Retail

Luxury Industry Set to Decline By 18 Percent This Year Due to COVID-19

by

Meaghan Corzine | May 14, 2020

Luxury shopping behaviour, channel dynamics and travel plans are seeing inevitable shifts as a result of the lockdown, all contributing to the pandemic’s monumental economic and emotional impact on the luxury market.

The Coronavirus pandemic has disrupted every aspect of people’s lives on a global scale. From the heartbreaking human toll, to the loss of jobs, to questions of sustainable responsibility, the world as a whole has been deeply affected as the year 2020 seemed to be getting off to a stable start.

The implications of COVID-19 are far from over and it will be in the next half of 2020 and the coming years that various industries will experience the most severe impact.

Luxury Hit Hard

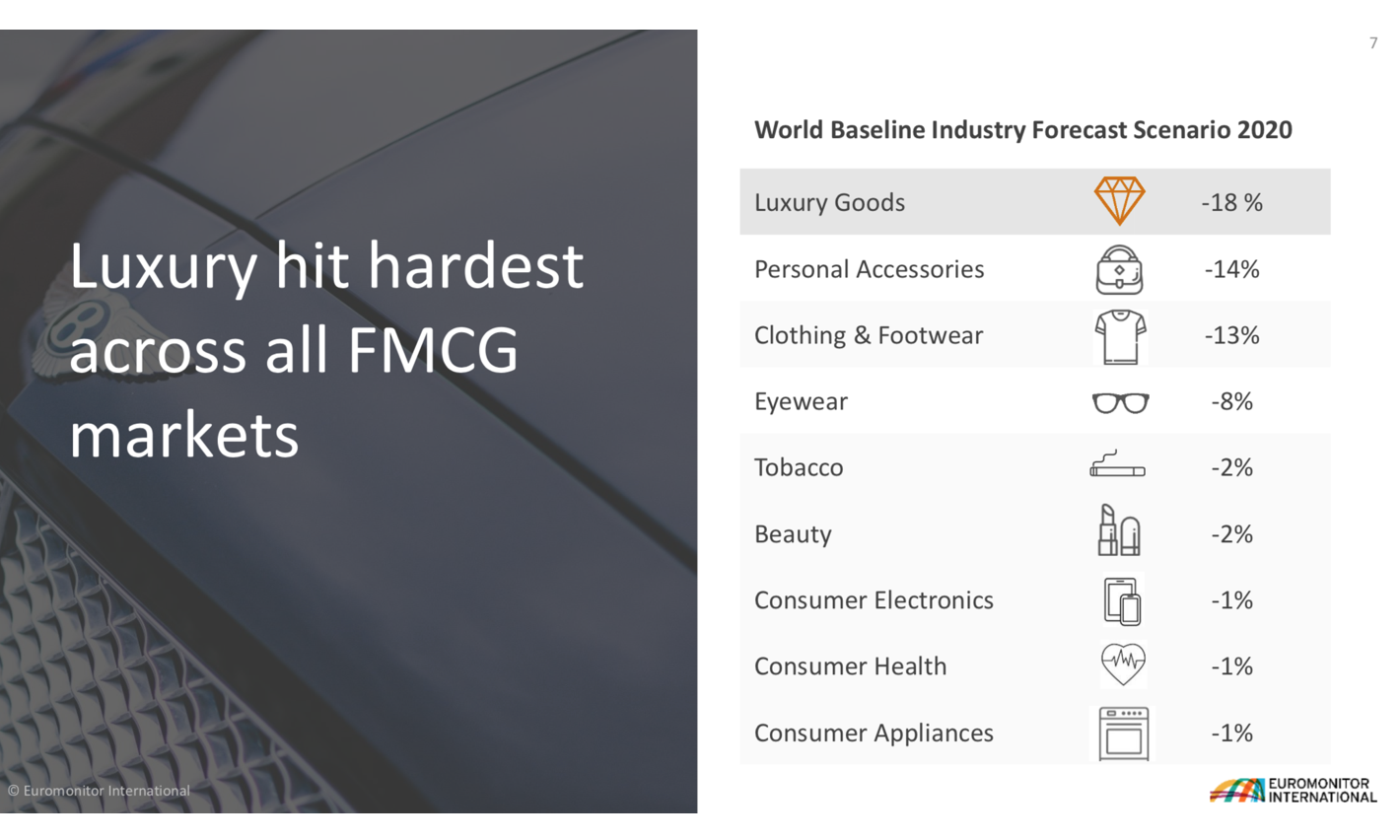

The luxury goods market is particularly fragile during this time and is expected to be hit hardest across all FMCG (fast-moving consumer goods) markets, with a projected 18 percent decrease, according to market research provider Euromonitor International's newly released report “Luxury and COVID-19: Effects on the Industry.”

