Retail

For the Luxury Industry, the Consequences of COVID-19 Will Continue Into 2021 and Beyond

by

Meaghan Corzine | March 30, 2020

Luxury sales are expected to suffer a year-over-year decline of 25 percent to 30 percent, according to the latest research from Bain & Company.

The global pandemic COVID-19 seems to have left no industry spared, but the luxury industry will be one that is affected well into 2021 and the years to come.

New research from management consultancy Bain & Company released one of the first in-depth looks at just how intensely the pandemic will affect the luxury industry and how brands should move forward in order to accelerate recovery and minimise today’s threat.

The luxury industry may have been one of the very first to realise the gravity of what is now a global crisis. As the virus first spread throughout China, a country whose population accounted for 90 percent of local market growth last year, brands and executives were quick to feel the economic repercussions, soon reaching Italy where some of the world’s top brands are headquartered.

Looking Forward

While the effects of COVID-19 are still quickly developing, industry experts suggest that gross domestic product, employment (affecting spending power), and financial markets will all have a severe strain on the luxury sector.

Aspects that are expected to continue into 2021 and beyond include:

- Decrease in consumer confidence

- Decrease in willingness to spend

- Cautionary travel in a world that was previously primarily rid of restrictions and fears of contagion

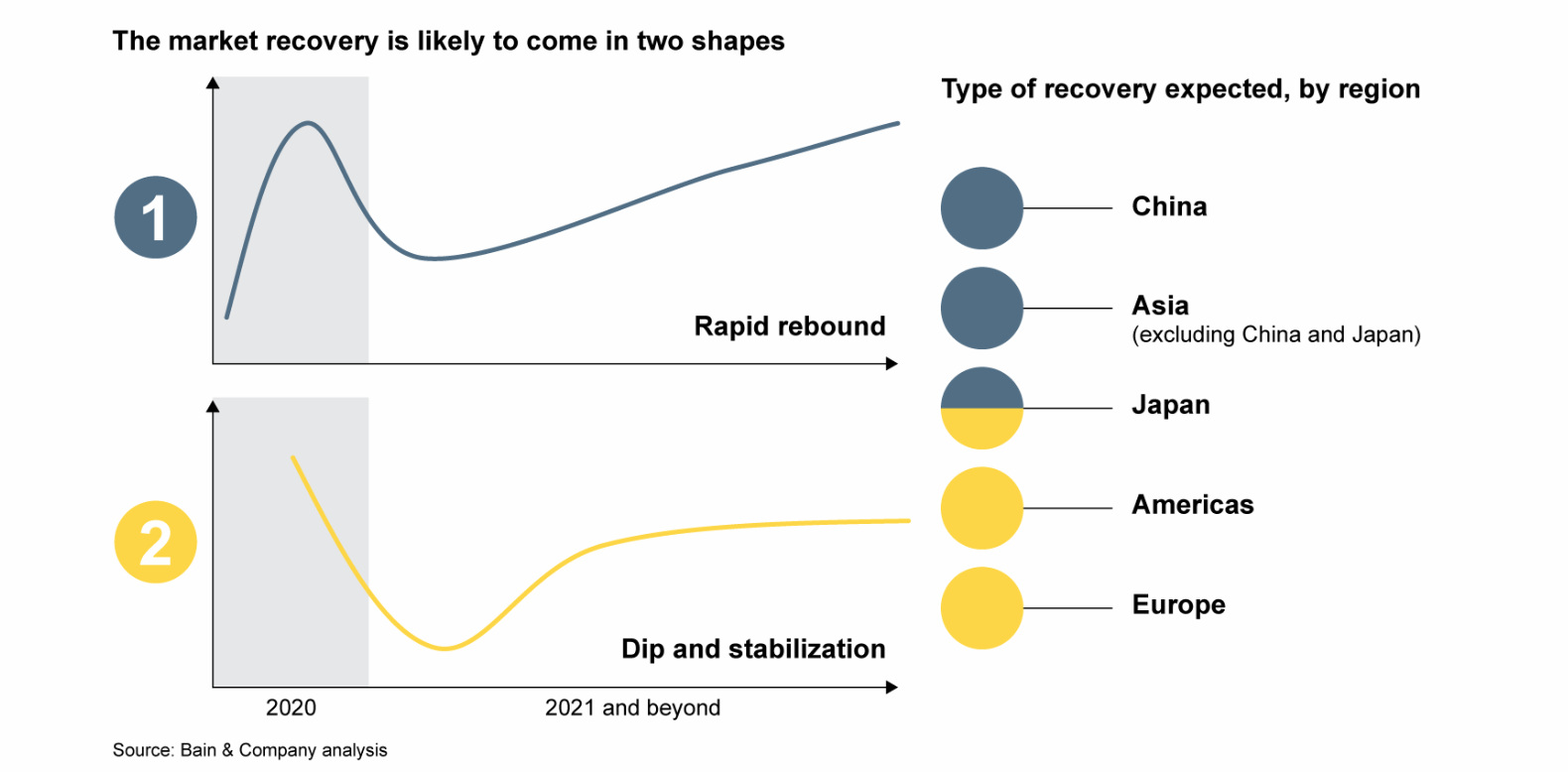

The evolution and duration of the pandemic will surely be impacted by the response of individual governments and populations, however Bain & Company predicts that the market is likely to recover in two different schematics for 2021 and forward.

Some countries can expect to experience a rapid rebound, while others will follow a dip and stabilization model. Predictions suggest that China and the broader Asian market may experience the strongest recovery, while regions of the U.S., Japan and Europe can expect to feel the impact for longer.

Overall, medium-term market growth will still be expected, supported by the Chinese middle class and growing demand for luxury products among millennials and younger generations.

How to Minimise Future Effects

While the repercussions of COVID-19 are not expected to be a permanent affair, brands now have the decision of how strongly they will emerge from this crisis depending on the steps the take now and in the coming years.

Lessons taken from these “dark days” may enable brands to come out even more dynamic and stronger than before. Bain outlined six consumer trends that are emerging for leaders to help solidify their response to the crisis. These include:

- China-centric

- Accelerate shift to digital shopping

- Heightened environmental and social consciousness

- Rise of a post-aspirational mindset

- Strengthened local pride

- Expanding the need for inclusion

Industry analysis also suggests that governing through a new leadership framework, acting to maximise short-term financial, operational and brand resilience, and transforming the value proposition and business model for the future will all help luxury brands protect the health of their companies, people, and consumers.

Welcome to Data Digest, our breakdown of the latest data releases and reports focused on the luxury industry.

Cover image: Pexels.