Digital

Content Production Remains The Biggest Challenge for Luxury Brands on Douyin

by

Alexander Wei | February 22, 2021

As luxury brands accelerate their digital transformation in China, Douyin, dominated by short videos, has become one of their biggest targets. But in order to capture the attention of the younger generations on this platform, brands need to rethink their content strategy.

Earlier this month, Chinese short video platform Kuaishou raised over $5.32 billion with its initial public offering in Hong Kong, surpassing estimates and valuing the 10-year-old company at over US$159 billion.

Kuaishou's headlines-making listing reflects the rising popularity of short videos in China. According to QuestMobile's China Mobile Internet 2020 Half-Year Report, the number of monthly active users for Chinese short video apps reached 852 million by June of 2020. The medium currently captures nearly 20 per cent of the total time spent by netizens online, second only to instant messaging. As the China digital ecosystem evolves, consumer behaviours are changing together with it and luxury brands find themselves having to constantly upgrade their communications approach and embrace new media formats – such as short videos and livestreaming – beyond the typical text-image format, all while venturing onto new platforms one after another.

While Kuaishou might be making a splash internationally now, it‘s probably rival platform Douyin that international brands are more familiar with – thanks to its wildly popular global version, TikTok. While the fate of TikTok remains in the balance with ongoing US-China trade tensions, Douyin has been enjoying strong traction in the Chinese market. In the past year, top luxury maisons such as Gucci, Louis Vuitton and Cartier have all launched official accounts on Douyin. But keeping audiences on this platform engaged is no mean feat.

The prestigious image luxury brands have built up over the years appear incongruous with the faddish viral videos that tend to trend on Douyin. Brands have come to realise this disconnect, and it has become a priority for them to create relevant content on Douyin that does not dilute their brand image, while resonating with audiences.

Closing The Loop

With 426 million daily users (as of 30 September 2020), Douyin represents a gateway for brands to millennials and Generation Z with rising spending power, residents of third- and fourth-tier cities with plenty of spare time, and digital natives.

These user profiles also illustrate the content that is trending on this platform: A man fully wrapped in a scarf dancing wildly in the street; a celebrity using a platform-developed filter to fire lasers with her eyes; or a cat that seems to understand human language. These wacky clips, which can easily clock millions of engagement actions (including likes, comments, and reposts), have built an environment that is vastly different from “traditional” social channels like Weibo and WeChat, and it is for this reason that some brands regard this platform with wariness.

Apart from short videos that last about 15 seconds, Douyin supports videos up to 15 minutes and livestreaming, making it a more than sufficient channel for brands to distribute their content. On 2 August last year, Louis Vuitton debuted on Douyin to promote its Shanghai menswear fashion show, which was later live broadcast on the platform. More than 102,000 people tuned in simultaneously to this session that day, and the related topic #LV春夏男装秀 (Louis Vuitton Spring 2021 Menswear Fashion Show) received more than 94 million page views. This marketing campaign served as a model for subsequent collaborations between other luxury brands and Douyin.

As with all Chinese social media platforms, Douyin has built up its own sophisticated ecosystem over time. Not only does it help brands increase awareness via video content, now with Mini Programs, Douyin Shop and the recently-launched payment solution Douyin Pay, it also has e-commerce and CRM functionalities. Douyin is gradually becoming a multi-faceted platform like WeChat, where content has become the foundation for a brand’s success. From content comes traffic, and only with traffic can brands drive conversions.

Creating The Right Content

The first challenge brands encounter on the content level is adapting to the platform's standard video format given their existing assets. Much of the content posted by brands on Chinese social media is derived from international assets distributed on global social platforms. Most of these videos are shot and produced in a horizontal format and do not fit the 9:16 vertical video format on Douyin. Moreover, they are often not short and snappy enough to captivate China's attention-deficit youths. While brands can still reuse existing materials provided by global teams, original content created and tailored for this platform is more likely to be well-received by audiences.