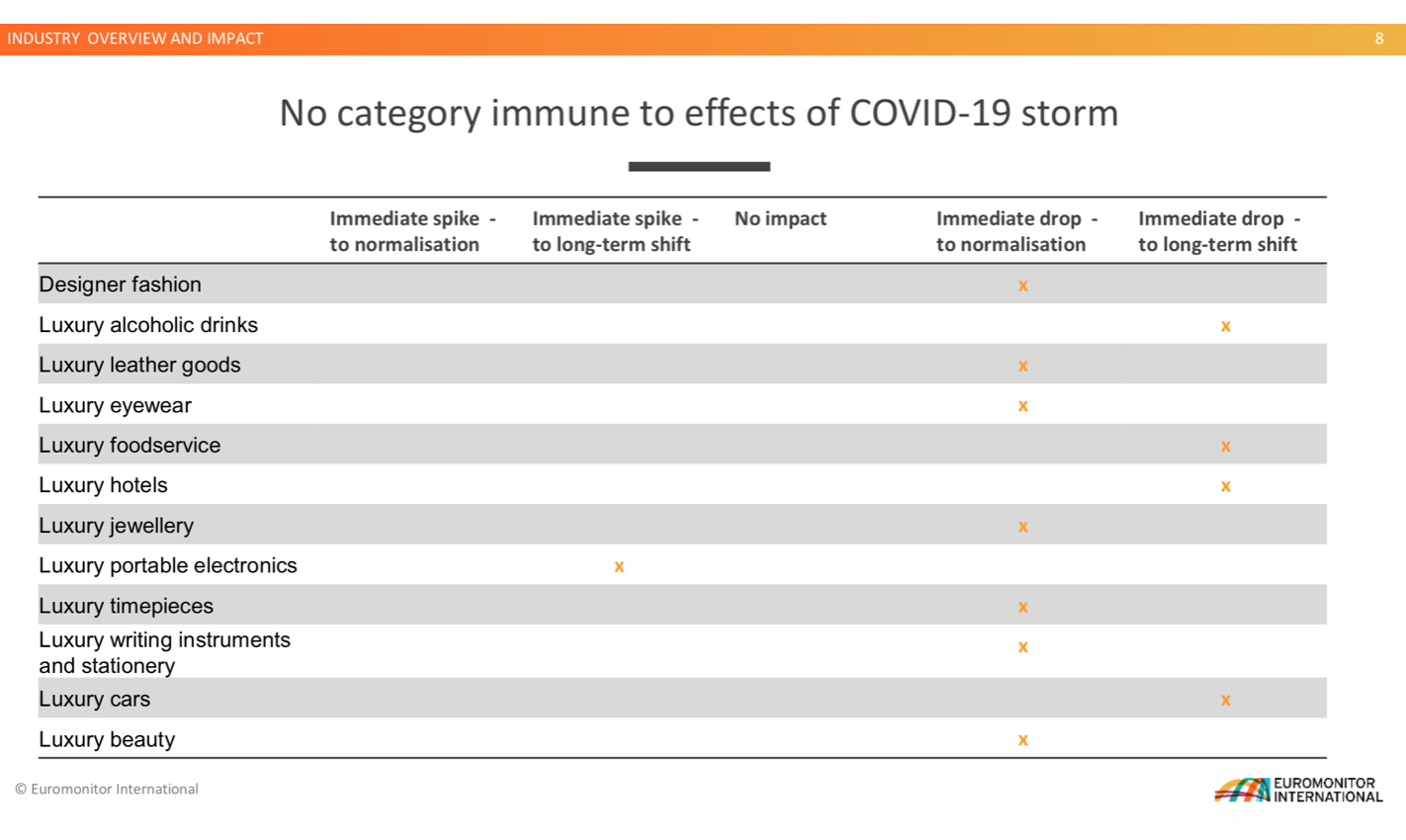

The world baseline industry forecast scenario for 2020 predicts that no luxury category will be exempt from the negative impacts of COVID-19 and that many sectors, including designer fashion, jewellery and timepieces, can expect to experience an immediate drop to normalisation.

The other 68 percent of luxury goods categories, including food service, hotels, and cars are expected to experience immediate drop followed by a long-term shift. Personal luxury will see a faster recovery supported by demand from the Chinese middle class, millennials, Gen Z and the continued adoption of the digital channel, according to the report.

