Kering has officially established its beauty division Kering Beauté to develop its beauty business, following in the footsteps of LVMH, Chanel, and Hermès. What are the possibilities for Kering Beauté, and how will it reshape the premium beauty landscape?

The acquisition of Tiffany & Co. by LVMH was the most talked-about luxury deal in 2021, but the M&A frenzy in luxury is far from over. Estée Lauder Companies acquired American luxury brand Tom Ford for $2.8 billion at the end of 2022, after the former had been a partner of the licensed Tom Ford Beauty business for years. Tom Ford will become the first fashion brand owned by the beauty behemoth, which is worth more than $90 billion.

There is another protagonist in this bidding story: Kering, which was known to have put in a bid for Tom Ford alongside. At the time, the industry was more inclined to believe that the luxury conglomerate, with its proven track record in managing fashion brands, and personal ties to Tom Ford, would outbid Estée Lauder Companies.

While it did not, Kering didn't rest in its ambitions, and is now determined to take a cut of Estée Lauder's beauty share as well. Kering announced the creation of Kering Beauté, a dedicated beauty division, at the beginning of February. Kering does not currently have any in-house beauty lines.

The company appointed Raffaella Cornaggia, the former Estée Lauder Companies Senior Vice President, as Chief Executive Officer of its beauty department. Cornaggia was previously responsible for the group's flagship brand Estée Lauder and Aerin, the eponymous brand of Aerin Lauder from the Lauder family.

Kering states that Cornaggia and the team will “develop an expertise in the Beauty category for Bottega Veneta, Balenciaga, Alexander McQueen, Pomellato and Qeelin.” Apart from Bottega Veneta, the other aforementioned brands currently do not have active beauty lines.

Interestingly, Kering did not mention the elephants in the room, Gucci Beauty and YSL Beauté, in this brief statement. According to Thomas Chauvet, Citigroup's Head of Luxury Goods Equity Research, Gucci's licensed beauty business generates $500 million in sales per year for Coty. The latter, a well-established beauty brand owned by L'Oréal, has surpassed $1 billion in sales.

What are the possible pathways for Kering Beauté? Will it write a new playbook for the beauty divisions of luxury houses?

Internalising Beauty Lines

Kering was not always pleased with the licensing model. Group Managing Director Jean-François Palus stated at the 2019 full-year results meeting, “The [Gucci Beauty] potential is enormous. We’re pretty frustrated with the speed at which that potential is being exploited.” The possibility of withdrawing from the licensing agreement has since been placed on the table. Kering has repeatedly left this open to speculation at its earnings calls.

“This seems to indicate that Kering is taking action, but whether it is the right course that will pay off is yet to be seen,” Iris Chan, Partner and Head of International Client Development at DLG (Digital Luxury group) opines. “Taking over from Coty, there is something to build off of with some of the brands and an opportunity to bring the holistic brand perspective and establish cohesion across brand products, which is often a disconnect seen in brand licensing structures.”

There are precedents of Kering withdrawing its brand licenses. Roberto Vedovotto, the former Chief Executive of Safilo, was hired and tasked with creating Kering Eyewear in 2014 to run the group's eyewear business and expand its licensing offering to other brands. The group went out of its way to pay 90 million euros compensation in three instalments to Safilo for terminating the Gucci licensing agreement two years in advance.

Kering Eyewear has become the group's fastest growing division in 2022, with revenues exceeding 1 billion euros, up 58 per cent year on year. Excluding the contribution from the recently acquired Lindberg and Maui Jim, organic growth has also reached 27 per cent since the end of 2021. Kering describes this division's performance as "firing on all cylinders" in its annual report.

LVMH, Chanel, and Hermès are among the luxury behemoths that have launched their own beauty divisions. According to analysis, Chanel's beauty and fragrance revenue accounts for one-third of the brand total, while Hermès' newly launched beauty line has become an important platform for the brand to reach a larger audience.