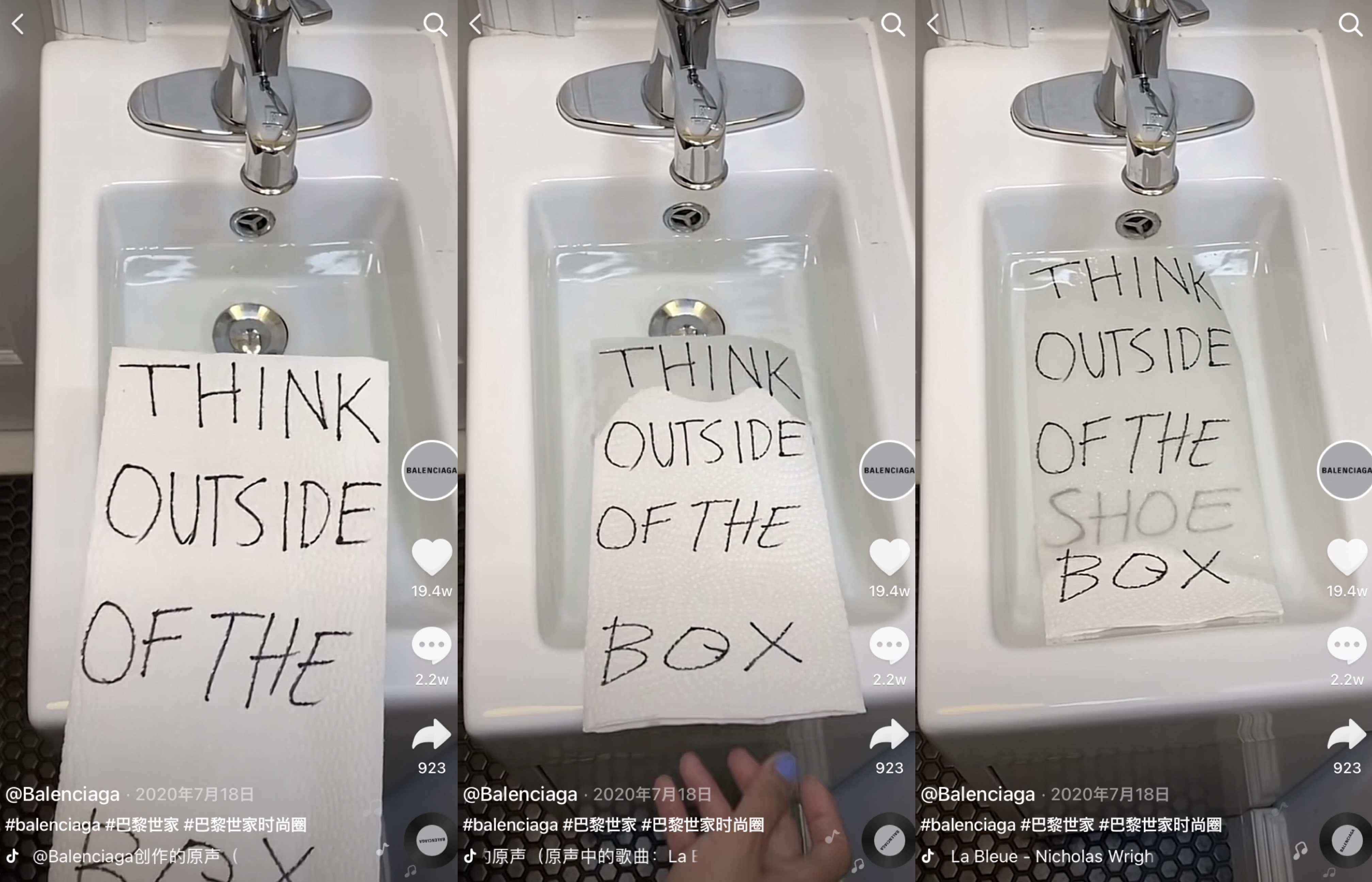

Then there are brands like Balenciaga that are on both TikTok and Douyin, and feeding both platforms with similar content that generally resonates with both local and global audiences. Its eye-catching but somewhat bizarre videos echo the visual leitmotifs of Creative Director Demna Gvasalia, while addressing the tastes of the younger generation on Douyin. In one notable video, a piece of paper inscribed with the words "THINK OUTSIDE OF THE BOX" is dropped into a sink, after which the word "SHOE" gradually appears. The video received almost 200,000 likes, with users responding positively and expressing curiosity towards the video.

While Balenciaga’s strategy works from a global communications standpoint, there are also local communication milestones that brands will need to address in China – and which they will not have relevant global assets for. This leads to another challenge for brands in terms of content creation: Local production.

International luxury brands are no strangers to producing local content, having done so on various Chinese digital platforms like WeChat and Weibo over the years. But given the differences across ecosystems, assets created for one platform might not necessarily be relevant for another. It was with this in mind that Gucci collaborated with Chinese hip-hop group Higher Brothers in a video exclusively for Douyin, featuring group members wearing pieces from Gucci's Fake/Not Collection and a rapping a verse (especially written for Gucci) in the Sichuan dialect. The video, aimed at the younger generation, received 116,000 likes on Douyin and generated widespread discussion.

Optimising Communication Strategies

Given the fragmentation of consumers across different markets and the complexity of the global digital ecosystem, standard digital assets produced for a fixed product mix and international marketing milestones are no longer sufficient to meet the needs of the dizzying number of digital platforms popular across different markets, especially in China.

Bain estimates that China's personal luxury market will achieve 48 per cent growth in 2020 to reach approximately 346 billion Yuan. With this momentum, China will become the world's largest luxury market by 2025. In terms of products, brands have already long been releasing special collections for this market. However, the rate at which they are adapting to content needs in the market remains slow, despite the fact that online touchpoints influence 92 per cent of purchases in China.

Apart from ramping up content investment in this market, brands also need to consider how they can adapt their content strategies from the top down to fit the unique digital ecosystem in China, says Elsie Zhang, Client Development Director at DLG (Digital Luxury Group). "When creating a marketing plan, brands need to think about how they can reuse these material assets on Chinese digital platforms, in addition to pure distribution.” She elaborates that content localisation requires financial investment, time and a clear product strategy, as well as clear understanding of the local marketing calendar. Brands also need to work closely with local teams and possibly even third-party agencies to help them fill in the gaps when it comes to the production of these assets.

The issues brands face in producing relevant content on Douyin is part of a larger digital transformation challenge that brands need to contend with when developing their businesses in China today. Digital transformation in China is more than merely venturing into a new platform or opening up a sales channel. Strategies must be grounded in clear understanding of local consumers and the native culture, and crafting a China content strategy from a Western perspective is no longer viable.

Find out more about how your brand can develop the right content strategy in China in the latest edition of the DLG Webinar Series: China’s Digital Market, which will focus on Content Creation & Localisation. For more details and to register, click on the link below.

Cover image: Handout

DLG Webinar Series: China's Digital Market

Content Creation and Localisation

Wednesday, 24 March