Global Outlook

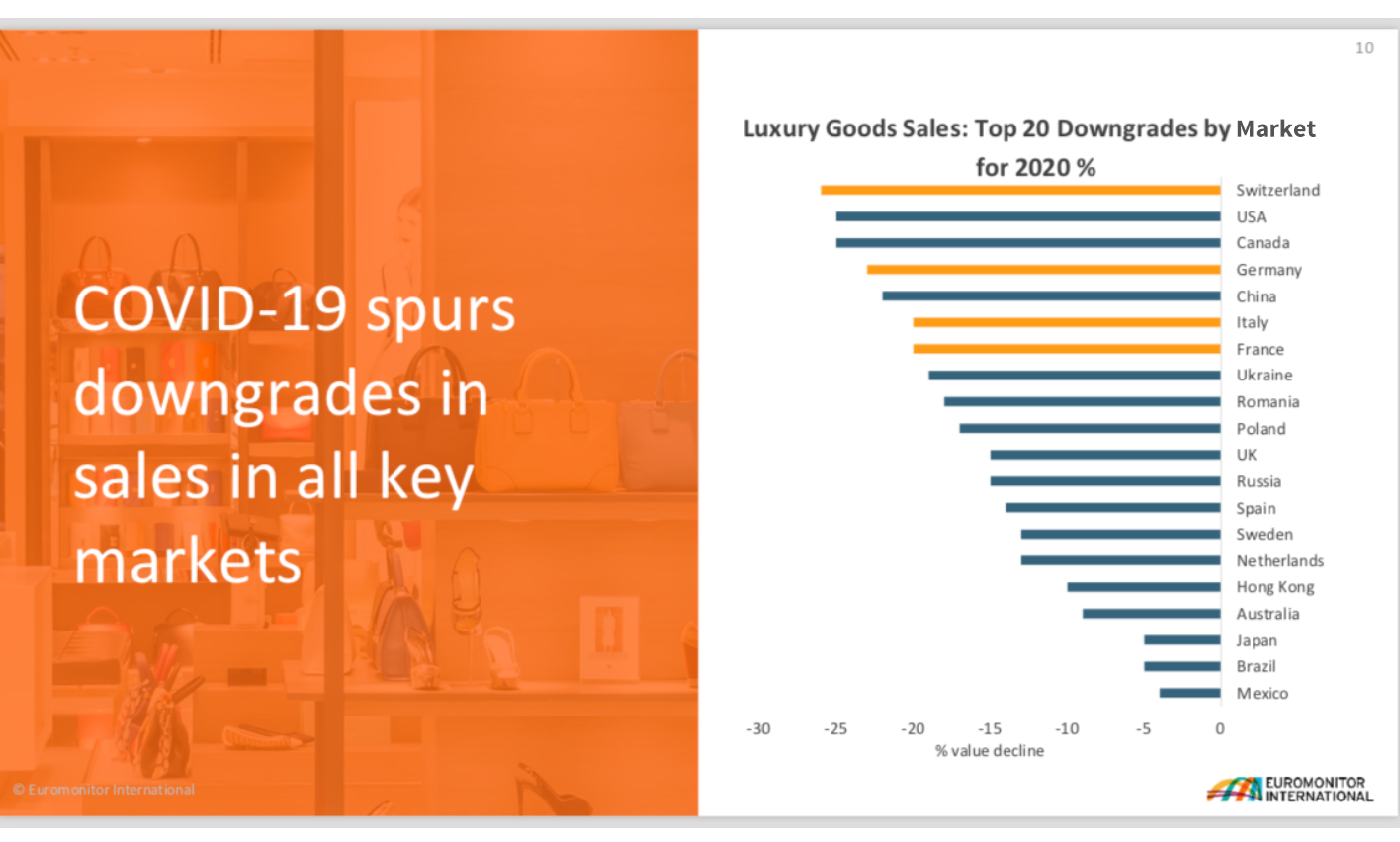

COVID-19 is spurring downgrades in sales in all key markets. Switzerland, the United States and Canada are among the top 20 countries for downgrades in luxury goods sales for the year 2020.

In Asia Pacific, China’s luxury goods spending alone makes up 68 percent of sales. Mainland China is set to experience loss in sales to the tune of $67 billion with severe economic damage, while Japan, Hong Kong and Singapore will experience the biggest economic contractions.

The Eurozone is also among the worst hit regions globally. While Western Europe is home to the world’s largest luxury goods conglomerates, several of its key players are expected to contract with predictions of Italy at -9 percent, Spain by -8 percent, France and the UK by -7 percent and Germany by -6 percent. Switzerland and Germany are forecasted to see the deepest global contraction in luxury sales in 2020.

When looking at North America, the U.S. economy is bracing for its deepest recession since the Great Depression. The U.S. can expect to lose $52 billion in luxury sales, while outlook for Canada remains poor as they recorded the highest ever drop in GDP.

As International shopping halts due to travel restrictions, total loss in sales owing to the travel ban could be in the region of $76 billion for 2020.

Key Themes Reshaping Luxury

While the future most certainly looks grim after combing through all the facts, luxury brands are now focusing on what it means to reshape the industry in times of crisis. Digital, wellness, experience and sustainability will all play even more important roles going forward.

With 4 billion internet users globally and with 51 percent of digital commerce executed now via mobile device in 2020, brands are looking toward innovation and connectivity to save themselves. With the restrictions on physical shopping, e-commerce is expected to grow by 694 percent this year, while store-based activity will likely suffer up to -86 percent.

Omni-channel, artificial intelligence, and looking beyond the human supply chain will all be major aspects for brands to take into consideration going forward. Luxury brands that invest in these things now not only provide customers with a solution to their concerns about health, but also will meet convenience and environmental needs.

