Consumers

Luxury Travel Is Undergoing A Transformation. How Can Brands Adapt?

by

Emma Cayeux | February 28, 2022

The rapid spread of a COVID variant has once again hit the global travel industry hard, resulting in the industry having to adapt to the numerous challenges that have emerged from new travel restrictions. But how can luxury brands adapt to this new environment?

Bigger rooms, less crowds, private jets – these are just some of the specifications that luxury travellers demand when it comes to planning their holidays in a post-COVID era. And with the rapid spread of Omicron in the past few months once again slowing down the pace of international travel, those trends look set to continue for a number of years to come.

In 2021, international tourism was estimated to have risen by 4 percent, according to United Nations World Tourism Organization, recording 15 million tourist arrivals compared to 2020. However, this was far below the levels seen in 2019, before the start of the global COVID-19 pandemic, where almost 1 billion more tourists travelled in 2019, representing a 72 percent drop.

Pre-pandemic, the economic contribution of tourism (measured in tourism direct gross domestic product) in 2019 was valued at $3.5 trillion, and while 2021 is estimated to be $1.9 trillion, it still trails behind 2019 levels.

However, there are early signs that 2022 may see an uptick in travel, despite the uncertainty that the Omicron variant poses. Luxury travel companies like Abercrombie & Kent are reporting a “new sense of urgency” to travel due to clients feeling like they have lost out on the past two years and according to a survey of 12,000 travellers in 12 countries conducted by Expedia, 65 percent of respondents are planning to “go big” by planning exciting or extravagant trips for the coming year.

With that, comes the opportunity for brands to tap and adapt their offering to luxury travel’s new trends that are reshaping the market. To help us understand more about the trends and demands of the luxury traveller, we looked at specific terms in the travel industry using the interpretations of the Google keyword planner tool - meaning we used it as a way to gauge the pulse of what luxury consumers are thinking, wanting and searching for.

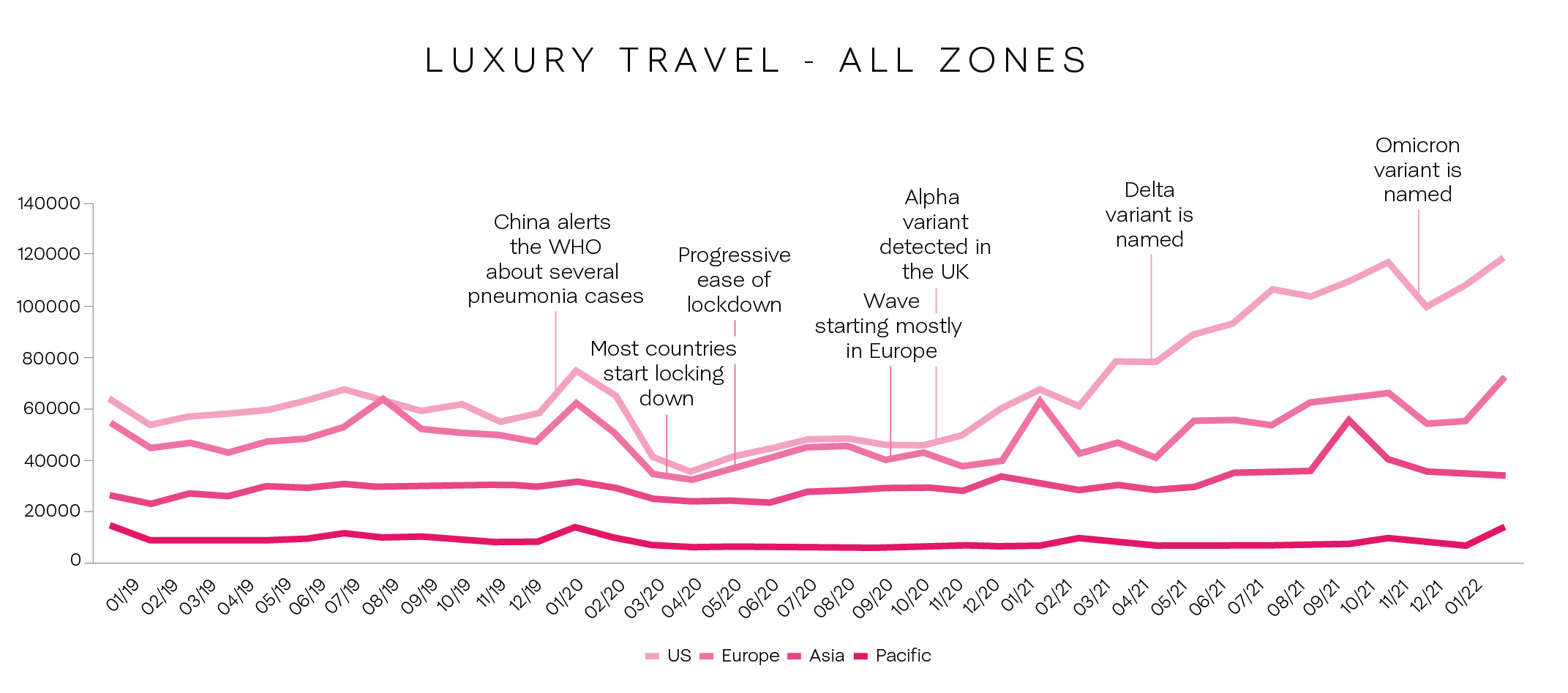

Focusing on four geographical regions: the United States, Europe, Australia and New Zealand and South-East Asia, we explored the theme of “travel,” “luxury travel,” and added thousands of keywords together, to see how brands can best adapt to the new normal for luxury travellers. This is what we found.