“We have observed a trend in the last two years that consumers prefer beauty brands that are backed by luxury houses, especially in cosmetics. These products have a low entry price while also providing unique options in terms of packaging and colorways. It's also proving to be a good opportunity because some brands already have a successful self-operating track record,” says Veronique Yang, Managing Director & Senior Partner at BCG.

For Kering, reclaiming these brands will be a watershed moment – especially for its two cash cows, Gucci and YSL.

Gucci's contract with Coty does not expire until 2028, according to sources. At the same time, L'Oréal states that its licenses with Kering are “very, very, very, very long term,” with the company’s Chief Executive Nicolas Hieromimus saying that Yves Saint Laurent-branded cosmetics and perfumes are not at risk with the creation of a new beauty division at Kering.

A similar question was addressed at Kering's recent annual earnings meeting. “We trust that our partners for the other brands will continue to work with us in a good relationship that we are having right now,” Jean-Philippe Bailly, the group's Chief Operating Officer, commented. At the moment, it is unclear whether Kering will take back its beauty businesses in advance, as it did previously.

A Holistic Brand Image

Even if the beauty lines of brands cannot be internalised anytime soon, the establishment of a dedicated division allows the group to gain a deeper involvement through its partnership with beauty companies.

The beauty licensing model of today is not the same as it once was. The fragrance market boom drove the beauty licensing business in the early 21st century, with brands large and small, from Issey Miyake to Abercrombie & Fitch, launching their own fragrances. While some of these licensed products may have stayed true to the original brand image, others resembled commodities created solely to capitalise on the hype.