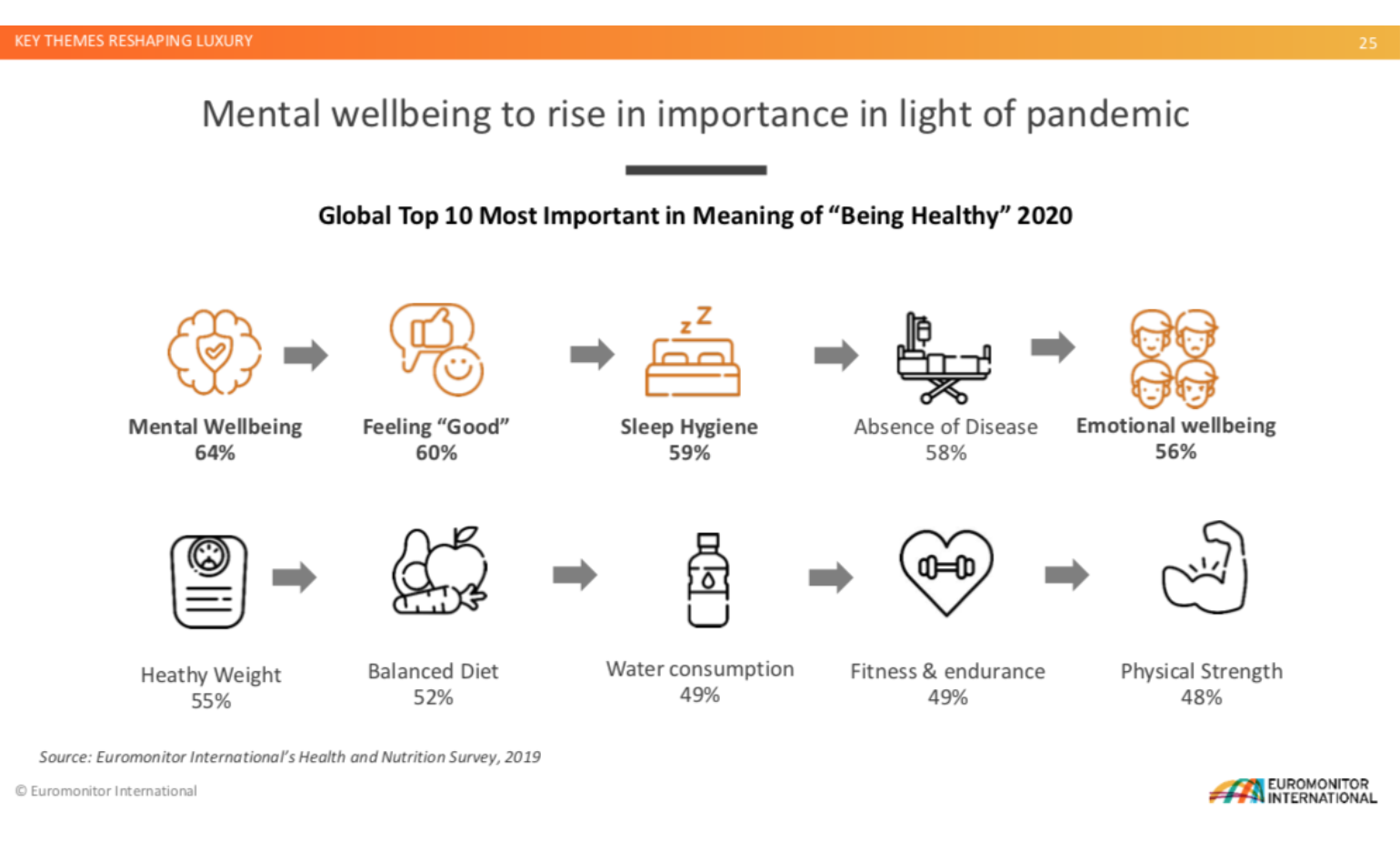

Along the same lines, we are seeing consumers shifting their focus more and more on mental and emotional well-being. While a lot of these components can be directly correlated to the hospitality and wellness industries, all luxury categories must take the emotional climate into account when looking at the customer experience.

Industry Resilience Going Forward

In times of global crisis, it’s undoubtedly hard for many industries to have a positive outlook. How can luxury brands still reach their customers in an engaging and authentic way? How can we bounce back stronger than ever?

Brands should keep a few things in mind going forward:

- Relevancy: Consumers across all income groups will be feeling the effects. Brands need a 360- degree customer strategy.

- Customer-Centric: New luxury focuses on delivering what the consumer really wants. Its intuitive, personalised and high tech.

- Purpose-Driven: Luxury brands with purpose may be more resilient to unexpected situations and should find inspiration from innovating and embracing sustainability

- Digital: Experience, wellness and their perception will become a critical part of the equation. Digital will play a lead role here.

- Empathy: Establishing and maintaining empathy will increase in importance. No amount of technology can replace the human element here.

Check out more insights and the full Euromonitor report, “Luxury and COVID-19: Effects on the Industry."

All image credit: Euromonitor.