Luxury Travel Is Recovering Faster

The first thing to note is that the luxury travel segment is recovering faster than the overall industry. While the average monthly searches for travel related keywords like budget hotel or cheap travel are respectively 18 percent and 45 percent lower in 2021 than in 2019, this is not the case for luxury travel. Google searches in English for the term “luxury travel” during 2021 rose by 38 percent compared to 2019. And the average monthly searches for “luxury travel” also rose by 174 percent, compared to 2019.

But It Depends On The Geographical Region

While Europe and United States had a similar level of Google search demand for luxury travel related keywords with around 60,000 monthly queries in 2019, the recovery has been much stronger in the United States where Google searches were almost double compared to 2019 levels, reaching around 118,110 monthly queries, reflecting the appetite from American travellers for overall travel.

And even though the Europe’s luxury travel recovery is not as strong as the demand seen in the United States, it is still faster than the overall travel related keywords pickup: while “travel” related keywords only returned to their 2019 level in May 2021, “luxury travel” keywords returned to their 2019 levels in January 2021.

In Southeast Asia, a similar story can be seen in the United States. Demand for luxury travel grew faster than levels seen in 2019, but in contrary to the United States, searches in Asia fell in April 2021 to reflect the second wave of Covid from the Delta variant. Unsurprisingly, due to the stricter travel measures and border closures in the Asia-Pacific region, search volumes are still below 2019 levels for both travel and luxury travel keywords.

What Do Luxury Customers Want?

The faster recovery in luxury travel can be attributed to the many demands of its consumers, whose desire for space and privacy, and a focus outdoor and wellness, is driving the trend towards bigger rooms, private jets, and destinations that are orientated towards health and wellbeing.

Google keyword searches for anything related to “private” spaces, like private jets, private boats and private homes, increased by 71 percent between January 2019 and January 2022. Travellers appear to be looking for luxury private jets, luxury villas, and more specifically luxury experiences delivered by key hospitality players such as The Four Seasons.

Private jets were up 71 percent, private boats 45 percent and private holiday home rentals were up 17 percent, demonstrating the interest from luxury travellers.

Likewise, the health and wellness trend that accelerated during the pandemic and a survey by American Express published in September found that 76 percent of the respondents answered that they wanted to spend more on travel that improves their wellbeing. This corresponds with our data, which shows “wellness” queries related to luxury travel were, in January 2022, up 17 percent compared to the pre-COVID average of 6,000 monthly searches.

Searches for outdoor holidays have also risen. Queries for “outdoor holidays” and its related keywords reached an all-time high of 4 million monthly searches in November 2020, nearly three times the level of queries a year earlier.

Impeccable Service and Flexibility

Unsurprisingly, the need for companies to be more flexible about bookings and cancellations has become very important in the travel industry. We have seen most international hotel groups revise their booking policies and cancellations, offering free cancellations or more flexible choices and conditions for their customers.

This can be seen when we look at the term “travel insurance,” which reached a high in early 2020 of 5 million average monthly searches – reflecting consumer concerns about existing pre-COVID bookings – up 55 percent compared to March 2019 levels. However, searches fell almost as fast as they rose after April/May 2020, the reason most likely being that with most of the travel industry adapting to offer flexible terms, the need for travel insurance ebbed.

With these trends in mind, we believe that luxury brands need to be more tactical and reactive to the changes in the market, as short term trends are becoming impossible to predict in these times of uncertainty.

Be Unique

Firstly, brands must differentiate themselves. The travel industry is already fiercely competitive and battling over flexibility or sanitary protocols is not generally what luxury consumers seek out when it comes to planning their next trips.

Brands should focus on emphasising what they have to offer in terms of unique experiences, particularly those of a once-in-a-lifetime variety, like luxury hotel group Belmond, which recently reopened the Venice Simplon-Orient-Express: a private luxury train service travelling from London to various cities in Europe. Likewise, wellness retreats like the Sky Lagoon Hotel that offer “naturally healing geothermal waters” are proving popular.

Secondly, companies must know their customer. Knowing what your customer wants and how your brand is perceived is something all companies must ensure they do regularly particularly after such a disruptive event in the industry. One way to do this would be conducting qualitative interviews as they allow brands to see how their key personas have evolved in terms of concerns, needs, and preferences.

And lastly, data is key. Making good use of customer data enables companies to connect the dot between the different sources they have available to help anticipate their customers’ needs.

From search queries and on-site behaviours (booking date requests, destination enquires, or customer service questions) to social media engagement, being able to track and analyse all the available information helps companies predict trends before they emerge so that they can be the first in answering the evolving needs of the luxury traveller.

With these points in mind, we believe solutions can be found even when challenges arrive. Luxury travel still remains a compelling industry and the opportunities for brands to adapt their services to meet the needs of its consumers are abundant, if companies listen to what they want.