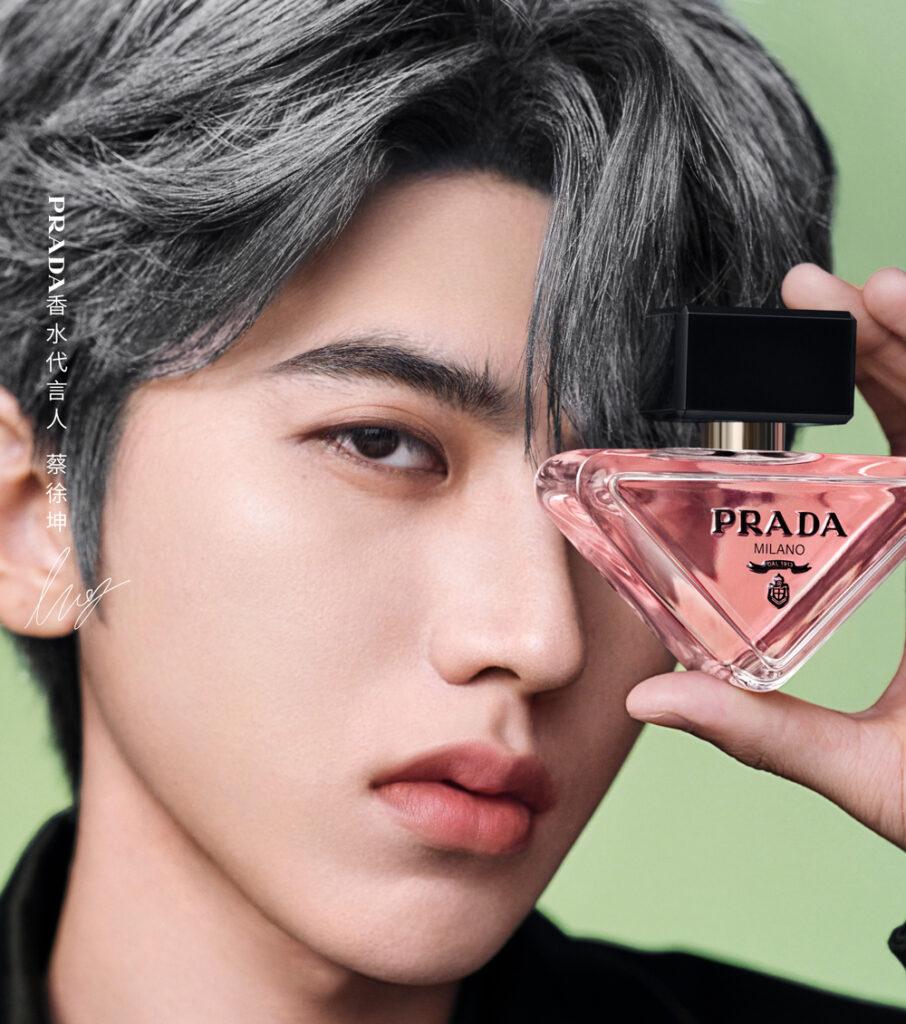

But today, in the luxury sector, brands and their licensed beauty businesses have become more and more entwined. Gucci Beauty was relaunched in 2019, and although it is operated by Coty, several collections and the visual languages were inextricably tied to then brand Creative Director Alessandro Michele. Prada Beauty, which is run by L’Oréal, named Cai Xukun, who is also the ambassador of the main brand, as its Fragrance Ambassador.

“Luxury houses are developing a beauty line for more than just a commercial purpose,” Yang points out. “On one hand, the autonomy allows brands to maintain control over their brand equity and image. On the other hand, beauty, for example, accounts for a significant portion of women's lives. Any expansion into other categories serves to improve brand consistency from a lifestyle standpoint.

The revival of Gucci Beauty under Michele's helm is a compelling story, but does every luxury brand have the same opportunity?

“The potential for cross-category expansion is still heavily reliant on brand equity. We find that opportunities are more significant for first-tier luxury houses, but the category gap for emerging brands is much larger,” she explains.

Chan likewise mentioned that there are is still a big disconnection between fashion brands and their licensed beauty business – in general, cross markets and cross channels. “It will be critical to assess each brand to identify what and where those gaps lie. Identifying key markets will also mark the priorities and resources in order to make moves at the outset,” she says.

The Bigger, The Better

Kering Beauté's inauguration sparked speculations about the sectors it will enter, partnerships with brands outside of Kering, and even possible acquisitions.

Perfumes seems to be a likely target for Kering. The majority of the group's houses have already launched perfume lines, and sources say the company was interested in acquiring niche fragrance brand Byredo. However, Puig acquired a majority stake in the brand in May of last year.

Following the pandemic, Puig accelerated its portfolio expansion by acquiring Charlotte Tilbury, Byredo, and other niche labels, as well as developing beauty lines for its fashion brands such as Dries van Noten.

Acquisitions appear to be a quick fix for building beauty muscle and increasing the company's turnover in the short term. However, Chan believes that internalising the beauty business is a more long-term solution: “To bid on other beauty brands, Kering would need to bring more than just money to the table. Building capabilities and know-how is critical to the longevity of the brand, which companies like Coty and Puig have long been known for in the industry.”

Join Luxury Society to have more articles like this delivered directly to your inbox

But what is certain is that broadening expertise has become an act of “diplomacy” for Kering. Kering Beauté could be the group’s next olive branch.

Back to Kering Eyewear, a division that not only manages the Group's eyewear business but also assists Swiss luxury group Richemont's brands, such as Chloé, Dunhill, and Montblanc, in producing and distributing eyewear. In 2017, Cartier became the first brand outside of Kering to partner with Kering Eyewear.

LVMH established eyewear company Thélios with Italian eyewear manufacturer Marcolin the same year, and took full control of the company in 2021. This move was interpreted as intensifying the rivalry between LVMH and Kering in the eyewear sector. Today, Thelios designs, produces and distributes eyewear products for brands including Dior, Fendi, Celine of LVMH.

In the beauty sector, neither Kering nor Richemont has group-operating beauty lines, whereas LVMH's Beauty and Fragrance segment already has 15 brands, generating over 7.7 billion euros in revenue over the last year, accounting for nearly 10 per cent of the group’s earnings.

In terms of scale, LVMH appears to be out of reach for Kering and Richemont, which is why rumours of a possible merger between the two companies have circulated for some time. Despite the fact that the story hasn't ended, the two are looking for ways to join forces.

With the founding of Kering Beauté, another chapter in the luxury world has begun.