital tends to serve more functional purposes, while digital in China takes on an entertainment angle as well. “Consumers here are hungry for innovation and newness. As long as it’s entertaining, the consumer rewards you,” added Roizen.

To wrap things up, WWD China’s Co-founder and Strategy Officer Lena Yang moderated a discussion about the Digital Transformation of International Brands in China with Boston Consulting Group’s Partner and Managing Director Veronique Yang, Senior Vice President, Digital at LVMH Asia-Pacific and Wendy Chan, and GBMax, Max Mara Group of Brands’ Chief Executive Officer Esteban Liang. The seasoned luxury executives delved into topics related to omnichannel, marketing and building the right digital infrastructure in China.

“Some of my clients are thinking from a very interesting perspective: Going forward, there should be a Chinese consumer strategy, not only a China strategy,” said Veronique Yang. Her comment perhaps underscored the message of the entire conference – as the Chinese market continues to grow in importance and Chinese consumers become more sophisticated, the interpretation of and practices around people and consumers should be a top priority in a brand’s digital strategy.